filmov

tv

SBA EIDL Loan Application [Step by Step Instructions] Where & How to Apply for SBA Disaster Loan

Показать описание

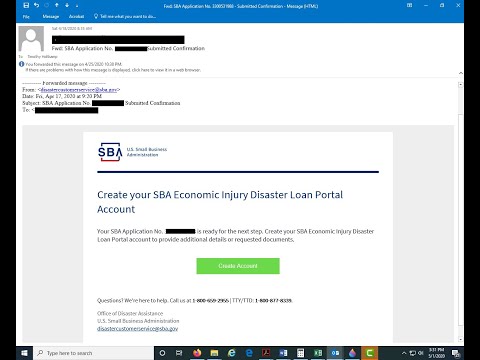

Step by Step Instruction on how to apply for the SBA EIDL Loan.

#eidl #eidlapplication #sba #sbaloan #sbaloanapplication #covid19eidl

DISCLAIMER

This video is intended for education purposes and should not be taken as legal or tax advice. You should consult with your financial professionals about your unique financial situation before acting on anything discussed in these videos. Freedomtax Accounting and Multiservices Inc. is providing educational content to help small business owners become more aware of certain issues and topics, but we cannot give blanket advice to a broad audience. Freedomtax Accounting and Multiservices Inc. or its members cannot be held liable for any use or misuse of this content.

#eidl #eidlloan #eidlapplication #sbaeidl

Small businesses applied for Economic Injury Disaster Loans (EIDL) in droves when they became available on March 30th. Normally, these loans only provide assistance after natural disasters like tornadoes, wildfires or floods, but when President Trump declared Covid-19 a nationwide emergency on March 13th, the door opened for small businesses across the country to seek emergency financing. With uncertain prospects ahead, business owners saw the program’s maximum $10,000 advance as a way to tide their companies over until the effects of Covid-19 were under control.

Unfortunately, the roll out of the program was much rougher than anticipated. A flood of applications overwhelmed the system and the SBA stopped processing the first round of EIDLs after about two weeks. With the second round of funding, the money lasted just about a week before the SBA limited applications to agricultural businesses.

Additionally, the SBA was completely silent for weeks on the status of the applications that were submitted. The advances, which were supposed to be sent within three days of applying, were delayed for weeks and adjusted to $1,000/employee or a $1,000 for the self employed.

But the advances began mysteriously showing up in applicants' bank accounts a few weeks ago, and as of last week the SBA started processing and approving applications. As such, it seems like a good time to revisit the EIDL program and how its loans work.

Loans up to $150,000...this may change to $2 million

30-year terms

Interest rates of 3.75% for small businesses (2.75% for non-profits)

First payment is 12 months from the date of the promissory note

EIDLs smaller than $200,000 can be approved without a personal guarantee

For loans under $25,000, the SBA does not take a security interest in any collateral

For loans above $25,00 the SBA takes a general security interest in any and all “Collateral” as defined in the promissory note

There are no prepayment fees

Unlike the Paycheck Protection Program (PPP) loan, EIDLs do not have a forgiveness aspect. However, any advance funds that you received will not be included in the loan.

Additionally, you may request a loan increase for additional disaster-related damages as soon as the need for additional funds is discovered. However, the SBA will not consider a request for a loan increase received more than two years from the date of loan approval unless, “there are extraordinary and unforeseeable circumstances beyond the control of the borrower.”

As they say, the devil is in the details. I got a copy of a Loan Authorization Agreement, Promissory Note, and Security Agreement. The document is 19 pages long. You’ll want to make sure to read it carefully before immediately signing off on the loan. Here are a couple of sections that caught my eye.

The security interest requirement

For those loans over $25,000 the SBA lays claim on any tangible and intangible personal property including, but not limited to:

inventory,

equipment,

instruments, including promissory notes,

chattel paper, including tangible chattel paper and electronic chattel paper,

documents,

letter of credit rights,

accounts, including health-care insurance receivables and credit card receivables,

deposit accounts,

commercial tort claims,

general intangibles, including payment intangibles and software and

as-extracted collateral as such terms may from time to time be defined in the Uniform Commercial Code.

#eidl #eidlapplication #sba #sbaloan #sbaloanapplication #covid19eidl

DISCLAIMER

This video is intended for education purposes and should not be taken as legal or tax advice. You should consult with your financial professionals about your unique financial situation before acting on anything discussed in these videos. Freedomtax Accounting and Multiservices Inc. is providing educational content to help small business owners become more aware of certain issues and topics, but we cannot give blanket advice to a broad audience. Freedomtax Accounting and Multiservices Inc. or its members cannot be held liable for any use or misuse of this content.

#eidl #eidlloan #eidlapplication #sbaeidl

Small businesses applied for Economic Injury Disaster Loans (EIDL) in droves when they became available on March 30th. Normally, these loans only provide assistance after natural disasters like tornadoes, wildfires or floods, but when President Trump declared Covid-19 a nationwide emergency on March 13th, the door opened for small businesses across the country to seek emergency financing. With uncertain prospects ahead, business owners saw the program’s maximum $10,000 advance as a way to tide their companies over until the effects of Covid-19 were under control.

Unfortunately, the roll out of the program was much rougher than anticipated. A flood of applications overwhelmed the system and the SBA stopped processing the first round of EIDLs after about two weeks. With the second round of funding, the money lasted just about a week before the SBA limited applications to agricultural businesses.

Additionally, the SBA was completely silent for weeks on the status of the applications that were submitted. The advances, which were supposed to be sent within three days of applying, were delayed for weeks and adjusted to $1,000/employee or a $1,000 for the self employed.

But the advances began mysteriously showing up in applicants' bank accounts a few weeks ago, and as of last week the SBA started processing and approving applications. As such, it seems like a good time to revisit the EIDL program and how its loans work.

Loans up to $150,000...this may change to $2 million

30-year terms

Interest rates of 3.75% for small businesses (2.75% for non-profits)

First payment is 12 months from the date of the promissory note

EIDLs smaller than $200,000 can be approved without a personal guarantee

For loans under $25,000, the SBA does not take a security interest in any collateral

For loans above $25,00 the SBA takes a general security interest in any and all “Collateral” as defined in the promissory note

There are no prepayment fees

Unlike the Paycheck Protection Program (PPP) loan, EIDLs do not have a forgiveness aspect. However, any advance funds that you received will not be included in the loan.

Additionally, you may request a loan increase for additional disaster-related damages as soon as the need for additional funds is discovered. However, the SBA will not consider a request for a loan increase received more than two years from the date of loan approval unless, “there are extraordinary and unforeseeable circumstances beyond the control of the borrower.”

As they say, the devil is in the details. I got a copy of a Loan Authorization Agreement, Promissory Note, and Security Agreement. The document is 19 pages long. You’ll want to make sure to read it carefully before immediately signing off on the loan. Here are a couple of sections that caught my eye.

The security interest requirement

For those loans over $25,000 the SBA lays claim on any tangible and intangible personal property including, but not limited to:

inventory,

equipment,

instruments, including promissory notes,

chattel paper, including tangible chattel paper and electronic chattel paper,

documents,

letter of credit rights,

accounts, including health-care insurance receivables and credit card receivables,

deposit accounts,

commercial tort claims,

general intangibles, including payment intangibles and software and

as-extracted collateral as such terms may from time to time be defined in the Uniform Commercial Code.

Комментарии

0:26:05

0:26:05

0:09:00

0:09:00

0:11:30

0:11:30

0:08:06

0:08:06

0:07:14

0:07:14

0:13:20

0:13:20

0:04:53

0:04:53

0:58:10

0:58:10

0:08:13

0:08:13

0:59:52

0:59:52

0:01:51

0:01:51

0:14:58

0:14:58

0:14:32

0:14:32

0:05:40

0:05:40

0:13:50

0:13:50

0:12:32

0:12:32

0:05:39

0:05:39

0:06:28

0:06:28

0:13:09

0:13:09

0:01:44

0:01:44

1:26:51

1:26:51

0:26:43

0:26:43

0:05:57

0:05:57

0:11:14

0:11:14