filmov

tv

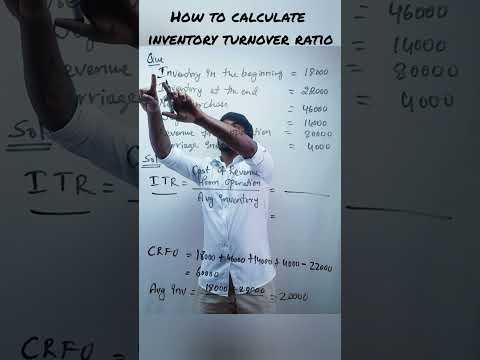

Inventory turnover explained

Показать описание

Inventory turnover is an indicator of speed or velocity in a company: how quickly does a company turn its inventory into sales. How many times is the inventory sold or used in a year? Inventory turns can be a very meaningful metric for a retail company or an industrial company.

⏱️TIMESTAMPS⏱️

0:00 Why is inventory turnover important

0:33 Inventory turnover definitions

1:21 Improving inventory turns

1:56 Inventory turnover and asset turnover

2:18 Calculating inventory turnover example

Different companies and different people use different definitions of #inventory turnover. Rather than asking what is the “right” definition, I would like to ask: what is the most useful definition? A: Inventory turns as the ratio between Sales and Inventory, or B: inventory turns as the ratio between Cost of Goods Sold and Inventory. When you drill down into the components, you will see that the first definition has units sold times the selling price per unit in the numerator, and units in stock times cost per unit in the denominator. The second definition has units sold times cost per unit in the numerator, and units in stock times cost per unit in the denominator. As cost per unit divided by cost per unit equals 1, you are in this second definition basically just dividing units sold by units in stock, and those are the only two variables that can be influenced when you strive for improvement.

In my opinion, option A: Inventory turns as the ratio between Sales and Inventory, is the most useful definition. As a finance director in a company, you can help create value for this company by providing visibility of the drivers of this key ratio of inventory turns. The management team can then ask the right questions to drive results: How do we sell more units? How do we increase the price per unit sold? How do we optimize our supply chain so we have fewer units in stock? How do we work on productivity to lower the cost per unit? The second reason I prefer option A, is that it links closely to Asset Turnover (sales over assets) in the DuPont formula, a key business equation that every business and finance person should understand. If you prefer option B, then there are several videos available on other YouTube channels that take you through a calculation.

Philip de Vroe (The Finance Storyteller) aims to make strategy, #finance and leadership enjoyable and easier to understand. Learn the business vocabulary to join the conversation with your CEO at your company. Understand how financial statements work in order to make better stock market investment decisions. Philip delivers training in various formats: YouTube videos, classroom sessions, webinars, and business simulations. Connect with me through Linked In!

⏱️TIMESTAMPS⏱️

0:00 Why is inventory turnover important

0:33 Inventory turnover definitions

1:21 Improving inventory turns

1:56 Inventory turnover and asset turnover

2:18 Calculating inventory turnover example

Different companies and different people use different definitions of #inventory turnover. Rather than asking what is the “right” definition, I would like to ask: what is the most useful definition? A: Inventory turns as the ratio between Sales and Inventory, or B: inventory turns as the ratio between Cost of Goods Sold and Inventory. When you drill down into the components, you will see that the first definition has units sold times the selling price per unit in the numerator, and units in stock times cost per unit in the denominator. The second definition has units sold times cost per unit in the numerator, and units in stock times cost per unit in the denominator. As cost per unit divided by cost per unit equals 1, you are in this second definition basically just dividing units sold by units in stock, and those are the only two variables that can be influenced when you strive for improvement.

In my opinion, option A: Inventory turns as the ratio between Sales and Inventory, is the most useful definition. As a finance director in a company, you can help create value for this company by providing visibility of the drivers of this key ratio of inventory turns. The management team can then ask the right questions to drive results: How do we sell more units? How do we increase the price per unit sold? How do we optimize our supply chain so we have fewer units in stock? How do we work on productivity to lower the cost per unit? The second reason I prefer option A, is that it links closely to Asset Turnover (sales over assets) in the DuPont formula, a key business equation that every business and finance person should understand. If you prefer option B, then there are several videos available on other YouTube channels that take you through a calculation.

Philip de Vroe (The Finance Storyteller) aims to make strategy, #finance and leadership enjoyable and easier to understand. Learn the business vocabulary to join the conversation with your CEO at your company. Understand how financial statements work in order to make better stock market investment decisions. Philip delivers training in various formats: YouTube videos, classroom sessions, webinars, and business simulations. Connect with me through Linked In!

Комментарии

0:04:15

0:04:15

0:03:40

0:03:40

0:01:41

0:01:41

0:01:38

0:01:38

0:03:37

0:03:37

0:01:11

0:01:11

0:05:56

0:05:56

0:15:13

0:15:13

0:06:43

0:06:43

0:01:55

0:01:55

0:02:16

0:02:16

0:00:39

0:00:39

0:13:27

0:13:27

0:05:08

0:05:08

0:01:24

0:01:24

0:09:09

0:09:09

0:02:22

0:02:22

0:06:40

0:06:40

0:05:32

0:05:32

0:01:00

0:01:00

0:02:20

0:02:20

0:01:00

0:01:00

0:05:45

0:05:45

0:04:37

0:04:37