filmov

tv

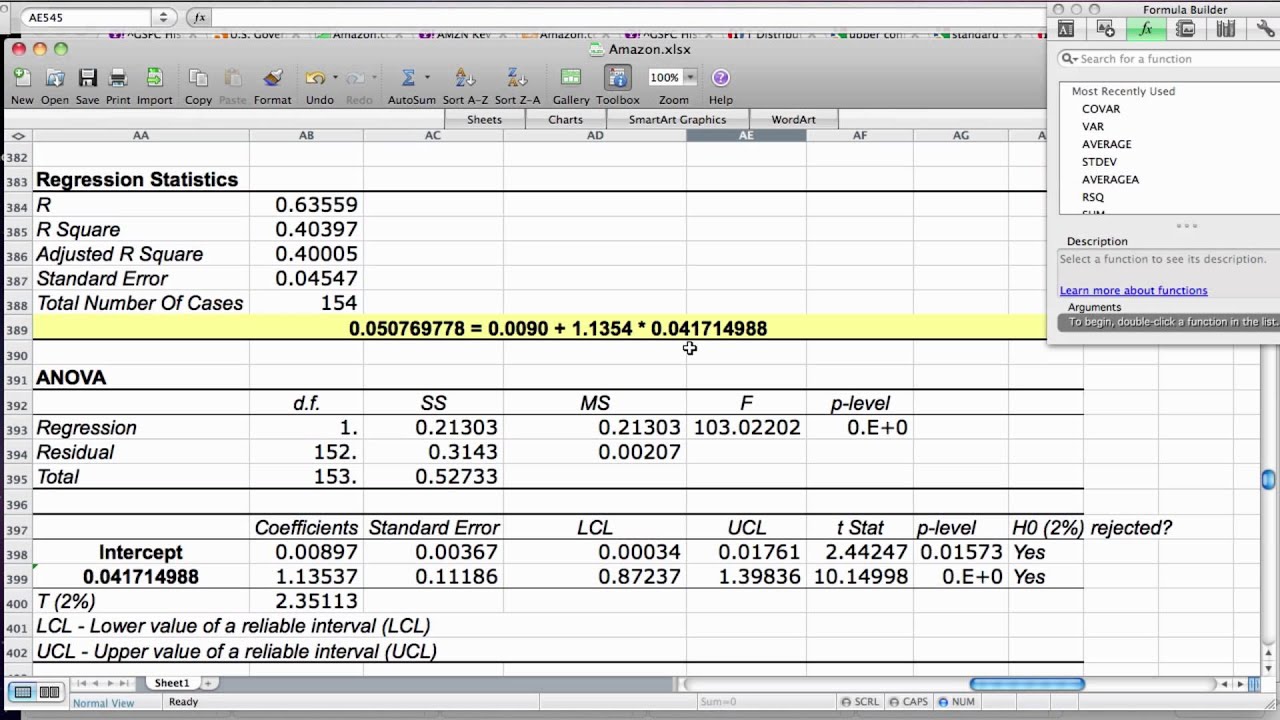

Explanation of Regression Analysis Results

Показать описание

Explanation of Regression Analysis Results

Interpreting Linear Regression Results

How to Report #Regression Analysis Results from #SPSS Output

Regression Output Explained

Regression analysis

Reading Regression Tables

Regression Analysis | Full Course

Regression Analysis Using SPSS - Analysis, Interpretation, and Reporting

Interpretation of Adjusted Odds Ratio from Logistic regression

Multiple Regression - Interpretation (3of3)

Multiple Regression | Coefficients – Interpretation, C.I, Hypothesis Testing

Regression Analysis: An introduction to Linear and Logistic Regression

Simple Linear Regressions

Linear Regression in 2 minutes

Interpreting Output for Multiple Regression in SPSS

019 What Does the StatsModels Summary Regression Table Tell us

Reading and Using STATA Regression Output (Step by step Explanation)

Linear Regression in Excel: How to Interpret a Model & Make Predictions

Video 1: Introduction to Simple Linear Regression

Summary of Interpreting a Regression Output from Stata

Simple linear regression in Excel | with interpretation of regression output

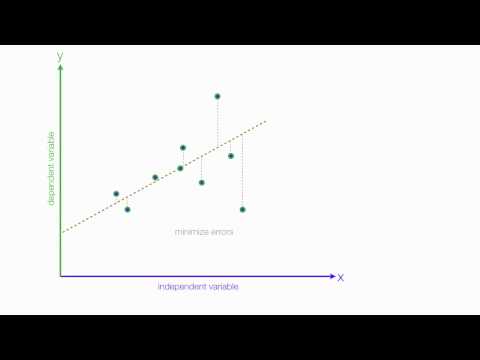

An Introduction to Linear Regression Analysis

Linear Regression, Clearly Explained!!!

Evaluating Regression Model Fit and Interpreting Model Results (2024 Level II CFA® Exam – Reading 2)...

Комментарии

0:06:14

0:06:14

0:16:08

0:16:08

0:05:14

0:05:14

0:33:19

0:33:19

0:03:51

0:03:51

0:12:57

0:12:57

0:45:17

0:45:17

0:16:24

0:16:24

0:02:21

0:02:21

0:11:36

0:11:36

0:08:06

0:08:06

0:09:38

0:09:38

0:05:32

0:05:32

0:02:34

0:02:34

0:08:41

0:08:41

0:05:48

0:05:48

0:18:08

0:18:08

0:04:23

0:04:23

0:13:29

0:13:29

0:09:18

0:09:18

0:07:38

0:07:38

0:05:18

0:05:18

0:27:27

0:27:27

0:27:59

0:27:59