filmov

tv

ROIC vs ROE vs ROA vs ROI

Показать описание

Return On Invested Capital versus Return On Equity versus Return On Assets versus Return On Investment. Why do we need them, and what are the similarities and differences between these financial metrics?

⏱️TIMESTAMPS⏱️

0:00 Introduction

0:15 ROIC ROE ROA ROI common factor

0:51 RO* formula

1:17 ROIC formula

1:32 ROE and ROA formula

1:43 ROI formula

1:56 ROIC vs ROE

2:23 ROA vs ROE

3:24 ROA vs ROI

4:02 ROE vs ROI

4:33 ROIC ROE ROA ROI summary

Let’s start with the common factor in these financial metrics. ROIC, ROE, ROA, ROI. Do you see any similarities? Yep! They all start with R O which means Return On, which is then followed by one or more letters of the alphabet. Each of these financial metrics is trying to help you understand how much bang for the buck you get, in more financial terms how much value for money you get. For all of these financial metrics (ROIC, ROE, ROA, ROI), the higher the better, assuming the returns are sustainable and not a one-off.

That’s because the formula, the calculation of the financial metrics, is very similar. Put the bang in the numerator, and put the buck in the denominator. In other words, put the outputs or benefits or returns (per year) in the numerator, and the inputs or investment or capital in the denominator. If I invest $1, how much annual return is being generated on that investment.

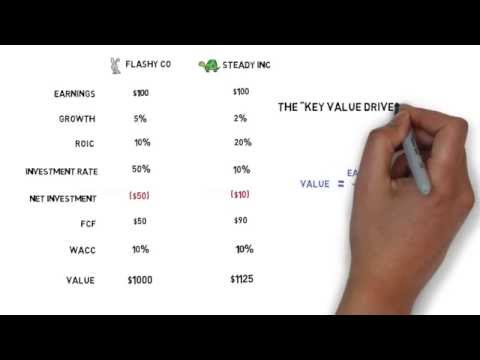

Let’s look at the formula more specifically for each of the four common financial metrics. ROIC, Return On Invested Capital, is calculated as the sum of after-tax interest expense plus net income, divided by the sum of debt plus equity. ROE, Return On Equity, is calculated as net income divided by equity. ROA, Return On Assets, is calculated as net income divided by assets. ROI, Return On Investment, is calculated as benefits or returns divided by investment. Let’s make some meaningful comparisons on a one-to-one basis between these financial metrics.

In summary: ROIC, ROE, ROA and ROI are similar metrics, helping you to analyze whether an investment brings value for money. You can choose which financial metric to use for a specific situation. Each metric has a situation where it provides the most relevant perspective. Remember, financial analysis is as much an art as it is a science!

Philip de Vroe (The Finance Storyteller) aims to make strategy, #finance and leadership enjoyable and easier to understand. Learn the business and accounting vocabulary to join the conversation with your CEO at your company. Understand how financial statements work in order to make better stock market investment decisions. Learn how to do #financialanalysis. Philip delivers #financetraining in various formats: YouTube videos, classroom sessions, webinars, and business simulations. Connect with me through Linked In!

⏱️TIMESTAMPS⏱️

0:00 Introduction

0:15 ROIC ROE ROA ROI common factor

0:51 RO* formula

1:17 ROIC formula

1:32 ROE and ROA formula

1:43 ROI formula

1:56 ROIC vs ROE

2:23 ROA vs ROE

3:24 ROA vs ROI

4:02 ROE vs ROI

4:33 ROIC ROE ROA ROI summary

Let’s start with the common factor in these financial metrics. ROIC, ROE, ROA, ROI. Do you see any similarities? Yep! They all start with R O which means Return On, which is then followed by one or more letters of the alphabet. Each of these financial metrics is trying to help you understand how much bang for the buck you get, in more financial terms how much value for money you get. For all of these financial metrics (ROIC, ROE, ROA, ROI), the higher the better, assuming the returns are sustainable and not a one-off.

That’s because the formula, the calculation of the financial metrics, is very similar. Put the bang in the numerator, and put the buck in the denominator. In other words, put the outputs or benefits or returns (per year) in the numerator, and the inputs or investment or capital in the denominator. If I invest $1, how much annual return is being generated on that investment.

Let’s look at the formula more specifically for each of the four common financial metrics. ROIC, Return On Invested Capital, is calculated as the sum of after-tax interest expense plus net income, divided by the sum of debt plus equity. ROE, Return On Equity, is calculated as net income divided by equity. ROA, Return On Assets, is calculated as net income divided by assets. ROI, Return On Investment, is calculated as benefits or returns divided by investment. Let’s make some meaningful comparisons on a one-to-one basis between these financial metrics.

In summary: ROIC, ROE, ROA and ROI are similar metrics, helping you to analyze whether an investment brings value for money. You can choose which financial metric to use for a specific situation. Each metric has a situation where it provides the most relevant perspective. Remember, financial analysis is as much an art as it is a science!

Philip de Vroe (The Finance Storyteller) aims to make strategy, #finance and leadership enjoyable and easier to understand. Learn the business and accounting vocabulary to join the conversation with your CEO at your company. Understand how financial statements work in order to make better stock market investment decisions. Learn how to do #financialanalysis. Philip delivers #financetraining in various formats: YouTube videos, classroom sessions, webinars, and business simulations. Connect with me through Linked In!

Комментарии

0:05:18

0:05:18

0:02:08

0:02:08

0:14:02

0:14:02

0:15:10

0:15:10

0:05:57

0:05:57

0:09:40

0:09:40

0:04:26

0:04:26

0:24:13

0:24:13

0:05:12

0:05:12

0:24:13

0:24:13

0:12:20

0:12:20

0:09:15

0:09:15

0:08:47

0:08:47

0:09:13

0:09:13

0:03:07

0:03:07

0:16:49

0:16:49

0:05:22

0:05:22

0:07:35

0:07:35

0:12:52

0:12:52

0:04:02

0:04:02

0:09:03

0:09:03

0:03:57

0:03:57

0:03:56

0:03:56

0:11:27

0:11:27