filmov

tv

Tech Talk: interview with Gary Rohloff, Laybuy

Показать описание

Gary Rohloff, co-founder and managing director, Laybuy, a New Zealand-based buy now, pay later service which launched in the UK earlier this year, talks to The Banker’s Joy Macknight about differentiating itself from competitors and why retailers like AlexaChung and Footasylum are interested in partnering with Laybuy.

Tech Talk: interview with Gary Rohloff, Laybuy

Tech Talks Daily Podcast With Gary Vaynerchuk At WCIT 2019

Gary, Keith and Ron reflect on broadcasting together as the trio enters their 20th season | SNY

Tech Talks | Garry A. Bolles | Insights from Gary A. Bolles on Thriving in Today’s Job Market

Gary Shilling explains the only way to beat the market and win

Taming Silicon Valley - Prof. Gary Marcus

Ian Hislop on skewering Gary Neville over Qatar World Cup hypocrisy

Key cybersecurity advice for 2025 from Gary Hayslip

Gary Vee on Metaverse Takeover #impaulsive #loganpaul #jakepaul #garyvee #success #metaverse #vr

Auditmacs: Tech Talk with Gary Spurgeon from BluHorn

Mega Talks with Gary Cantrell #InspireTomorrow | Part 2

Garry Kasparov Answers Chess Questions From Twitter | Tech Support | WIRED

Gary Fowler and M.R. Rangaswami: Tech Talk In The Indian Diaspora

A Conversation with Gary Winnick (LucasArts/Maniac Mansion/Thimbleweed Park/Rescue On Fractalus)

Betting on the collapse of our society | Gary Stevenson @garyseconomics

Tech Talk: interview with Paul Taylor, Thought Machine

Gary Neville & Jill Scott Go To The Manchester Derby! | The Overlap X Barclays WSL

AI Expert Gary Marcus on What Comes After the Hype Cycle | TechCrunch Disrupt 2023

Gary Cardone - BUY NOW!

Garry Nolan; UFO Whistleblowers, Skywatcher & Sol Foundation || That UFO Podcast

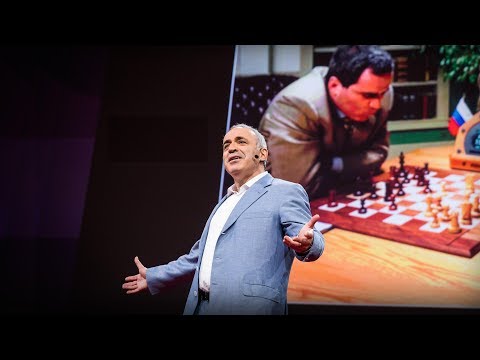

Don't fear intelligent machines. Work with them | Garry Kasparov

The Future of Technology and Innovation: A Conversation with Gary Shapiro, CEO of CTA

Tech Talk with Anu - Anu Deshpande/Gary Oliver, CEO of Razorthink - Episode 6

Tech Talk with Anu - Anu Deshpande/Gary Fowler, Co-Founder & CEO of Findo - Episode 3

Комментарии

0:04:55

0:04:55

0:10:21

0:10:21

0:14:54

0:14:54

0:57:07

0:57:07

0:03:06

0:03:06

1:56:56

1:56:56

0:00:52

0:00:52

0:00:33

0:00:33

0:00:17

0:00:17

0:04:29

0:04:29

0:23:17

0:23:17

0:07:47

0:07:47

0:31:57

0:31:57

1:27:17

1:27:17

0:00:36

0:00:36

0:05:14

0:05:14

0:32:32

0:32:32

0:38:43

0:38:43

0:00:24

0:00:24

0:55:30

0:55:30

0:15:21

0:15:21

0:39:04

0:39:04

0:27:34

0:27:34

0:20:05

0:20:05