filmov

tv

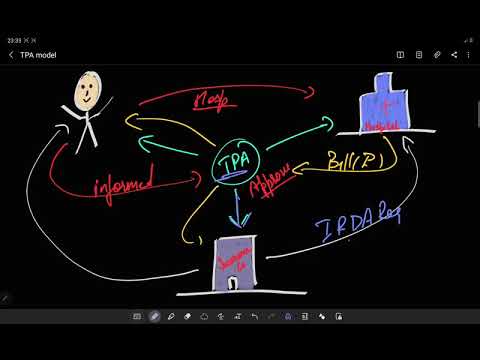

What is TPA in Health Insurance|How TPA Works?|Role of TPA in Health Insurance|#healthinsurance #tpa

Показать описание

#tpa #healthinsurance #irdai #insurance #mediclaim #hospitalizations #roleoftpainhealthinsurance #insuranceclaims #thirdparty #administrator

#india

Role of TPA in Health Insurance|

What is TPA in Health Insurance?

health insurance

health insurance in india

health insurance policy

best health insurance

why health insurance is important in kannada

insurance benefits of health insurance in kannada

benefits of health insurance in telugu

low cost health insurance in kannada

health insurance tpa,health insurance tips in kannada

health insurance cost in kannada

best health insurance in kannada

health insurance claim process

save on health insurance in kannada

Medical emergencies are unexpected and uncertain. They strike at the most inopportune times, leaving you stranded. The costs of availing of medical facilities are skyrocketing. The soaring medical inflation makes it even more necessary to have health insurance coverage.

Those who have robust health insurance coverage are protected from financial hassles whereas those who don't could find themselves in a debt trap. Here the importance of health insurance policies is established. But apart from the health insurance company, there is an intermediary organisation known as the third-party administrator, that you might need to interact with.

Fret not! Here we explain all you need to know about the meaning of TPA, including the vital role a TPA plays.

What is TPA?

A third-party administrator or TPA is an organisation that administers the claim-handling process for an insurance company. Not only that, but any grievance or redressal process for the claimant is also taken care of by the TPA. Health insurance TPA is an independent organisation different from the insurance company. These bodies are also licensed by the Insurance Regulatory and Development Authority of India (IRDAI) to operate on behalf of the insurance companies. One can understand the meaning of TPA in health insurance by looking at it as an extended arm of the insurance company.

What role does a TPA play in health insurance administration?

Apart from functioning as an intermediary between the insurance company and the policyholder, a health insurance TPA plays a crucial role as follows –

1. Maintain records of the policyholder

Once the insurance company issues the policy, these records are transferred to the TPA organisation. The TPA maintains the records and assumes most of the responsibilities for the insurance company. Identity cards with a unique number are issued to policyholders, including the beneficiaries under the policy.

2. Settlement of Claims

One of the crucial roles that a TPA plays is the settlement of your claim applications. In case of a cashless claim settlement, the TPA directly coordinates with the hospital for settling the medical bill. Moreover, in reimbursement cases, the TPA checks the validity of your claim application for admissible expenses under the policy terms. If there are any doubts regarding the claim filed, the TPA can investigate hospital records too.

3. Cashless claim facility

A third-party administrator assists the policyholder when it comes to claims related to cashless health insurance plans. Once you furnish the required forms to the hospital, it submits the details to your health insurance TPA. All further matters related to medical facilities availed at the hospital are taken care of by the TPA. You must note to avail of a cashless facility, you need to avail treatment from a specified network hospital pre-defined in your insurance policy. Although it is a handy feature, it is your choice, i.e., the insured's choice, as to where to opt for the treatment.

4. Empanelling network hospitals

TPAs are further responsible for monitoring as well as adding new medical facilities to the list of network hospitals for the insurance company. As stated earlier, a policyholder can avail of a cashless medical facility at a network hospital. The facilities provided and the quality of services offered along with its proven track record are some of the factors accounted for when adding a hospital as part of the network chain. The general insurance policy document specifies the list of such network hospitals at the time of purchase or renewal.

5. Serves as a helpdesk

Along with the functions mentioned above, a TPA is responsible for maintaining a 24x7 helpdesk facility. It is done to address any emergency claims of the insured as well as any queries regarding claims. The services of such helpdesk facilities are over and above those maintained by your insurance company.

#india

Role of TPA in Health Insurance|

What is TPA in Health Insurance?

health insurance

health insurance in india

health insurance policy

best health insurance

why health insurance is important in kannada

insurance benefits of health insurance in kannada

benefits of health insurance in telugu

low cost health insurance in kannada

health insurance tpa,health insurance tips in kannada

health insurance cost in kannada

best health insurance in kannada

health insurance claim process

save on health insurance in kannada

Medical emergencies are unexpected and uncertain. They strike at the most inopportune times, leaving you stranded. The costs of availing of medical facilities are skyrocketing. The soaring medical inflation makes it even more necessary to have health insurance coverage.

Those who have robust health insurance coverage are protected from financial hassles whereas those who don't could find themselves in a debt trap. Here the importance of health insurance policies is established. But apart from the health insurance company, there is an intermediary organisation known as the third-party administrator, that you might need to interact with.

Fret not! Here we explain all you need to know about the meaning of TPA, including the vital role a TPA plays.

What is TPA?

A third-party administrator or TPA is an organisation that administers the claim-handling process for an insurance company. Not only that, but any grievance or redressal process for the claimant is also taken care of by the TPA. Health insurance TPA is an independent organisation different from the insurance company. These bodies are also licensed by the Insurance Regulatory and Development Authority of India (IRDAI) to operate on behalf of the insurance companies. One can understand the meaning of TPA in health insurance by looking at it as an extended arm of the insurance company.

What role does a TPA play in health insurance administration?

Apart from functioning as an intermediary between the insurance company and the policyholder, a health insurance TPA plays a crucial role as follows –

1. Maintain records of the policyholder

Once the insurance company issues the policy, these records are transferred to the TPA organisation. The TPA maintains the records and assumes most of the responsibilities for the insurance company. Identity cards with a unique number are issued to policyholders, including the beneficiaries under the policy.

2. Settlement of Claims

One of the crucial roles that a TPA plays is the settlement of your claim applications. In case of a cashless claim settlement, the TPA directly coordinates with the hospital for settling the medical bill. Moreover, in reimbursement cases, the TPA checks the validity of your claim application for admissible expenses under the policy terms. If there are any doubts regarding the claim filed, the TPA can investigate hospital records too.

3. Cashless claim facility

A third-party administrator assists the policyholder when it comes to claims related to cashless health insurance plans. Once you furnish the required forms to the hospital, it submits the details to your health insurance TPA. All further matters related to medical facilities availed at the hospital are taken care of by the TPA. You must note to avail of a cashless facility, you need to avail treatment from a specified network hospital pre-defined in your insurance policy. Although it is a handy feature, it is your choice, i.e., the insured's choice, as to where to opt for the treatment.

4. Empanelling network hospitals

TPAs are further responsible for monitoring as well as adding new medical facilities to the list of network hospitals for the insurance company. As stated earlier, a policyholder can avail of a cashless medical facility at a network hospital. The facilities provided and the quality of services offered along with its proven track record are some of the factors accounted for when adding a hospital as part of the network chain. The general insurance policy document specifies the list of such network hospitals at the time of purchase or renewal.

5. Serves as a helpdesk

Along with the functions mentioned above, a TPA is responsible for maintaining a 24x7 helpdesk facility. It is done to address any emergency claims of the insured as well as any queries regarding claims. The services of such helpdesk facilities are over and above those maintained by your insurance company.

Комментарии

0:07:17

0:07:17

0:01:03

0:01:03

0:02:07

0:02:07

0:07:46

0:07:46

0:03:48

0:03:48

0:13:08

0:13:08

0:07:44

0:07:44

1:01:17

1:01:17

0:18:44

0:18:44

0:02:05

0:02:05

0:03:16

0:03:16

0:42:53

0:42:53

0:10:40

0:10:40

0:20:58

0:20:58

0:09:07

0:09:07

0:00:42

0:00:42

0:03:59

0:03:59

0:01:00

0:01:00

0:00:51

0:00:51

0:00:10

0:00:10

0:03:59

0:03:59

![[Testimonial] UMR's partnership](https://i.ytimg.com/vi/jPEn2K-n0CU/hqdefault.jpg) 0:01:58

0:01:58

0:00:34

0:00:34

0:04:17

0:04:17