filmov

tv

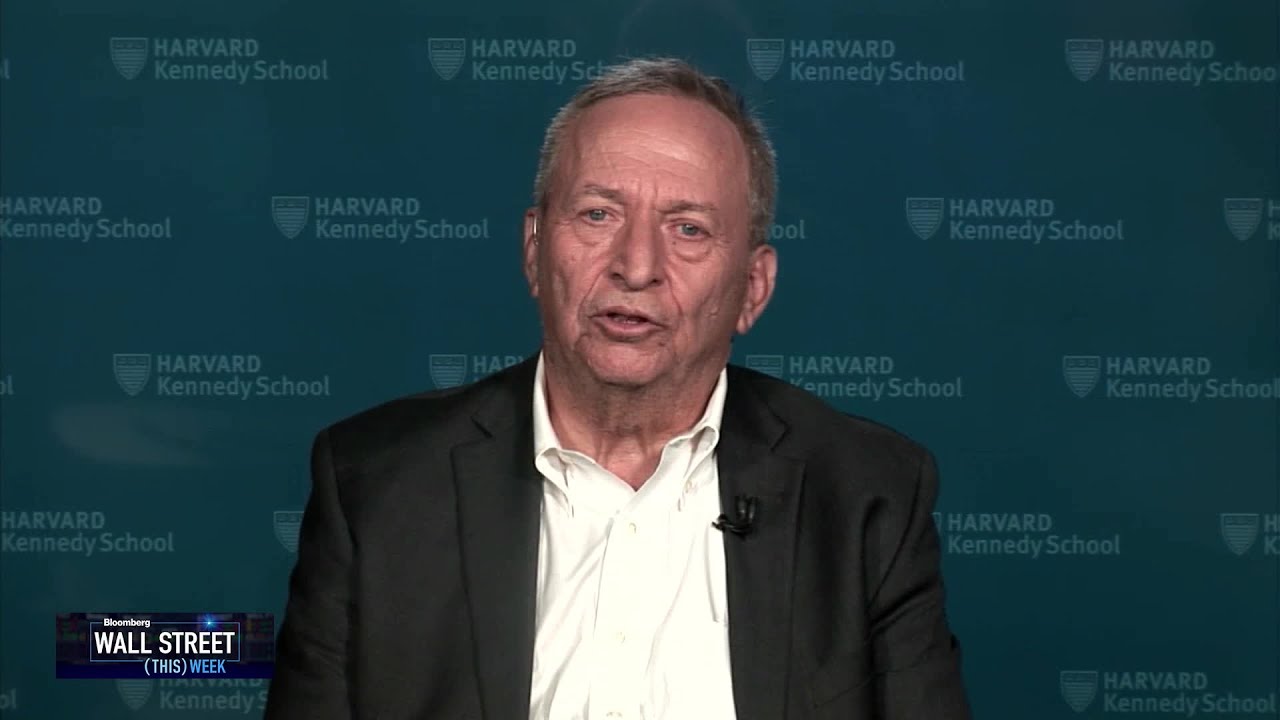

Summers Says Fed May Need to Hike Rates Past 6%

Показать описание

Former Treasury Secretary Lawrence Summers says the Federal Reserve may need to raise interest rates to 6% or higher to bring inflation under control, given that the US economy is still running strong. He speaks to David Westin on Bloomberg "Wall Street Week."

--------

Connect with us on...

--------

Connect with us on...

Summers Says Fed May Need to Hike Rates Past 6%

Summers: Fed May Need to Weigh In on Debt Problem

Summers Says Fed Terminal Rate Above 5% Wouldn't Surprise

Summers Sees 'Turbulent' Time

Summers Says Fed Should Raise Rates Four Times Next Year

Larry Summers: The Fed's Brakes Aren't Getting too much traction

Summers: Fed Unlikely to be Able to Cut as Much as They Want

Larry Summers Says the Fed Needs to be More Careful

Larry Summers Says Fed 'Closer to Done' on Inflation Fight

Summers Says Fed Rate Cut in June Would Be Dangerous

Summers Says Fed's 'Brakes' Not Getting Much Traction on Inflation

Summers Says Fed Officials Entering 'New Era' on Overheating

Summers: Wage Slowdown May Be Positive Inflation Sign

Larry Summers: Be 'Prepared' for Fed Rate Hikes at Every Meeting This Year

Larry Summers: Terminal Rate May go past 6%

Summers Says Fed Should Not Cut Rates Right Now

Fed Finally Recognizes Inflation Danger: Summers

Larry Summers Says Fed Delivers Good News to Markets

Summers Says Politically Pressuring Fed a 'Fool's Game'

The Fed Finally Got it Right, Summers Says

Summers Says Don't Be Surprised by a 75 Basis Point Fed Rate Hike

Larry Summers Says Fed Tilt to Avoid Downturn 'Broadly Appropriate'

Summers Says Fed Rate Hike Was Broadly Appropriate

Larry Summers: Fed Should Meet Now to End QE

Комментарии

0:03:28

0:03:28

0:02:35

0:02:35

0:04:05

0:04:05

0:09:50

0:09:50

0:03:01

0:03:01

0:09:32

0:09:32

0:02:19

0:02:19

0:09:23

0:09:23

0:02:44

0:02:44

0:02:08

0:02:08

0:02:26

0:02:26

0:09:05

0:09:05

0:05:05

0:05:05

0:01:46

0:01:46

0:09:18

0:09:18

0:16:54

0:16:54

0:10:02

0:10:02

0:08:10

0:08:10

0:02:57

0:02:57

0:00:44

0:00:44

0:01:14

0:01:14

0:01:03

0:01:03

0:01:57

0:01:57

0:09:20

0:09:20