filmov

tv

Silicon Valley Bank faces 'classic run on a bank', says Lazard's Peter Orszag

Показать описание

Turn to CNBC TV for the latest stock market news and analysis. From market futures to live price updates CNBC is the leader in business news worldwide.

Connect with CNBC News Online

#CNBC

#CNBCTV

Silicon Valley Bank faces 'classic run on a bank', says Lazard's Peter Orszag

FDIC: Insured Silicon Valley Bank deposits will be available no later than Monday

SVB Collapse: What's Next?

Ava Lab’s Wu on SVB: This Is a Classic Bank Run

Silicon Valley Bank meltdown: Contagion risk or contained?

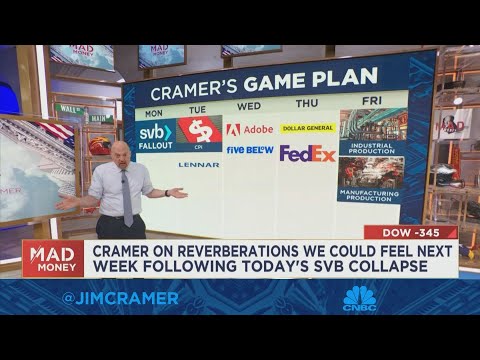

Cramer’s First Take: Here's why the Silicon Valley Bank situation is unique

Short Hills' Steve Weiss on Silicon Valley Bank: My first call was get the money out

SVB Financial meltdown: Here's the latest

Why Silicon Valley Bank may be the ideal candidate for a bailout

Silicon Valley Bank customers left in the cold and the dark

Silicon Valley Bank and Signature Bank hearing before House on bank failures

Silicon Valley Bank Stock Plunges 60%

SVB's collapse could be the thing that keeps the Fed from wrecking the entire economy, says Cra...

Markets fall after key Silicon Valley bank collapses

BREAKING: Silicon Valley Bank FAILS, BIGGEST Since 2008 | Breaking Points

FDIC plans to pay SVB depositors after bank fails

Silicon Valley Bank is an outlier relative to the industry: Oppenheimer's Chris Kotowski

I think SVB was overly punished, says Cramer

SVB Financial plunging more than 60% is a 'warning shot,' economist says

Silicon Valley Bank customer used personal funds to pay employees due to shutdown

Financial shock waves follow Silicon Valley Bank failure

Silicon Valley Bank Financial in talks to sell itself, sources tell CNBC

SVB Collapse | Bloomberg Surveillance 03/10/2023

SVB customers in Mass. scramble to get money out of branches

Комментарии

0:05:49

0:05:49

0:02:01

0:02:01

0:02:16

0:02:16

0:02:47

0:02:47

0:05:22

0:05:22

0:03:20

0:03:20

0:03:54

0:03:54

0:03:22

0:03:22

0:10:51

0:10:51

0:05:02

0:05:02

5:16:25

5:16:25

0:00:44

0:00:44

0:08:39

0:08:39

0:07:45

0:07:45

0:06:28

0:06:28

0:03:43

0:03:43

0:05:28

0:05:28

0:02:30

0:02:30

0:03:47

0:03:47

0:04:18

0:04:18

0:05:03

0:05:03

0:03:05

0:03:05

2:31:20

2:31:20

0:01:58

0:01:58