filmov

tv

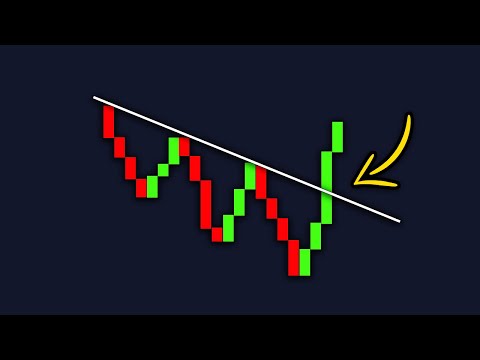

Best Trend Line Trading Strategy (Surprising)

Показать описание

#scalping #trendline #daytrading

00:00 - SMB Trader

02:18 - Three Step Process

07:27 - What Makes a Good Trend Line

09:04 - Strategy 1

11:12 - Strategy 2

14:00 - Strategy 3

15:29 - Bonus Strategy

17:22 - Extra Benefits of Trend Lines

BEST Trend Lines Strategy for Daytrading Forex & Stocks (Simple Technique)

Best Trend Lines Trading Strategy (Advanced)

Best Trend Line Trading Strategy (Surprising)

Accurate Trend Lines Trading Strategy **ADVANCED**

My Trend Line Trading Edge: Strategy Explained

Best Trendline Trading Strategy (Price Action Trading Setup)

BEST Trend Line Breakout Strategy on TradingView 📈

I Found the Best Trend Lines Trading Strategy (Advanced)

Best Indicator For Tradingview Strategy | Triangle Pattern With Fibonacci Retracement

BEST Trend Line Trading Strategy (Advanced Trading) - JeaFx

📈 Trendline Trading System - Full Course with Strategies

Trendline Trading Strategy - 3 SIMPLE STEPS To Improve Profitability

How To Draw The Perfect Trend Line #shorts

The Ultimate Trendline Trading Guide For Beginners

Trendline Trading Master Guide!! Best Strategies

Best Trend Line Trading Strategy! Logical Explanation

Simple trendline strategy to make you millions with low risk in forex trading #forex

2 Best Trendline Trading Strategy | Stock Dictionary

Best Trendline + Price Action trading secrets and trading strategies

How To Predict Reversals

TRENDLINE TRADING COURSE | With Live Examples + Secrets

Trendline Trading Strategy: Proven Techniques That Actually Work

🔴 How to Trade 'TREND LINES' Perfectly Every Time (ADVANCED Price Action Trading Strategy)...

13 Trendline Trading tips and tricks you must know

Комментарии

0:09:25

0:09:25

0:28:55

0:28:55

0:22:50

0:22:50

0:04:24

0:04:24

0:03:25

0:03:25

0:17:51

0:17:51

0:00:47

0:00:47

0:12:04

0:12:04

0:42:36

0:42:36

0:08:10

0:08:10

0:28:08

0:28:08

0:20:42

0:20:42

0:00:43

0:00:43

0:14:57

0:14:57

0:12:16

0:12:16

0:17:10

0:17:10

0:12:14

0:12:14

0:08:38

0:08:38

0:18:35

0:18:35

0:01:00

0:01:00

0:44:13

0:44:13

0:27:06

0:27:06

0:14:04

0:14:04

0:16:08

0:16:08