filmov

tv

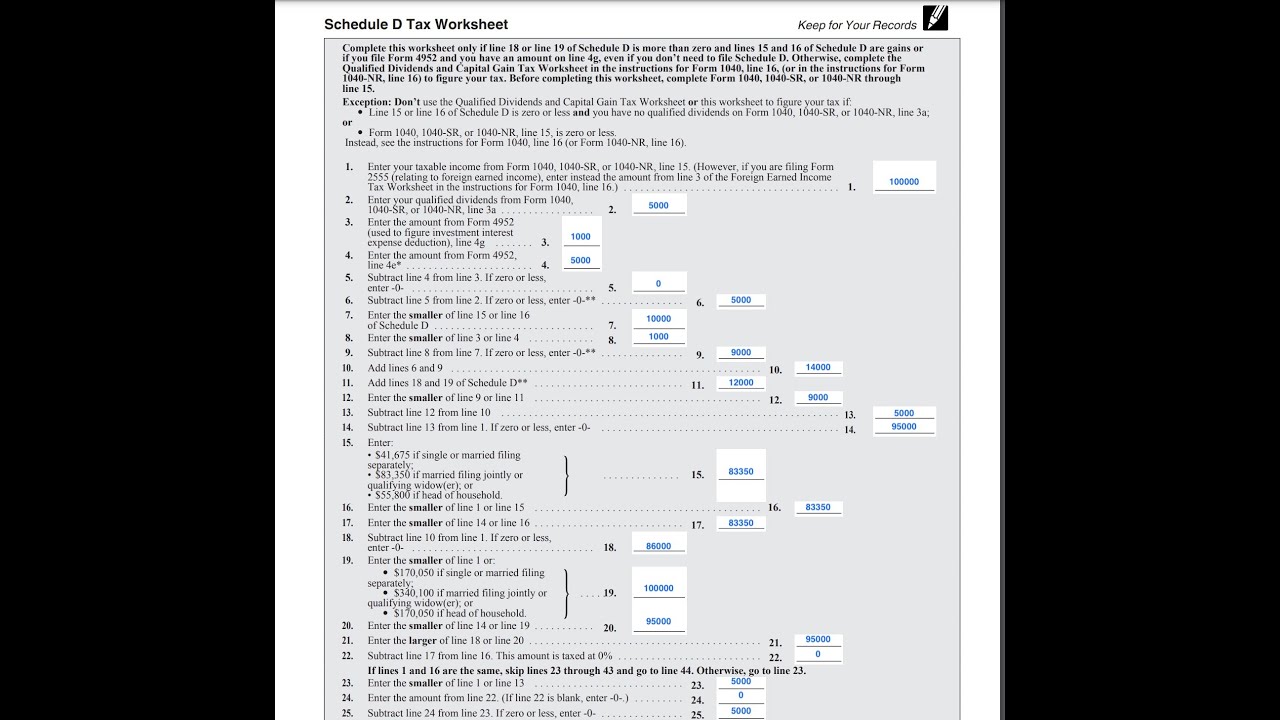

Schedule D Tax Worksheet walkthrough

Показать описание

Tired of doing it yourself? Here are several ways we can work together:

Here are links to articles and videos we've created about other tax forms mentioned in this video:

IRS Form 4952, Investment Interest Expense Deduction:

IRS Form 2555, Foreign Earned Income:

Schedule D Tax Worksheet walkthrough

IRS Schedule D Walkthrough (Capital Gains and Losses)

IRS Form 709, Schedule D walkthrough (Computation of Generation-Skipping Transfer Tax )

How to Fill Out Schedule D

Capital Gains - Putting it all Together on a Schedule D

Qualified Dividend and Capital Gains Tax Worksheet?

Schedule D Capital Loss Carryover Worksheet Walkthrough (Lines 6 & 14)

Reporting Capital Gains on IRS Form 8949 and Schedule D

IRS Form 709, Schedule C walkthrough (Deceased Spousal Unused Exclusion and Restored Exclusion)

28% Rate Gain Worksheet walkthrough (IRS Schedule D)

Schedule D Explained - IRS Form 1040 - Capital Gains and Losses

TurboTax 2022 Form 1040 - Capital Loss Carryovers on Schedule D

IRS Form 1040 Schedule SE Walkthrough

IRS Form 6781 Walkthrough (Gains and Losses From Section 1256 Contracts and Straddles)

IRS Form 8949 walkthrough (Sales and Other Dispositions of Capital Assets)

How to Enter 1099-B Capital Gains & Losses into Tax Software

Let's Look at Schedule D - Capital Gains and Losses - ENGAGE CPAs

IRS Schedule D Line-by-Line Instructions 2024: How to Report Capital Gains and Losses 🔶 TAXES S2•E58...

How to report sale of ESPP and RSU on tax return – TurboTax #1

2023 IRS Form 1120-S Schedule K-1 Walkthrough

Schedule A Explained - IRS Form 1040 - Itemized Deductions

2023 IRS Form 1065 Schedule K-1 Walkthrough

Don't Use Basic Vlookup in Excel‼️Instead Use Advanced Vlookup #excel #exceltips #short #excelt...

CryptoTax360 - Your 360° Solution for Crypto Tax Reporting!

Комментарии

0:22:14

0:22:14

0:32:16

0:32:16

0:10:15

0:10:15

0:09:36

0:09:36

0:07:13

0:07:13

0:11:29

0:11:29

0:07:22

0:07:22

0:05:22

0:05:22

0:09:07

0:09:07

0:08:51

0:08:51

0:08:13

0:08:13

0:12:26

0:12:26

0:04:15

0:04:15

0:27:34

0:27:34

0:22:25

0:22:25

0:04:08

0:04:08

0:03:39

0:03:39

0:32:34

0:32:34

0:12:25

0:12:25

0:17:52

0:17:52

0:06:16

0:06:16

0:25:36

0:25:36

0:01:03

0:01:03

0:00:11

0:00:11