filmov

tv

How I use Intermarket Analysis for Swing Trading

Показать описание

In this video I discuss the concepts outlined by John Murphy in his book Intermarket Technical Analysis from 2001. Hard assets are solid commodities such as gold and silver; these assets traditionally are considered an inflation hedge. Soft assets are financial assets, called paper assets, which primarily include stocks and bonds.

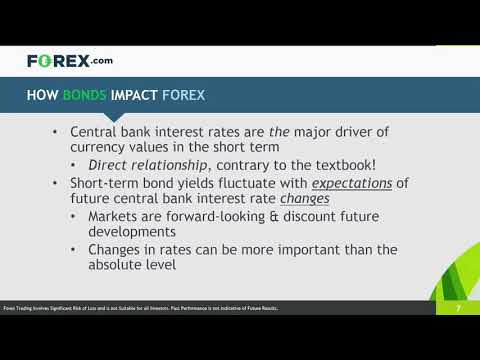

The reason for the inverse relationship between the value of hard assets and of soft assets is that a close correlation exists between material prices and interest rates. Inflation, or higher material prices, is generally associated with higher interest rates. When inflation becomes a threat, paper assets, which decrease in value as interest rates rise, are undesirable as investments. Likewise, when hard asset prices decline, interest rates usually decline, and soft assets increase in value.

The reason for the inverse relationship between the value of hard assets and of soft assets is that a close correlation exists between material prices and interest rates. Inflation, or higher material prices, is generally associated with higher interest rates. When inflation becomes a threat, paper assets, which decrease in value as interest rates rise, are undesirable as investments. Likewise, when hard asset prices decline, interest rates usually decline, and soft assets increase in value.

0:14:41

0:14:41

0:08:54

0:08:54

0:09:02

0:09:02

0:00:16

0:00:16

1:04:06

1:04:06

0:19:45

0:19:45

0:06:14

0:06:14

0:53:17

0:53:17

0:00:23

0:00:23

0:40:53

0:40:53

0:15:46

0:15:46

0:47:33

0:47:33

0:15:52

0:15:52

0:27:35

0:27:35

0:22:50

0:22:50

0:17:57

0:17:57

1:04:06

1:04:06

0:08:13

0:08:13

0:08:07

0:08:07

0:21:13

0:21:13

0:21:27

0:21:27

1:30:00

1:30:00

0:02:05

0:02:05

0:14:54

0:14:54