filmov

tv

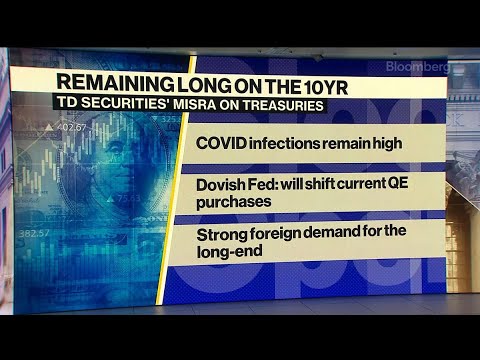

Traders Watch Fed Closely for Clues to Tapering Plan

Показать описание

Bloomberg Quicktake brings you live global news and original shows spanning business, technology, politics and culture. Make sense of the stories changing your business and your world.

Connect with us on…

Traders Watch Fed Closely for Clues to Tapering Plan

Traders Watch Fed Closely for Clues to Tapering Plan

Why to Watch Fed Balance Sheet Moves Closely

Powell: Fed 'Looking Carefully' at Kaplan, Rosengren Trades

Markets watching the Fed most closely, says analyst

Fed Chairman Powell's speech to be closely watched

Fed's watching markets more closely, says strategist

Why the Fed is closely watching the labor market: Strategist

Trump vs. The Fed: What Traders Need to Know

Trader’s calendar on february March 7-8: Markets to closely watch ECB rate decision and labor market...

Fed's Powell proceeding 'carefully' on monetary policy, inflation

TD Securities Says Watch the Fed Very Closely

Fed closely watching jobs report and trade as it gears up for next policy meeting

Watch *THESE* Very Carefully Before the Fed Takes Action

Key inflation gauge tracked closely by Federal Reserve slowed in February

Legendary investor Charlie Munger says he's watching inflation, central banks closely

U.S. stock futures edge lower ahead of the closely watched Fed interest rate decision

The Federal Reserve Begins Closely Watched Meeting, Stocks Open Higher

What Jerome Powell Said: This is What The Fed is Going to Do!!

Here’s why markets are watching Jackson Hole so closely

Fed closely monitoring coronavirus: Fed vice chair Richard Clarida

UBS' Cashin: Viewers should watch Powell's prepared statement carefully

I don't think we're listening to the Fed quite closely enough, says Hightower's Farr

Fed will watch inflation expectations pretty carefully: Jefferies' David Zervos

Комментарии

0:01:08

0:01:08

0:01:24

0:01:24

0:00:55

0:00:55

0:03:39

0:03:39

0:00:52

0:00:52

0:02:37

0:02:37

0:05:49

0:05:49

0:50:13

0:50:13

0:13:30

0:13:30

0:02:31

0:02:31

0:03:08

0:03:08

0:02:38

0:02:38

0:16:21

0:16:21

0:03:21

0:03:21

0:02:55

0:02:55

0:00:38

0:00:38

0:01:07

0:01:07

0:25:13

0:25:13

0:01:05

0:01:05

0:01:54

0:01:54

0:03:45

0:03:45

0:03:20

0:03:20

0:03:08

0:03:08