filmov

tv

Combined GAP & RTI Insurance - Aaron Marsh - Volvo Ipswich

Показать описание

What if?

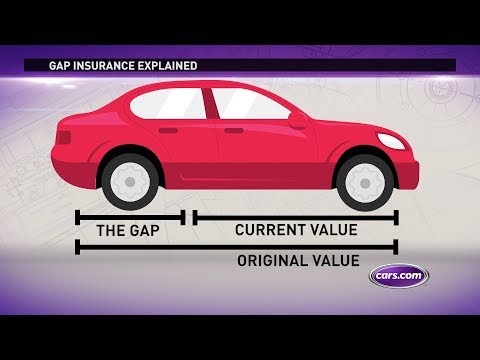

Due to accident, fire or theft, your motor insurance company declares your new vehicle a write-off?

What’s more its depreciation in value leads them to pay out less than the vehicle was originally worth.

What if you used a finance agreement to buy a vehicle that’s declared a write-off, before you’ve paid back all you owe? You may have to continue making monthly payments on a vehicle you no longer own.

Whether you’ve paid outright, or arranged a finance agreement, you can be covered fully with Combined Guaranteed Asset Protection.

How Combined Guaranteed Asset Protection works

If you bought your vehicle outright and paid £26,500 for your car and your motor insurance payout is £14,000, RTI can pay up to the difference of £12,500 to top it up to the original £26,500.

If you financed your vehicle and paid £26,500 and your motor insurance pay out is £14,000, and your outstanding finance payment was £17,500 Finance GAP insurance may payout up to £3,500.

Combined Guaranteed Asset Protection will payout the greater of the Finance GAP or RTI amount. It’s that simple!

Due to accident, fire or theft, your motor insurance company declares your new vehicle a write-off?

What’s more its depreciation in value leads them to pay out less than the vehicle was originally worth.

What if you used a finance agreement to buy a vehicle that’s declared a write-off, before you’ve paid back all you owe? You may have to continue making monthly payments on a vehicle you no longer own.

Whether you’ve paid outright, or arranged a finance agreement, you can be covered fully with Combined Guaranteed Asset Protection.

How Combined Guaranteed Asset Protection works

If you bought your vehicle outright and paid £26,500 for your car and your motor insurance payout is £14,000, RTI can pay up to the difference of £12,500 to top it up to the original £26,500.

If you financed your vehicle and paid £26,500 and your motor insurance pay out is £14,000, and your outstanding finance payment was £17,500 Finance GAP insurance may payout up to £3,500.

Combined Guaranteed Asset Protection will payout the greater of the Finance GAP or RTI amount. It’s that simple!

0:01:44

0:01:44

0:01:19

0:01:19

0:02:29

0:02:29

0:01:44

0:01:44

0:01:34

0:01:34

0:00:46

0:00:46

0:01:44

0:01:44

0:01:44

0:01:44

0:01:30

0:01:30

0:01:07

0:01:07

0:01:45

0:01:45

0:01:21

0:01:21

0:01:44

0:01:44

0:01:34

0:01:34

0:00:50

0:00:50

0:01:05

0:01:05

0:01:44

0:01:44

0:00:59

0:00:59

0:00:31

0:00:31

0:01:57

0:01:57

0:04:44

0:04:44

0:00:59

0:00:59

0:00:46

0:00:46

0:01:41

0:01:41