filmov

tv

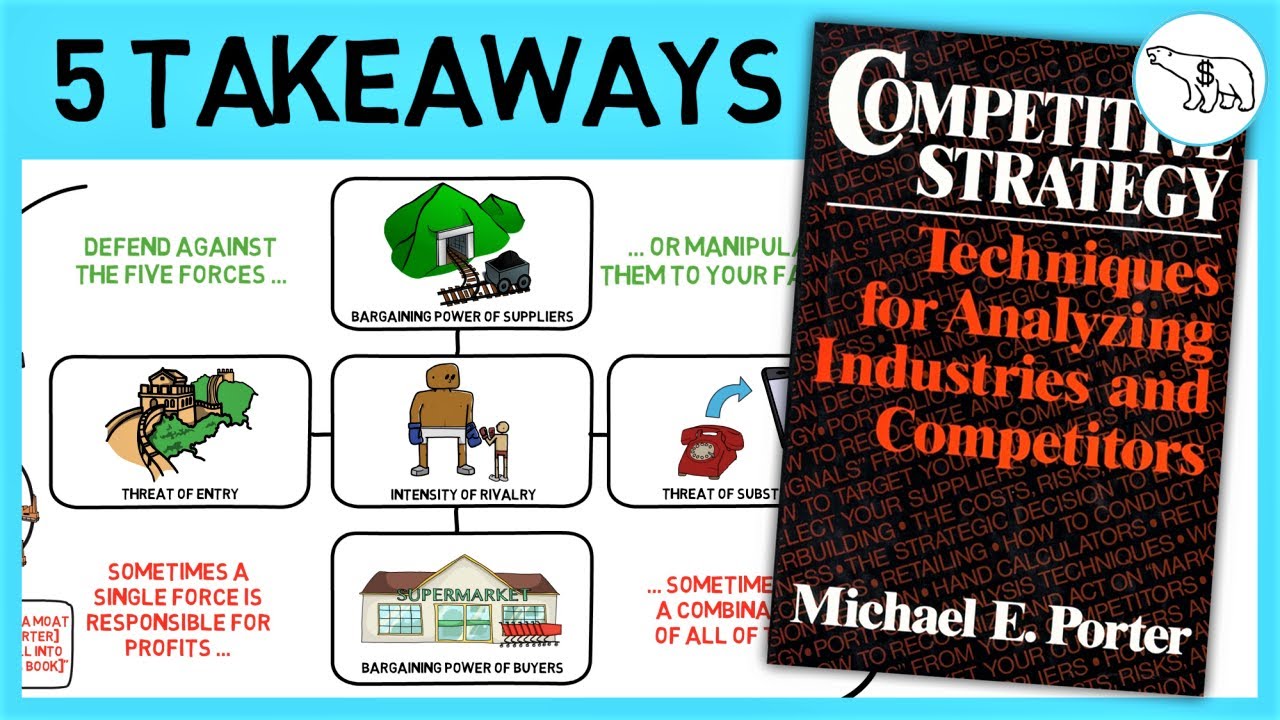

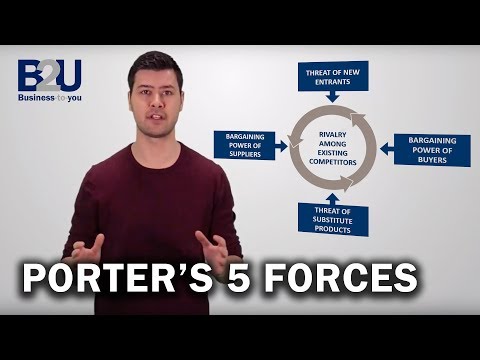

COMPETITIVE STRATEGY (BY MICHAEL PORTER)

Показать описание

As an Amazon Associate I earn from qualified purchases.

The most important factor to consider before making a long-term stock market investment is whether the company you are looking at has a sustainable competitive advantage, which will allow it to be profitable for many years to come. Companies like Apple, Johnson & Johnson & VISA thrive, while companies like American Airlines, British Petroleum & Fiat & Chrysler barely scrape by. But why? That’s what you will learn in this video.

Michael Porter is an American academic known for his theories on economics, business strategy, and social causes. He is the Bishop William Lawrence University Professor at Harvard Business School and his Five Forces model on industry rivalry is one of the most extensively taught concepts in business schools around the world. For good reasons.

Top 5 takeaways from Competitive Strategy:

0:00 Intro

01:02 1. Porter’s Five Forces

03:00 2. Threat of entry

06:34 3. Threat of substitution

08:21 4. Bargaining power of suppliers/buyers

11:34 5. Intensity of rivalry

My goal with this channel is to help you make more money and improve your personal finances. How to become a millionaire? There are many ways to get there – investing in the stock market, becoming a stock trader, doing real estate investing, or why not becoming an entrepreneur? But whether you are interested in how to invest in stocks or investing strategies for creating passive income with rental properties – I hope to be able to provide you with a solution (or at least an idea) here. Warren Buffett - the greatest investor of our time - says that you should fill your mind with competing ideas and then see what makes sense to you. This channel is about filling your mind with those ideas. And in the process – upgrading your money-making toolbox.

Комментарии

0:15:10

0:15:10

0:06:01

0:06:01

0:07:25

0:07:25

0:01:58

0:01:58

0:04:50

0:04:50

1:09:23

1:09:23

0:17:55

0:17:55

0:03:53

0:03:53

0:05:19

0:05:19

0:13:29

0:13:29

0:03:35

0:03:35

0:16:39

0:16:39

0:14:27

0:14:27

0:02:34

0:02:34

0:00:31

0:00:31

0:00:41

0:00:41

0:10:41

0:10:41

0:13:24

0:13:24

0:13:17

0:13:17

0:09:39

0:09:39

0:16:54

0:16:54

0:01:14

0:01:14

0:35:27

0:35:27

0:03:01

0:03:01