filmov

tv

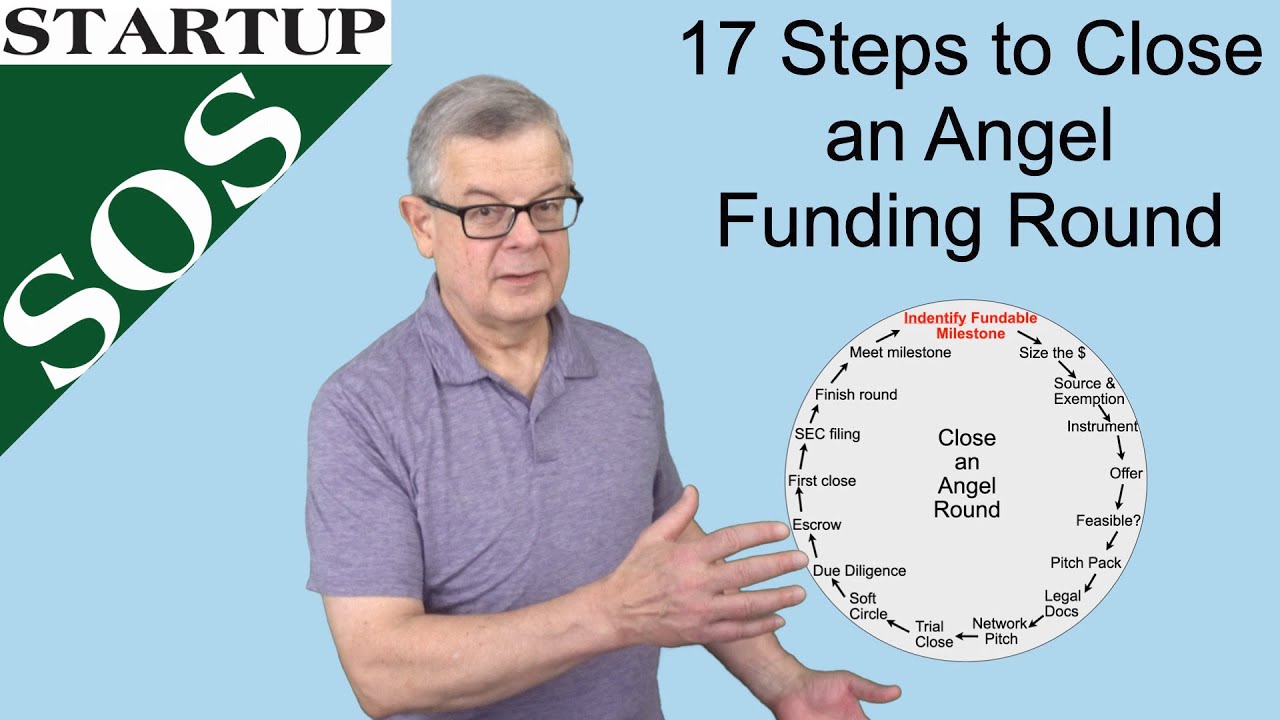

17 Steps to Closing an angel startup funding round - Convertible Note, SAFE or Priced Round

Показать описание

The 17 steps covered here are:

1. Identify the next fundable milestone (part of your startup funding plan)

2. Size the funding round needed to meet the milestone by doing a bottoms-up cash flow projection

3. Decide what funding source you believe you can access and that has the ability fo fund the amount of money needed, and what SEC exemption to a full registration you will use.

4. Identify the funding instrument to be used - typically a Convertible Note, pre-money SAFE (Simple Agreement for Future Equity) or post-money SAFE.

5. Develop the offer - which may include things like the valuation cap, discount, interest rate maturing date (for a Note) and pro-rata rights.

6. Decide - is the combination of amount, source, instrument and offer feasible given the stage you are at, or do you need to select a more approachable fundable milestone?

7. Develop your pitch pack - pitch deck, financial projection, and due diligence materials.

8. Develop the legal documents required for the funding instrument you have selected.

9. Start networking and pitching!

10. You'll typically be doing trial closes.

11. Trial closed lead to soft-circle commitments from investors

12. There will always be some due diligence done before an investor writes a check.

13. You may need an escrow agreement to encourage angels to invest

14. With luck, you get your first close, which tends to help close others.

15. After your first close (if you have not done it already) is a good time to complete your SEC filing, if you are using an exemption that requires filing.

16. Finish closing the round.

17. Use the funds to meet the milestone! In the example in this video, the milestone was to develop a beta-test-level product, and get customer beta-test feedback.

And then you're ready to tackle the next milestone!

Комментарии

0:16:20

0:16:20

0:33:16

0:33:16

0:06:27

0:06:27

0:00:44

0:00:44

0:15:01

0:15:01

0:01:15

0:01:15

0:15:03

0:15:03

0:17:42

0:17:42

0:14:10

0:14:10

0:18:36

0:18:36

0:17:42

0:17:42

1:44:05

1:44:05

0:00:28

0:00:28

0:00:13

0:00:13

0:02:03

0:02:03

0:00:20

0:00:20

0:04:00

0:04:00

0:08:17

0:08:17

0:00:12

0:00:12

0:00:16

0:00:16

0:00:23

0:00:23

0:00:48

0:00:48

0:00:59

0:00:59

0:00:05

0:00:05