filmov

tv

Pre EMI vs full EMI - What should you consider while applying for a home loan? | Mint Primer

Показать описание

As property rates keep on rising day by day, it has become nearly impossible to buy a house entirely from your savings. In such situations, home loans have become quite a popular and viable option. With these loans, one may comfortably pay off the mortgage amount over a period of 20 to 30 years by breaking it up into several modest payments, or EMIs.

The principal loan amount as well as the interest on the loan, which will be spread out over a number of years until the loan repayment is fully paid off, are both included in the EMI.

EMIs are of two types- pre-EMI and full EMI. As it might be confusing for you to pick one, we go through each of them in detail in this video.

#emi #homeloan #loanrepayment #loan #mint

The principal loan amount as well as the interest on the loan, which will be spread out over a number of years until the loan repayment is fully paid off, are both included in the EMI.

EMIs are of two types- pre-EMI and full EMI. As it might be confusing for you to pick one, we go through each of them in detail in this video.

#emi #homeloan #loanrepayment #loan #mint

Pre EMI vs full EMI - What should you consider while applying for a home loan? | Mint Primer

Pre EMI Interest vs Full EMI Home Loan | Hindi

Pre EMI or Full EMI? What to opt for on Home loan? 🏚️ #finance #shorts

PRE EMI VS FULL EMI | INTEREST CALCULATION DURING PRE EMI PERIOD | #loan #banking #bankingexams

Home Loan: Pre-EMI & Full-EMI options | Calculation included | Tamil

PRE EMI in Home Loan | InfraBrick

Real Estate Pre-EMI & EMI Payment Method | Explained in Hindi | Experts Reviews & Suggestion...

Do I buy a house under construction? (Tamil) | Pre-EMI vs. Full EMI – Which is better?

Pre EMI Complete Guide Malayalam | Pre EMI vs Full EMI - Which one to choose | Best Home Loan Option

Pre and Full EMI in Home Loan - Which Is a Better Option? | SMFG Grihashakti

How to save LAKHS on your Home Loan: Complete Guide

Pre-EMI vs. Regular EMI: Which is Best for Your Home Loan? #shorts #mymoneykarma #homeloan #loan

Don’t Prepay Home Loan. Newsletter Link In Comment Section.

Investing vs Loan Repayment | 2022 | CA Rachana Ranade

Taxation on the Pre-EMI Interest of your housing loan

WHAT TO CHOOSE - PRE-EMI / NO -EMI TILL POSSESSION

Buying A Flat? Things That Your Real Estate Agent Won't Tell You

PRE EMI kya hota HAIN?! | Ankur Warikoo #Shorts

how to claim pre-emi interest in housing loan in tamil 2023#homeloanemi #taxbenefit

EMI v/s PRE-EMI

Should I pre-pay my home loan or invest the surplus in mutual funds?

Save LAKHS while paying off LOANS! | Ankur Warikoo Hindi

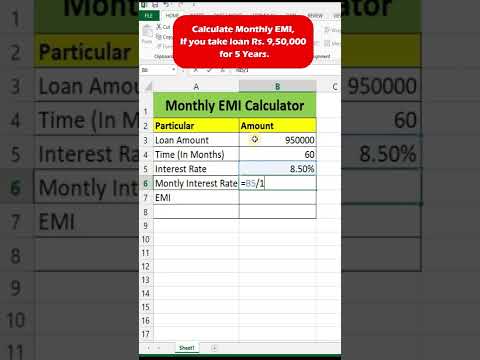

Calculate Monthly EMI for your loan amount🤩🤩

Difference between EMI and Pre EMI #emi #preemi #property #construction #realestate #homeloan

Комментарии

0:03:22

0:03:22

0:13:00

0:13:00

0:00:48

0:00:48

0:03:41

0:03:41

0:11:16

0:11:16

0:00:46

0:00:46

0:03:10

0:03:10

0:14:26

0:14:26

0:14:10

0:14:10

0:01:18

0:01:18

0:24:12

0:24:12

0:00:51

0:00:51

0:00:57

0:00:57

0:17:15

0:17:15

0:02:10

0:02:10

0:04:14

0:04:14

0:12:14

0:12:14

0:00:34

0:00:34

0:00:59

0:00:59

0:00:51

0:00:51

0:02:03

0:02:03

0:13:47

0:13:47

0:00:34

0:00:34

0:00:19

0:00:19