filmov

tv

Using the 8% Tax Rate for 3rd Quarter: BIR Registered Freelancers' Guide

Показать описание

Maximize Your Savings as a Freelancer! 📊

Exploring the 8% Tax Rate for 3rd Quarter 💰 Learn the Ins and Outs with Our Guide.

#FreelancerTaxTips #BIRForms #TaxSavings #QuarterlyTaxes #FreelanceFinance #BIRGuidelines #TaxRateExplained #FinancialFreedom #FreelanceHustle #MoneyMatters #TaxBreakdown #BIRCompliance #QuarterlyFiling #SmartFreelancing #BIRRegistered #TaxKnowHow #FreelanceSuccess #EarningPotential #TaxEducation #SavvyFreelancer

---

Stay updated by becoming a part of our Support Group!

📚 Grab your FREE DIY ebook!

💬 Need assistance? Let's chat!

---

BIR 8% tax rate requirements

How to file 8% tax as a freelancer 3rd quarter

BIR registration for freelancers

Freelancer tax saving tips

BIR quarterly tax deadlines

Understanding BIR Form 1701Q

Benefits of 8% tax rate for freelancers

Freelance finance management

BIR tax options for self-employed

Simplified tax guide for Filipino freelancers

Exploring the 8% Tax Rate for 3rd Quarter 💰 Learn the Ins and Outs with Our Guide.

#FreelancerTaxTips #BIRForms #TaxSavings #QuarterlyTaxes #FreelanceFinance #BIRGuidelines #TaxRateExplained #FinancialFreedom #FreelanceHustle #MoneyMatters #TaxBreakdown #BIRCompliance #QuarterlyFiling #SmartFreelancing #BIRRegistered #TaxKnowHow #FreelanceSuccess #EarningPotential #TaxEducation #SavvyFreelancer

---

Stay updated by becoming a part of our Support Group!

📚 Grab your FREE DIY ebook!

💬 Need assistance? Let's chat!

---

BIR 8% tax rate requirements

How to file 8% tax as a freelancer 3rd quarter

BIR registration for freelancers

Freelancer tax saving tips

BIR quarterly tax deadlines

Understanding BIR Form 1701Q

Benefits of 8% tax rate for freelancers

Freelance finance management

BIR tax options for self-employed

Simplified tax guide for Filipino freelancers

Saan ba tayo makakatipid: 8% or Graduated Income Tax? - BT V005

WHAT IS AN 8% INCOME TAX?

1701A for NON-VAT TAXPAYER under 8% Income Tax Rate

8% Income Tax Rate | Graduated Income Tax | OSD | Itemized Deduction | Online Freelancers

1701Q for 8% INCOME TAX OPTION 1st, 2nd & 3rd Quarter

How to avail BIR 8% Income Tax Rate? 🤔🐈

SAN NGA BA MAS MAKAKATIPID NG TAX? | Graduated Rates versus 8% Optional Rate

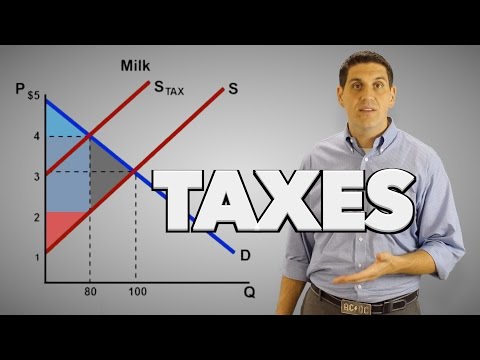

Taxes on Producers- Micro Topic 2.8

Tax Rate applicable for Senior Citizens A.Y. 2025-26| New v/s Old Tax Regime | Complete Details ✅

3% Percentage Tax Explained | How to Compute and File 3% Percentage Tax (Tagalog)

How to estimate your personal income taxes

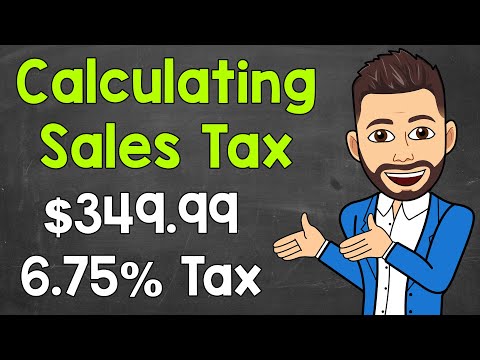

How to Calculate Sales Tax | Math with Mr. J

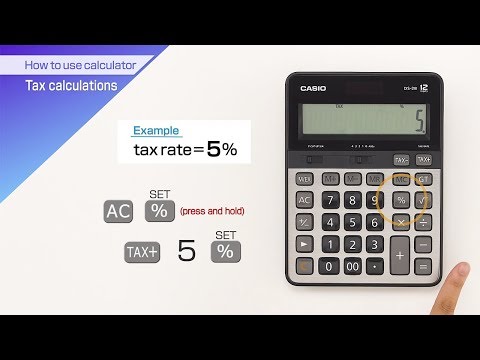

How To Calculate Sales Tax On Calculator Easy Way

CASIO【How to use calculator Tax calculations】

How to Compute Individual Income Tax in 2024 | PAANO MAG COMPUTE NG INCOME TAX

How to Compute Income Tax of Mixed Income Earner (TRAIN Law)

Introduction to Business Tax | Basics of Percentage Tax and VAT

Tax Brackets Explained For Beginners in The USA

You can save CRORES if you know about this INCOME TAX ACT! | Ankur Warikoo #shorts

Secret Way To Save Tax !

How to calculate tax

How much Tax should u pay as per New Regime?

Income Tax - Corbettmaths

Itemized Deduction vs. Optional Standard Deduction vs. 8% Income Tax

Комментарии

0:14:32

0:14:32

0:13:17

0:13:17

0:10:51

0:10:51

0:23:05

0:23:05

0:15:40

0:15:40

0:05:10

0:05:10

0:24:52

0:24:52

0:05:58

0:05:58

0:16:58

0:16:58

0:04:34

0:04:34

0:04:49

0:04:49

0:07:21

0:07:21

0:03:15

0:03:15

0:00:48

0:00:48

0:05:07

0:05:07

0:05:35

0:05:35

0:06:02

0:06:02

0:04:29

0:04:29

0:00:34

0:00:34

0:00:56

0:00:56

0:13:07

0:13:07

0:00:45

0:00:45

0:07:55

0:07:55

0:05:12

0:05:12