filmov

tv

This Concept Will Easily Increase Your ICT Win Rate - Timeframe Alignment (Full Lecture)

Показать описание

In this lecture I cover timeframe alignment, how it has changed my trading, and made me consistent. I also cover some examples of all timeframe alignments in a diverse range of markets.

⬇️ Learn I went from my first $0 - $10,000/mo (and how you can too): ⬇️

CFTC RISK DISCLOSURE:

Investing and trading in futures and commodities can involve significant risk. You should only use risk capital (money you can afford to lose) for such investments. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. Be aware that past performance is not indicative of future results. As a viewer, any investment decisions you make are solely your responsibility. My content is for informational and entertainment purposes only, it does not constitute financial advice. Always do your own research before making any investment decisions.

TIMESTAMPS:

00:00 Introduction

02:18 Timeframe Alignment

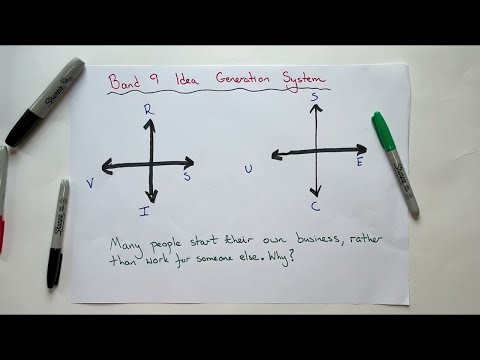

05:54 Diagram of Timeframe Alignment - IRL to ERL

08:11 Diagram of Timeframe Alignment - ERL to IRL

09:59 Examples of IRL to ERL

32:00 Live Execution

33:03 Conclusion

⬇️ Learn I went from my first $0 - $10,000/mo (and how you can too): ⬇️

CFTC RISK DISCLOSURE:

Investing and trading in futures and commodities can involve significant risk. You should only use risk capital (money you can afford to lose) for such investments. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. Be aware that past performance is not indicative of future results. As a viewer, any investment decisions you make are solely your responsibility. My content is for informational and entertainment purposes only, it does not constitute financial advice. Always do your own research before making any investment decisions.

TIMESTAMPS:

00:00 Introduction

02:18 Timeframe Alignment

05:54 Diagram of Timeframe Alignment - IRL to ERL

08:11 Diagram of Timeframe Alignment - ERL to IRL

09:59 Examples of IRL to ERL

32:00 Live Execution

33:03 Conclusion

Комментарии

0:33:23

0:33:23

0:00:19

0:00:19

0:07:26

0:07:26

0:00:32

0:00:32

0:00:08

0:00:08

0:00:57

0:00:57

0:00:29

0:00:29

0:00:28

0:00:28

0:00:31

0:00:31

0:24:41

0:24:41

0:00:48

0:00:48

0:00:39

0:00:39

0:00:20

0:00:20

1:30:01

1:30:01

0:00:27

0:00:27

0:06:17

0:06:17

0:00:26

0:00:26

0:00:16

0:00:16

0:01:00

0:01:00

0:10:39

0:10:39

0:00:46

0:00:46

0:00:31

0:00:31

0:03:25

0:03:25

0:00:31

0:00:31