filmov

tv

This Is The Average Age A First Time Home-buyer (Wow)

Показать описание

This Is The Average Age A First Time Home-buyer (Wow)

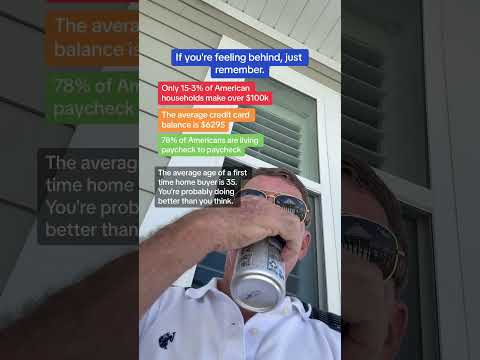

The average age someone becomes a homeowner for the first time has changed over the years and the reasons why will surprise you. With various factors influencing this trend, we’ll take a look at the shifts as well as examine why home-ownership is one of the best investments you can make.

The average age someone becomes a homeowner for the first time has changed over the years and the reasons why will surprise you. With various factors influencing this trend, we’ll take a look at the shifts as well as examine why home-ownership is one of the best investments you can make.

Average Age Comparison

Comparison: Average Age For Everything

Comparison: Average Age For Everything (Part 2)

I found out what the average AGE for EVERYTHING is 😳

Average Age To Start Doing ___ ?

Comparison: Average Age For Your First ___?

Comparison: Average Age To Learn ___

Average age for everything 😭😭😭💀

Jay Olshansky on the debate of reaching the age 150

Average age in Europe

The average age for EVERYTHING #shorts

What’s the average age of a successful business owner? 🤑 #shorts

This Is The Average Age A First Time Home-buyer (Wow)

Average Age for Everything | Comparison

Average age of European countries

What AGE Does The AVERAGE PERSON Get ENGAGED! And More! #shorts #dating #engagement #age #average

Average Height At Every Age...📈🧐

COUNTRIES WHERE THE AVERAGE AGE IS OVER 35!

Average age of Americans on the rise

Average Age of Death in the U.S. by Year

What is the average age in your country?

Average age of People in different countries. #shorts

The Average Age of a First Time Home Buyer is 35. (grandpa)

Comparison: What is the Average Age For Everything? ⚡

Комментарии

0:00:10

0:00:10

0:03:01

0:03:01

0:03:03

0:03:03

0:01:00

0:01:00

0:00:58

0:00:58

0:03:02

0:03:02

0:03:03

0:03:03

0:00:07

0:00:07

0:06:45

0:06:45

0:00:09

0:00:09

0:00:48

0:00:48

0:01:00

0:01:00

0:08:45

0:08:45

0:03:16

0:03:16

0:00:07

0:00:07

0:01:00

0:01:00

0:00:08

0:00:08

0:00:05

0:00:05

0:00:35

0:00:35

0:00:43

0:00:43

0:00:12

0:00:12

0:00:30

0:00:30

0:00:06

0:00:06

0:03:07

0:03:07