filmov

tv

Tax File Number (TFN) Declaration Form Explained 💰 | AUSTRALIA

Показать описание

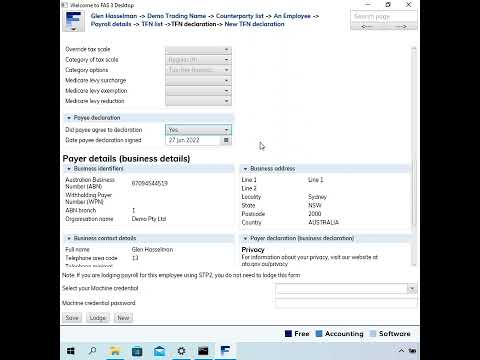

The Tax File Number (TFN) Declaration Form (NAT 3092) is a form provided by Australian employers to their new employees to determine the correct rate of tax to withhold from their salary, wage or other types of payments in a tax year as required by the Australian Taxation Office (ATO) approved form.

LINKS

🎁 Get the exact budget tool I built in this video — FREE download:

(BONUS When you signup using this link, the first 4 months of subscription are free if you choose to upgrade to advanced plan and I may get a small my commission at no extra cost to you, so we both win!)

OTHER VIDEOS

ATO LINKS

This video will explain this form in detail and will answer many common questions that employees have and will also help those employees understand the consequences for answering each question correctly.

An employee must provide their TFN to ensure they are not taxed incorrectly and failure to do so, could to lead to either too much, or not enough, tax being paid withheld. This could mean a larger than usual tax bill or refund when an employee lodged their Australian income tax return.

Watch this video to understand why this form is so important to ensure you are tax correctly and paid the correct salary or wage each payroll cycle.

CHAPTERS

00:00 Intro

00:46 Question 1

01:04 Questions 1 to 6

01:19 Question 7

02:06 Question 8

03:12 Question 9

04:15 Question 10

Remember to SUBSCRIBE to my channel! It's free!

DISCLAIMER This video is intended for general information and entertainment only and is not a replacement for professional advice. Money with Dan is not a financial advisor. You should consider seeking independent legal, financial, taxation or other advice to check how the information in this video relates to your unique circumstances. Money with Dan is not liable for any loss caused, whether due to negligence or otherwise arising from the use of. or reliance on, the information provided directly or indirectly, by use of this video.

#TFN #Moneywithdan #IncomeTax

LINKS

🎁 Get the exact budget tool I built in this video — FREE download:

(BONUS When you signup using this link, the first 4 months of subscription are free if you choose to upgrade to advanced plan and I may get a small my commission at no extra cost to you, so we both win!)

OTHER VIDEOS

ATO LINKS

This video will explain this form in detail and will answer many common questions that employees have and will also help those employees understand the consequences for answering each question correctly.

An employee must provide their TFN to ensure they are not taxed incorrectly and failure to do so, could to lead to either too much, or not enough, tax being paid withheld. This could mean a larger than usual tax bill or refund when an employee lodged their Australian income tax return.

Watch this video to understand why this form is so important to ensure you are tax correctly and paid the correct salary or wage each payroll cycle.

CHAPTERS

00:00 Intro

00:46 Question 1

01:04 Questions 1 to 6

01:19 Question 7

02:06 Question 8

03:12 Question 9

04:15 Question 10

Remember to SUBSCRIBE to my channel! It's free!

DISCLAIMER This video is intended for general information and entertainment only and is not a replacement for professional advice. Money with Dan is not a financial advisor. You should consider seeking independent legal, financial, taxation or other advice to check how the information in this video relates to your unique circumstances. Money with Dan is not liable for any loss caused, whether due to negligence or otherwise arising from the use of. or reliance on, the information provided directly or indirectly, by use of this video.

#TFN #Moneywithdan #IncomeTax

Комментарии

0:03:28

0:03:28

0:05:34

0:05:34

0:08:45

0:08:45

0:03:31

0:03:31

0:00:53

0:00:53

0:01:25

0:01:25

0:04:01

0:04:01

0:01:08

0:01:08

0:06:36

0:06:36

0:03:49

0:03:49

0:07:27

0:07:27

0:00:49

0:00:49

0:03:20

0:03:20

0:04:04

0:04:04

0:01:45

0:01:45

0:11:24

0:11:24

0:03:14

0:03:14

0:12:55

0:12:55

0:00:16

0:00:16

0:03:53

0:03:53

0:08:14

0:08:14

0:12:59

0:12:59

0:02:06

0:02:06

0:03:40

0:03:40