filmov

tv

ACA Subsidies: How Do You Qualify for Them? | Ep. 104 | Martin James | The Guided Retirement Show

Показать описание

Making his third appearance on The Guided Retirement Show, Marty James, CPA, PFS joins Dean Barber to discuss how to qualify for Affordable Care Act subsidies. Qualifying for the Affordable Care Act subsidies can greatly reduce the cost of health insurance prior to becoming eligible for Medicare. Who doesn’t want that?! Marty and Dean are both excited to touch on this topic, so let’s see what they have to share.

In this podcast interview, you’ll learn:

• Aspects of the Affordable Care Act That Can Help People Who Need • Financial Assistance with Health Care

• How Someone Who Has Accumulated A Lot of Money Can Benefit from • Affordable Care Act Subsidies

• Affordable Care Act Subsidies Before and After 2026

• How to Utilize Roth IRAs and HSAs

Other Episodes with Marty James:

In this podcast interview, you’ll learn:

• Aspects of the Affordable Care Act That Can Help People Who Need • Financial Assistance with Health Care

• How Someone Who Has Accumulated A Lot of Money Can Benefit from • Affordable Care Act Subsidies

• Affordable Care Act Subsidies Before and After 2026

• How to Utilize Roth IRAs and HSAs

Other Episodes with Marty James:

ACA Subsidies: How Do You Qualify for Them? | Ep. 104 | Martin James | The Guided Retirement Show

How Premium Tax Credit works (ACA Subsidies Explained) | Obamacare

What the Healthcare - Obamacare Subsidies and do you Qualify

How do Obamacare subsidies work?

Obamacare subsidies explained in one minute

eBook Video #5: How do you qualify for Obamacare subsidies?

📣 Unlock Subsidies for Affordable Healthcare: Check Your Eligibility Today! 🏥💰

Understanding ACA Health Insurance Subsidies – Simple & Fast!

Obamacare Subsidies: How an Extra $1 in Income Can Cost You Thousands

Can someone with Employer coverage get an ACA plan with subsidies and how to CYA.

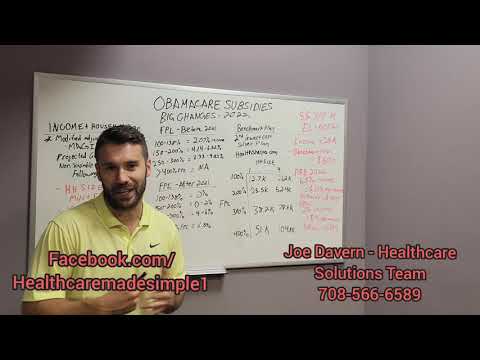

Obamacare Subsidies explained...and increasing for 2022

AFFORDABLE CARE ACT: SUBSIDIES - HOW CAN I PAY LESS??

ACA Subsidies explained

Roth Conversions Or ACA Subsidies-What is Better for Early Retirement?

Retiring Before Age 65? Get a Larger Affordable Care Act Healthcare Subsidy!

Married Filing Separate - Can they get subsidies for ACA 'Obamacare'

The real reason American health care is so expensive

💡 How to Keep Healthcare Affordable While Job Hunting | ACA Subsidies Explained 💼💰

How to Qualify for ACA Health Insurance Subsidies as an Early Retiree

The ACA’s Insurance Subsidies - Christopher Holt

The Pros and Cons of ACA 'Obamacare: Cost Share Reductions & Subsidies: Should You Take Par...

Afforable Health Insurance: Obamacare Subsidies and do you Qualify

🏥 Affordable Care: Subsidies and Premiums 📈

Early Retirement Health Insurance Strategies | Roth Conversions vs. ACA Subsidies

Комментарии

0:18:55

0:18:55

0:07:29

0:07:29

0:08:03

0:08:03

0:03:45

0:03:45

0:01:00

0:01:00

0:01:12

0:01:12

0:00:05

0:00:05

0:02:10

0:02:10

0:02:50

0:02:50

0:08:02

0:08:02

0:11:25

0:11:25

0:05:13

0:05:13

0:01:12

0:01:12

0:18:46

0:18:46

0:09:58

0:09:58

0:03:04

0:03:04

0:05:42

0:05:42

0:01:03

0:01:03

0:17:43

0:17:43

0:01:27

0:01:27

0:15:17

0:15:17

0:06:38

0:06:38

0:00:05

0:00:05

0:32:45

0:32:45