filmov

tv

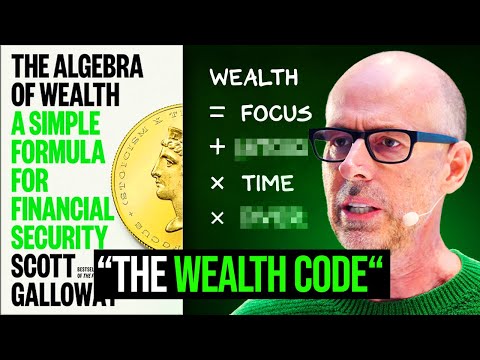

The Algebra of Wealth | The Prof G Show

Показать описание

On this episode of the Prof G Show, Scott Galloway ponders one of everyone's favorite questions: how do you get rich?

0:00 Let's Level Set

1:08 The Algebra of Wealth

1:19 Focus & Opportunity

3:23 Stoicism

4:47 Investing vs Consumption

6:59 Time (Friend or Foe?)

7:40 Diversification (Your Safety Net)

9:28 In Summary...

Prof G on Social:

*NEW: Q&A on TikTok*

0:00 Let's Level Set

1:08 The Algebra of Wealth

1:19 Focus & Opportunity

3:23 Stoicism

4:47 Investing vs Consumption

6:59 Time (Friend or Foe?)

7:40 Diversification (Your Safety Net)

9:28 In Summary...

Prof G on Social:

*NEW: Q&A on TikTok*

Scott Galloway - “The Algebra of Wealth” | The Daily Show

The Algebra of Wealth | The Prof G Show

The Algebra of Wealth Summary (Scott Galloway): 💰 = Focus + (Stoicism x Time x Diversification) 📈...

The Algebra of Wealth - Scott Galloway

The Algebra of Wealth Audiobook (Scott Galloway): 💰 = Focus + (Stoicism x Time x Diversification) 📈...

The Algebra of Wealth By Scott Galloway - Book Summary

Achieving Financial Success: Scott Galloway's Tips

Young people have every reason to be enraged, says 'Algebra of Wealth' author

Unveiling the Path to Wealth: Lessons from ‘Rich Dad Poor Dad’

A simple formula for Financial Security - The Algebra of Wealth

The Algebra Of Wealth by Scott Galloway (Book Summary) 🤑📈

Scott Galloway: The Algebra of Wealth | Rational Reminder 303

How To Become A Millionaire – Scott Galloway

How to Get Wealthy in an Economy Broken for Young People | Scott Galloway

Scott Galloway's Tips On How to Get Rich

The Algebra of Happiness

Scott Galloway & Adam Alter, Ph.D. - The Algebra of Wealth: A Simple Formula for Economic Securi...

Scott Galloway: The Algebra of Happiness

The Sad Reality Of Young Men in America 🤷♂️🇺🇸 | Scott Galloway

A Brief But Spectacular take on the algebra of happiness

The Algebra of Wealth: A Simple Formula for Success | Audiobook Summary

Scott Galloway's Ultimate Guide to Financial Well-Being: The Algebra of Wealth

How to Build Wealth Using a Simple Formula: The Algebra of Wealth Book Summary

Code to financial freedom: The algebra of wealth by Scott Galloway (summary)

Комментарии

0:09:26

0:09:26

0:10:14

0:10:14

0:08:52

0:08:52

1:47:37

1:47:37

1:53:34

1:53:34

0:04:46

0:04:46

1:20:21

1:20:21

0:07:37

0:07:37

0:10:56

0:10:56

1:19:47

1:19:47

0:17:57

0:17:57

1:14:34

1:14:34

0:02:49

0:02:49

0:32:45

0:32:45

0:03:46

0:03:46

0:10:26

0:10:26

0:53:29

0:53:29

0:30:40

0:30:40

0:00:46

0:00:46

0:03:58

0:03:58

0:15:38

0:15:38

1:15:27

1:15:27

0:04:49

0:04:49

0:07:03

0:07:03