filmov

tv

Why You're Trading The Markets Wrong

Показать описание

I see a lot of new traders make simple mistakes like this. Make sure you know how big money enters trades! Enjoy!

If you learned something new, leave a like!

Follow TradingLab:

===============================

*None of this is meant to be construed as investment advice, it's for entertainment purposes only. The links above include affiliate commissions or referrals. I'm part of an affiliate network and I receive compensation from partnering websites. The video is accurate as of the posting date but may not be accurate in the future.

If you learned something new, leave a like!

Follow TradingLab:

===============================

*None of this is meant to be construed as investment advice, it's for entertainment purposes only. The links above include affiliate commissions or referrals. I'm part of an affiliate network and I receive compensation from partnering websites. The video is accurate as of the posting date but may not be accurate in the future.

We Are Traders - A Tribute to All Those Trading the Markets

Gary Shilling explains the only way to beat the market and win

How does the stock market work? - Oliver Elfenbaum

The ONLY Candlestick Pattern Guide You'll EVER NEED

How To Grow A Small Stock Account

How much time do you spend trading and analyzing the markets?

How to Trade Pre-Market & After Hours -- Extended Hours Trading Explained

The Difference Between Trading and Investing

3 Golden Rules for Beginner Investors! 2024 #stockmarket #financetips #stocks #trading #investsmart

How To Identify Trends in Markets (Never Guess Again)

Why Trading Forex is so Difficult - Randomness in the Markets: Clusters of Bad and Good Luck

2 concepts that will change your trading: Market Structure and Fair Value Areas

The Only Market Structure Trading Video You Will Ever Need... (Beginner To Advanced)

How Does the Stock Market Work? (Stocks, Exchanges, IPOs, and More)

The Biggest SCAM In Trading Industry (A Deep Dive into Market Manipulation)

'We All Start Somewhere' - TRADER MOTIVATION (Trading Motivational Video)

How to Become a Professional Day Trader Explained in 5 minutes

Overthinking The Market? How To Improve Your Trading Decisions And Stick To The Charts | IBD

Here's why you'll NEVER make money in Forex. The Forex Cycle of Doom...

This is the difference between your trade hitting SL or TP

Best Trading Strategies For The Market Open (London & New York Sessions Made EASY)

How To Check If You're Trading On Worst Market - Binary Options Strategy

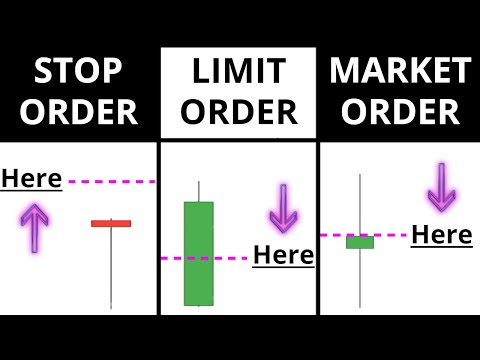

How To Place Your FIRST Forex Trade - (A BEGINNERS guide to Market / Limit / Stop orders)

Trading 101: How Online Brokers Work. Why You Need One.

Комментарии

0:01:32

0:01:32

0:03:06

0:03:06

0:04:30

0:04:30

0:11:45

0:11:45

0:08:45

0:08:45

0:03:32

0:03:32

0:14:27

0:14:27

0:10:29

0:10:29

0:00:40

0:00:40

0:06:43

0:06:43

0:10:28

0:10:28

0:18:19

0:18:19

0:40:44

0:40:44

0:08:49

0:08:49

0:14:51

0:14:51

0:04:49

0:04:49

0:05:05

0:05:05

0:51:20

0:51:20

0:07:18

0:07:18

0:00:46

0:00:46

0:14:38

0:14:38

0:10:31

0:10:31

0:26:13

0:26:13

0:08:36

0:08:36