filmov

tv

Risk Quantification and Assessment: A Practical Guide by Alex Sidorenko at Archer

Показать описание

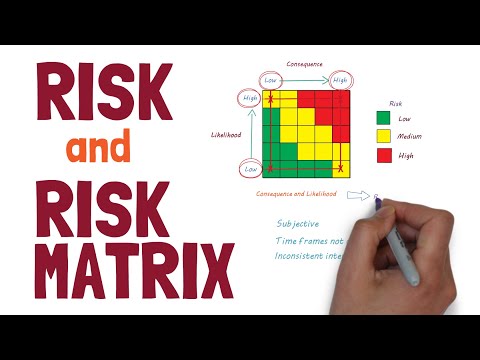

In this video, we provide a practical guide for quantifying and assessing risk in an organization. We cover the importance of understanding the likelihood and impact of risks and provide examples of how to use tools such as probability and impact stress tests, scenario analysis, and Monte Carlo simulations to help quantify and assess risks. This is a must-watch for risk managers looking to effectively manage risk in their organizations.

Risk management is a crucial aspect of any business, and Alex Sidorenko, Chief Risk Officer for large corporations, has dedicated his career to pushing for better quantifiable risk management and making risk-based decisions. He observes that there is a growing trend in the industry towards quantifying risk management, and it is becoming increasingly necessary for companies to adopt this approach in order to meet the demands of regulators and audit committees. Quantifiable risk management can also bring significant financial benefits, as seen in the example of Sidorenko's company saving 13 million dollars on one application of this approach. As an experienced risk management professional, Sidorenko is well-positioned to guide companies in implementing effective and profitable risk management strategies.

Moving risk management beyond reporting and saving $13M along the way.

Alex Sidorenko, FERMA Risk Manager of the Year 2021 and RIMS Honoree 2021, will share a practical case study how one $10B company used:

basic quantified risk registers to improve budgeting, reporting and insurance buying, saving $13M in just one year

standardised bow-ties to improve environmental decisions, affecting and changing multimillion decisions

advanced risk models to change procurement, investment and performance decisions, affecting thousands of vendors and changing how performance is calculated and remunerated.

Join this session to see how much value can be derived from risk management once you move beyond just reporting and monitoring and automate the hard quantitative part. Archer team takes care of the math so you can focus on adding value to decision making.

0:00 Intro

1:50 Current trend towards quantification

6:43 4 things you can do to more towards quant

9:30 4 levels of risk analysis

17:00 Basic level risk analysis

23:46 Standardized level risk analysis

25:55 Advanced level risk analysis

Risk management is a crucial aspect of any business, and Alex Sidorenko, Chief Risk Officer for large corporations, has dedicated his career to pushing for better quantifiable risk management and making risk-based decisions. He observes that there is a growing trend in the industry towards quantifying risk management, and it is becoming increasingly necessary for companies to adopt this approach in order to meet the demands of regulators and audit committees. Quantifiable risk management can also bring significant financial benefits, as seen in the example of Sidorenko's company saving 13 million dollars on one application of this approach. As an experienced risk management professional, Sidorenko is well-positioned to guide companies in implementing effective and profitable risk management strategies.

Moving risk management beyond reporting and saving $13M along the way.

Alex Sidorenko, FERMA Risk Manager of the Year 2021 and RIMS Honoree 2021, will share a practical case study how one $10B company used:

basic quantified risk registers to improve budgeting, reporting and insurance buying, saving $13M in just one year

standardised bow-ties to improve environmental decisions, affecting and changing multimillion decisions

advanced risk models to change procurement, investment and performance decisions, affecting thousands of vendors and changing how performance is calculated and remunerated.

Join this session to see how much value can be derived from risk management once you move beyond just reporting and monitoring and automate the hard quantitative part. Archer team takes care of the math so you can focus on adding value to decision making.

0:00 Intro

1:50 Current trend towards quantification

6:43 4 things you can do to more towards quant

9:30 4 levels of risk analysis

17:00 Basic level risk analysis

23:46 Standardized level risk analysis

25:55 Advanced level risk analysis

Комментарии

0:42:39

0:42:39

0:05:29

0:05:29

0:07:11

0:07:11

0:04:26

0:04:26

0:03:31

0:03:31

0:06:17

0:06:17

0:02:13

0:02:13

0:13:06

0:13:06

2:24:50

2:24:50

0:05:01

0:05:01

0:00:53

0:00:53

0:06:35

0:06:35

0:00:45

0:00:45

0:03:49

0:03:49

0:05:14

0:05:14

0:06:28

0:06:28

0:01:36

0:01:36

0:02:46

0:02:46

0:43:54

0:43:54

0:02:50

0:02:50

0:04:30

0:04:30

0:18:05

0:18:05

0:42:41

0:42:41

0:35:37

0:35:37