filmov

tv

Closing Instructions The Good, The Bad and The Ugly

Показать описание

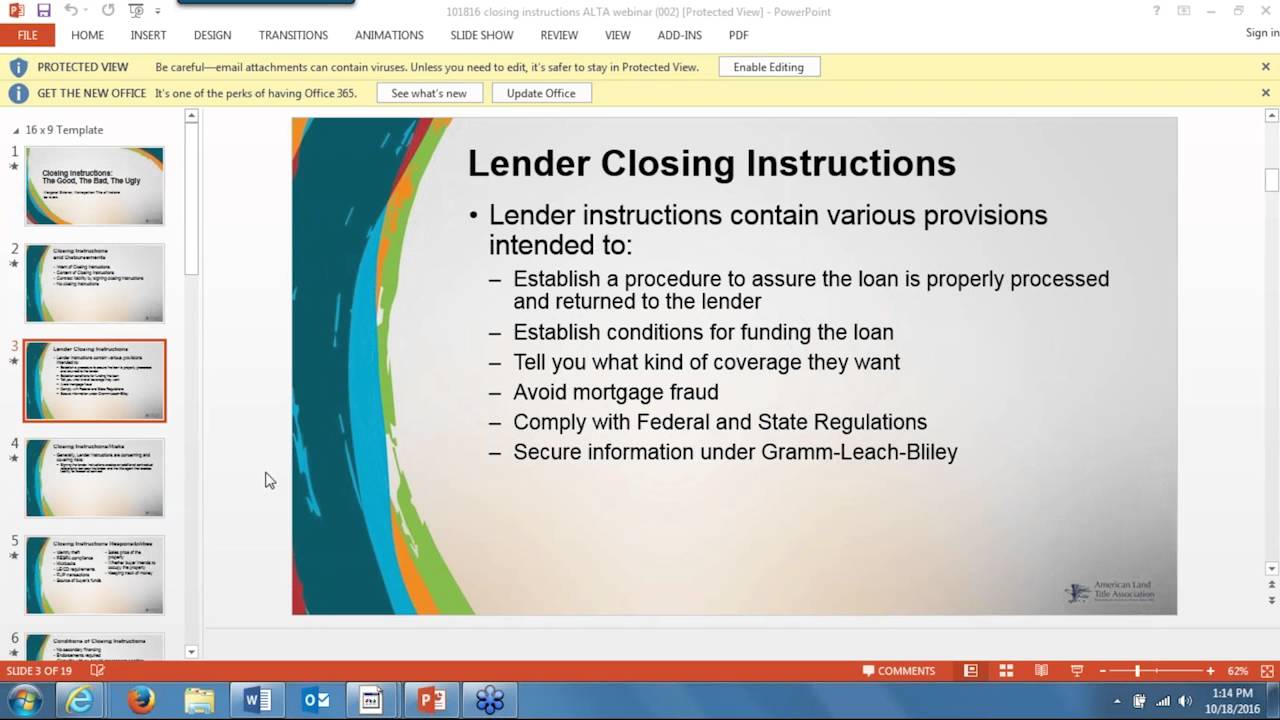

With lenders responsible for production and delivery of the Closing Disclosure under the TILA-RESPA Integrated Disclosures (TRID) rule, many lenders are modifying their closing instructions and shifting liability onto settlement and closing agents. These new instructions can create a host of problems for closers and your bottom line. This webinar discusses the importance of reading all closing instructions, share examples of different closing instructions and detail how settlement companies have pushed back on lender requirements.

Closing Instructions The Good, The Bad and The Ugly

Closing Instructions

Introduction to the Uniform Closing Instructions

10 Closing Instructions Lender

#5 Closing Instructions

Legal Bites #42 - New Closing Instructions

Soft Close Hinge Installation Instructions

Instructions at Work: Closing (2 examples)

Get Your Flop ... Close to the Hole Nonstop

Instructions to Closing Attorney

11 Refinance General Closing Instructions

Good Job..Baby Following Instructions #cutebaby #close#imitation

Closing instructions

ASMR Opening and Closing Your Eyes but The Instructions Keep Changing 🕺🏻💤

Hybrid Closing Instruction Video

close the door instruction

💥 2024 GAR Midyear Revisions - Instructions to Closing Attorney 💥 #realestatecontractrevision

[ASMR] FAST open and close your eyes 👀 while following my instructions

New Instruction; Garth Close, Chippenham 🤩

Closing Disclosure Instructions from PRMI

Proper instruction on how to close the lid and avoid leaks

Closing Document Instructions for Home Buyers - American Real Title, Karina Borgia-Lacroix

2 Escrow Supplemental Closing Instructions Training Video #LoanSigningAgent #notarybusiness

ASMR opening and closing your eyes to sleep💤 (follow my instructions)

Комментарии

0:56:27

0:56:27

0:02:00

0:02:00

1:01:28

1:01:28

0:03:58

0:03:58

0:03:04

0:03:04

0:06:31

0:06:31

0:02:07

0:02:07

0:01:16

0:01:16

0:01:20

0:01:20

0:04:04

0:04:04

0:01:22

0:01:22

0:00:06

0:00:06

0:03:02

0:03:02

0:15:42

0:15:42

0:01:47

0:01:47

0:00:19

0:00:19

0:12:21

0:12:21

![[ASMR] FAST open](https://i.ytimg.com/vi/5JSnIIS3KEc/hqdefault.jpg) 0:17:10

0:17:10

0:02:01

0:02:01

0:01:21

0:01:21

0:00:31

0:00:31

0:15:21

0:15:21

0:01:41

0:01:41

0:13:57

0:13:57