filmov

tv

PSU as a General Theme Is Over, No Need to Be Overly Concentrated While Choosing Stocks: Samir Arora

Показать описание

"Don't have Railway stocks in portfolio. PSU as a general theme is over. Fairly valued stocks will give returns based on earnings growth. MSCI flows impact is a momentum move for HDFC Bank. Pain of MFI sector has not bottomed out yet. Have around 7% stake in IT in portfolio. No need to be overly concentrated while choosing stocks.", says Samir Arora, Founder, Helios Capital

#samirarora #marketanalysis #valuations #liquidity #topstocks #budget #etnow #unionbudget2024 #budget2024 #topnews #stockmarket #businessnews #sharemarketnews

Subscribe Now To Our Network Channels :-

To Stay Updated Download the Times Now App :-

Social Media Links :-

#samirarora #marketanalysis #valuations #liquidity #topstocks #budget #etnow #unionbudget2024 #budget2024 #topnews #stockmarket #businessnews #sharemarketnews

Subscribe Now To Our Network Channels :-

To Stay Updated Download the Times Now App :-

Social Media Links :-

PSU as a General Theme Is Over, No Need to Be Overly Concentrated While Choosing Stocks: Samir Arora

manually writing data to a HDD...kinda #shorts

Psi Patrol Polska | Piosenka Czołówkowa (Muzyka) | Nick Jr.

PSU Clementine | Extended Menu Theme

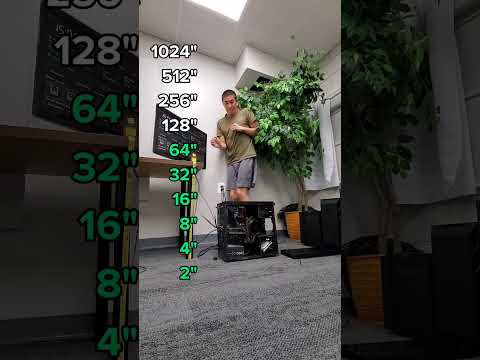

doubling the drop every time the PC survives #shorts

The Most Perfectly Timed Flyover in College Football History

Chitty Chitty Bang Bang (Theme): MuseScore 4 Version

4090 TUF OC - Lian Li Lancool 3 - ATX 3.0 PSU - Infinity Fans - 5950x

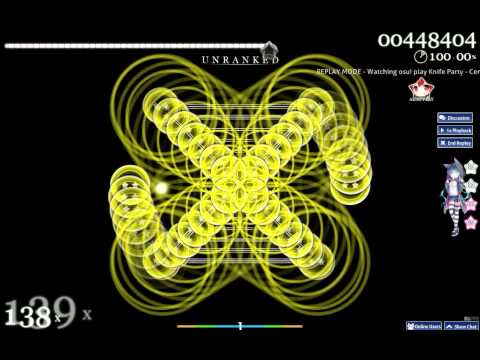

Osu! - Knife Party - Centipede [THE Impossible Map]

This kid is a better gaming Pc builder than you #shorts #gaming #gamer #pc #pcsetup #gamergirl

PAW Patrol Opening Theme

Data Center Power Chain - Animation

THERMALTAKE CES 2023 - ATX 3.0 PSU's & Custom PC MODS

James Franklin (Keegan-Michael Key) Leads Penn State Out of Tunnel | Big Ten Football

Psu Clementine : Protectors Mu Ultimate! (All Stages, Solo Mode) With a Wartecher!

What is ATX 3.0 Psu ? #powersupply #pcbuild #aryangamerx

3 PSU Stocks 💥 Election 2024 theme

8 September 2024

(EXTENDED) Favorite VGM #61 - Persona 4 Arena - The Wandering Wolf

Fume Extractor DIY

EEVblog 1606 - $45 AlienTek DP100 100W USB-C PSU REVIEW

PSO2:NGS -- Neudaiz (PSU)

All New Windows XP 20th Anniversary Build

A Calming $500 Gaming PC Build 💛

Комментарии

0:24:05

0:24:05

0:00:12

0:00:12

0:00:40

0:00:40

0:32:09

0:32:09

0:00:25

0:00:25

0:00:30

0:00:30

0:01:20

0:01:20

0:00:16

0:00:16

0:02:26

0:02:26

0:00:58

0:00:58

0:00:41

0:00:41

0:06:28

0:06:28

0:06:07

0:06:07

0:03:06

0:03:06

0:33:06

0:33:06

0:00:41

0:00:41

0:01:00

0:01:00

0:00:16

0:00:16

0:30:00

0:30:00

0:10:55

0:10:55

0:39:44

0:39:44

0:03:21

0:03:21

0:13:38

0:13:38

0:13:28

0:13:28