filmov

tv

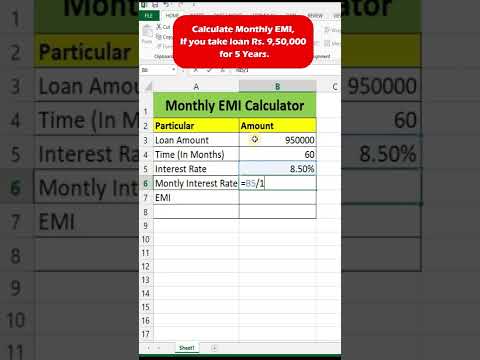

How To Calculate Interest On A Loan

Показать описание

How To Calculate Interest On A Loan

Calculate your cost, loan amount, rate of interest or variety of payments (time period). Consumers who couldn't qualify for conventional loans with a large down cost may finance their buy with an curiosity only loan and later refinance, as soon as the worth appreciation created a adequate fairness stake within the property. An ordinary mortgage cost calculation amortizes the original loan quantity over the term of the loan. A regular loan fee features a portion of the cost to cover the interest due on the mortgage and one other portion of the cost is used to lower the loan principal. For example, a $300,000 mortgage over 30 years with a 6% annual fastened interest rate has a month-to-month cost equal to $1798.65.

Try completely different situations to calculate how a lot mortgage you may afford ; with a current mortgage, if you recognize your rate of interest, monthly fee amount and how many funds are left, you can calculate the principal loan quantity that's left to pay. Strive totally different eventualities to see how lengthy it is going to take you to payoff a loan; with a present mortgage, if you know how a lot principal is left to pay, rate of interest and your month-to-month cost, you'll be able to calculate the number of funds remaining on your loan.

Interest solely loans usually are not an invention of modern finance As a matter of truth, a version of the curiosity solely loan, often called a time period mortgage, was the usual lending mannequin used for financing residential actual estate till the Nice Despair. Lately, curiosity only loans allowed consumers to buy real estate during a time of extraordinary worth progress.

Calculate your cost, loan amount, rate of interest or variety of payments (time period). Consumers who couldn't qualify for conventional loans with a large down cost may finance their buy with an curiosity only loan and later refinance, as soon as the worth appreciation created a adequate fairness stake within the property. An ordinary mortgage cost calculation amortizes the original loan quantity over the term of the loan. A regular loan fee features a portion of the cost to cover the interest due on the mortgage and one other portion of the cost is used to lower the loan principal. For example, a $300,000 mortgage over 30 years with a 6% annual fastened interest rate has a month-to-month cost equal to $1798.65.

Try completely different situations to calculate how a lot mortgage you may afford ; with a current mortgage, if you recognize your rate of interest, monthly fee amount and how many funds are left, you can calculate the principal loan quantity that's left to pay. Strive totally different eventualities to see how lengthy it is going to take you to payoff a loan; with a present mortgage, if you know how a lot principal is left to pay, rate of interest and your month-to-month cost, you'll be able to calculate the number of funds remaining on your loan.

Interest solely loans usually are not an invention of modern finance As a matter of truth, a version of the curiosity solely loan, often called a time period mortgage, was the usual lending mannequin used for financing residential actual estate till the Nice Despair. Lately, curiosity only loans allowed consumers to buy real estate during a time of extraordinary worth progress.

Комментарии

0:02:37

0:02:37

0:04:05

0:04:05

0:00:39

0:00:39

0:11:02

0:11:02

0:05:41

0:05:41

0:04:28

0:04:28

0:01:56

0:01:56

0:01:18

0:01:18

0:00:10

0:00:10

0:01:34

0:01:34

0:14:58

0:14:58

0:02:01

0:02:01

0:04:26

0:04:26

0:00:44

0:00:44

0:03:33

0:03:33

0:00:57

0:00:57

0:03:10

0:03:10

0:00:34

0:00:34

0:05:10

0:05:10

0:48:50

0:48:50

0:01:50

0:01:50

0:00:39

0:00:39

0:03:50

0:03:50

0:00:58

0:00:58