filmov

tv

What is Superannuation Fund & How it Works? Income Tax with Superannuation Fund

Показать описание

What is Superannuation Fund & How it Works? Income Tax with Superannuation Fund | Superannuation Fund in India in Hindi

In this video by FinCalC TV we will see what is superannuation fund in salary, how superannuation fund works in India, contribution limits in superannuation fund, income tax benefits and pension amount after retirement with the help of superannuation fund.

Blog Post:

JOIN Telegram Group:

CHAPTERS:

00:00 Superannuation fund intro

00:25 What is Superannuation Fund in Salary?

01:13 Is Superannuation Fund mandatory?

01:51 Meaning of Superannuation in Hindi

02:39 How Superannuation Fund Works?

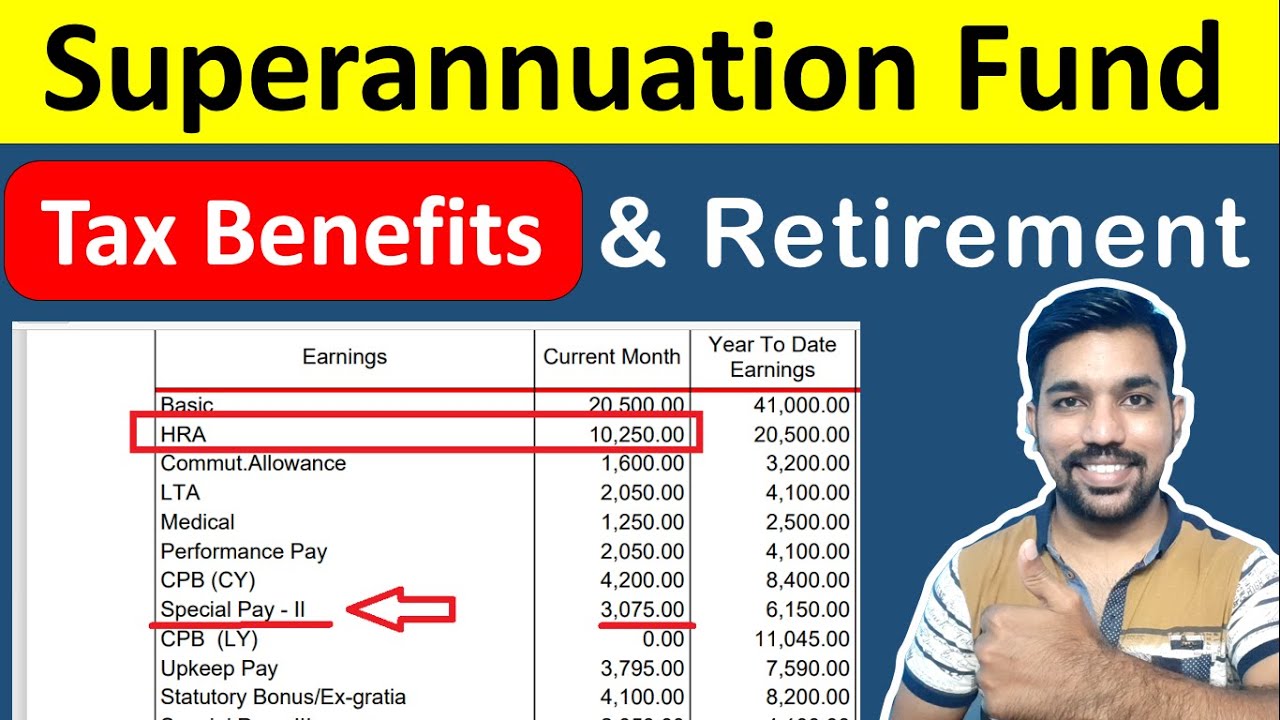

02:55 Example in Salary Payslip

04:04 Withdrawal from Superannuation Fund

04:40 Transfer funds on Job Switch or change

05:35 Income Tax Benefits on Superannuation Fund

06:35 Is Interest Tax Free?

06:46 Maximum contribution in Superannuation Fund

Income Tax Calculation on Salary Video:

What is Superannuation Fund in Salary?

Superannuation Fund is a type of pension fund which helps the employee to save for his or her retirement.

The employer / company helps in contributing the amount in the fund from their side to save for your future. This helps to secure your retirement age apart from provident fund, PPF and other pension funds.

The fund amount is part of your CTC (Cost to company)

Is Superannuation Fund mandatory?

Superannuation Fund is not mandatory and you have the option to take the fund amount to be credited as in hand salary every month.

Meaning of Superannuation in Hindi

The word superannuate means "to retire". And before retirement we need to have sufficient amount as balance in our account for retirement purpose and to meet our expenses while we enjoy free time.

That's the reason the scheme Superannuation Fund is used.

How Superannuation Fund Works?

In your salary, up to 15% of Basic pay + DA (Dearness allowance) is considered to be contributed in Superannuation Fund by your company.

The same is being contributed every month.

You can see the example on salary payslip with this contribution in the video.

Withdrawal from Superannuation Fund

After retirement, you have the option to withdraw 1/3 portion of the amount accumulated (Tax Free) and buy annuity with 2/3 portion of the remaining amount.

This annuity pla will help you to get pension every month.

If you withdraw the amount while switching or changing jobs, than the amount will be taxable.

Transfer funds on Job Switch or change

You can also get the funds transferred from one employer to another while you change jobs for better pay.

Income Tax Benefits on Superannuation Fund

You get maximum of Rs. 1.5 Lacs as deduction under section 80C that can be used to save your income tax with Old Tax regime.

This deduction is not allowed with new tax regime.

Is Interest Tax Free?

The interest you earn in Superannuation Fund is tax free post retirement.

Maximum contribution in Superannuation Fund

The limit of contribution in Superannuation Fund is maximum Rs. 1.5 Lacs in FY based on Budget 2020.

Amount exceeding this limit will be treated as perquisite in the hands of employee and willbe taxable.

#superannuation #pension #retirement #fincalc

==================

LIKE | SHARE | COMMENT | SUBSCRIBE

Mujhe Social Media par FOLLOW kare:

==================

MORE VIDEOS:

ALL EXCEL CALCULATORS VIDEOS:

============

DISCLAIMER:

Examples and demo used are for Illustration purpose only and might not cover every detail of examples shown. It is advised to seek professional help before taking any financial decisions. The owner of this channel shall not be liable in any way.

In this video by FinCalC TV we will see what is superannuation fund in salary, how superannuation fund works in India, contribution limits in superannuation fund, income tax benefits and pension amount after retirement with the help of superannuation fund.

Blog Post:

JOIN Telegram Group:

CHAPTERS:

00:00 Superannuation fund intro

00:25 What is Superannuation Fund in Salary?

01:13 Is Superannuation Fund mandatory?

01:51 Meaning of Superannuation in Hindi

02:39 How Superannuation Fund Works?

02:55 Example in Salary Payslip

04:04 Withdrawal from Superannuation Fund

04:40 Transfer funds on Job Switch or change

05:35 Income Tax Benefits on Superannuation Fund

06:35 Is Interest Tax Free?

06:46 Maximum contribution in Superannuation Fund

Income Tax Calculation on Salary Video:

What is Superannuation Fund in Salary?

Superannuation Fund is a type of pension fund which helps the employee to save for his or her retirement.

The employer / company helps in contributing the amount in the fund from their side to save for your future. This helps to secure your retirement age apart from provident fund, PPF and other pension funds.

The fund amount is part of your CTC (Cost to company)

Is Superannuation Fund mandatory?

Superannuation Fund is not mandatory and you have the option to take the fund amount to be credited as in hand salary every month.

Meaning of Superannuation in Hindi

The word superannuate means "to retire". And before retirement we need to have sufficient amount as balance in our account for retirement purpose and to meet our expenses while we enjoy free time.

That's the reason the scheme Superannuation Fund is used.

How Superannuation Fund Works?

In your salary, up to 15% of Basic pay + DA (Dearness allowance) is considered to be contributed in Superannuation Fund by your company.

The same is being contributed every month.

You can see the example on salary payslip with this contribution in the video.

Withdrawal from Superannuation Fund

After retirement, you have the option to withdraw 1/3 portion of the amount accumulated (Tax Free) and buy annuity with 2/3 portion of the remaining amount.

This annuity pla will help you to get pension every month.

If you withdraw the amount while switching or changing jobs, than the amount will be taxable.

Transfer funds on Job Switch or change

You can also get the funds transferred from one employer to another while you change jobs for better pay.

Income Tax Benefits on Superannuation Fund

You get maximum of Rs. 1.5 Lacs as deduction under section 80C that can be used to save your income tax with Old Tax regime.

This deduction is not allowed with new tax regime.

Is Interest Tax Free?

The interest you earn in Superannuation Fund is tax free post retirement.

Maximum contribution in Superannuation Fund

The limit of contribution in Superannuation Fund is maximum Rs. 1.5 Lacs in FY based on Budget 2020.

Amount exceeding this limit will be treated as perquisite in the hands of employee and willbe taxable.

#superannuation #pension #retirement #fincalc

==================

LIKE | SHARE | COMMENT | SUBSCRIBE

Mujhe Social Media par FOLLOW kare:

==================

MORE VIDEOS:

ALL EXCEL CALCULATORS VIDEOS:

============

DISCLAIMER:

Examples and demo used are for Illustration purpose only and might not cover every detail of examples shown. It is advised to seek professional help before taking any financial decisions. The owner of this channel shall not be liable in any way.

Комментарии

0:08:06

0:08:06

0:03:35

0:03:35

0:01:10

0:01:10

0:02:39

0:02:39

0:09:47

0:09:47

0:02:21

0:02:21

0:01:00

0:01:00

0:00:37

0:00:37

0:31:27

0:31:27

0:03:34

0:03:34

0:01:00

0:01:00

0:01:01

0:01:01

0:05:15

0:05:15

0:01:49

0:01:49

0:07:31

0:07:31

0:03:34

0:03:34

0:00:42

0:00:42

0:00:59

0:00:59

0:00:40

0:00:40

0:02:29

0:02:29

0:09:32

0:09:32

0:03:34

0:03:34

0:10:02

0:10:02

0:00:54

0:00:54