filmov

tv

Six things every investor should know about return on capital employed (ROCE)

Показать описание

Return on capital employed (ROCE) is a key ratio that can reveal lots of useful information about a firm. In this short guide, Tim Bennett explains how it works, when it is most useful and when it can let you down.

Six things every investor should know about return on capital employed (ROCE)

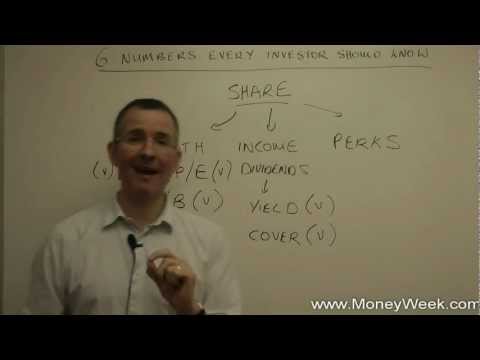

Six numbers every investor should know - MoneyWeek Investment Tutorials

Warren Buffett: 12 Mistakes Every Investor Makes

5 things every investor should know this Reporting Season

Warren Buffett: You Only Need To Know These 7 Rules

Warren Buffett: 10 Mistakes Every Investor Makes

Five things every investor should know about gold

Don’t Think and Trade like 90% Traders. Tom Hougaard Trading Psychology.

6 Wealth Isn't About How Much You Make!

Inflation Just Dropped! What It Means for Your Money & Stocks

Inflation, Interest Rates, and Stocks: What Every Investor Should Know

Warren Buffett | How To Invest For Beginners: 3 Simple Rules

Understanding the risks of Gold ETFs: What every investor should know | Value Research

The 2 BIGGEST mistakes every investor makes (and how to avoid them)

Park Emergency Funds at 6% Return & 24x7 Access | Alternative to Savings Account

Top 6 Ratios | Top six Ratio Every Investor Should Know | Ratios In Stock Market | Debt To Equity

Warren Buffett Investment Strategy

'Outperform 99% Of Investors With This Simple Strategy...' - Peter Lynch

8 Investing Terms Every New Investor Should Know

7 NUMBERS EVERY INVESTOR SHOULD KNOW (to invest money well)

8 Wealth Tips Once Your Portfolio Reaches $1 Million

Warren Buffett's Advice for Investors in 2025

Why does Warren Buffett love 'prefs'? - Moneyweek Investment Tutorials

What is goodwill? - MoneyWeek Investment Tutorials

Комментарии

0:10:31

0:10:31

0:12:26

0:12:26

0:24:40

0:24:40

0:01:15

0:01:15

0:10:38

0:10:38

0:18:51

0:18:51

0:08:20

0:08:20

0:00:57

0:00:57

0:00:48

0:00:48

0:14:48

0:14:48

0:15:59

0:15:59

0:13:21

0:13:21

0:01:00

0:01:00

0:00:37

0:00:37

0:00:58

0:00:58

0:00:08

0:00:08

0:00:27

0:00:27

0:10:23

0:10:23

0:20:15

0:20:15

0:27:23

0:27:23

0:09:58

0:09:58

0:17:50

0:17:50

0:09:46

0:09:46

0:10:29

0:10:29