filmov

tv

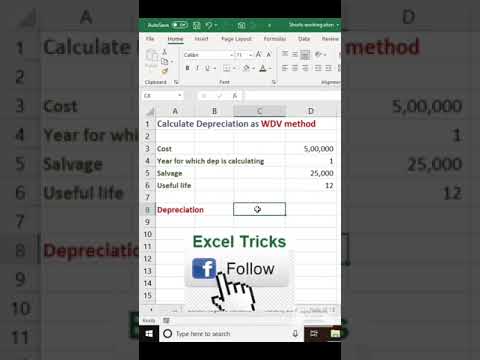

Depreciation Calculation in Account Finalization by @skillvivekawasthi

Показать описание

The term depreciation refers to an accounting method used to allocate the cost of a tangible or physical asset over its useful life. Depreciation represents how much of an asset's value has been used. It allows companies to earn revenue from the assets they own by paying for them over a certain period of time.

Because companies don't have to account for them entirely in the year the assets are purchased, the immediate cost of ownership is significantly reduced. Not accounting for depreciation can greatly affect a company's profits. Companies can also depreciate long-term assets for both tax and accounting purposes.

Depreciation can be compared with amortization, which accounts for the change in value over time of intangible assets.

EXCEL & NOTES ARE PARTS OF OUR PAID COURSES ONLY.

👨🏻🎓Enhance and upgrade your practical skills with our practical courses-

📞For course query please call @ 8368741773

Services we offer

👉GST Registration, Returns & Compliance

👉ITR Return, Compliance & Notices

👉Company/ LLP Incorporation

👉ROC Compliance

👉Trademark Reply

👉Auditing & Compliance

👉IEC Code

👉Payroll Compliance

👉ISO Certification

👉Project Reporting

👉Financial Modeling

📞For services please call @ 9718097735

Cheers Folks

Thanks for Watching :)

Disclaimer- Although all provisions, notifications, updates, and live demos are analyzed in-depth by our team before presenting to the public. We hereby provide our point of view only and tax matters are always subject to frequent changes hence advisory is only for the benefit of the general public. Hence neither Fintaxpro Advisory LLP nor its designated partner is liable for any consequence that arises on the basis of YouTube videos.

©️Fintaxpro Advisory LLP

Because companies don't have to account for them entirely in the year the assets are purchased, the immediate cost of ownership is significantly reduced. Not accounting for depreciation can greatly affect a company's profits. Companies can also depreciate long-term assets for both tax and accounting purposes.

Depreciation can be compared with amortization, which accounts for the change in value over time of intangible assets.

EXCEL & NOTES ARE PARTS OF OUR PAID COURSES ONLY.

👨🏻🎓Enhance and upgrade your practical skills with our practical courses-

📞For course query please call @ 8368741773

Services we offer

👉GST Registration, Returns & Compliance

👉ITR Return, Compliance & Notices

👉Company/ LLP Incorporation

👉ROC Compliance

👉Trademark Reply

👉Auditing & Compliance

👉IEC Code

👉Payroll Compliance

👉ISO Certification

👉Project Reporting

👉Financial Modeling

📞For services please call @ 9718097735

Cheers Folks

Thanks for Watching :)

Disclaimer- Although all provisions, notifications, updates, and live demos are analyzed in-depth by our team before presenting to the public. We hereby provide our point of view only and tax matters are always subject to frequent changes hence advisory is only for the benefit of the general public. Hence neither Fintaxpro Advisory LLP nor its designated partner is liable for any consequence that arises on the basis of YouTube videos.

©️Fintaxpro Advisory LLP

Комментарии

0:29:38

0:29:38

0:00:59

0:00:59

0:12:27

0:12:27

0:01:00

0:01:00

0:13:31

0:13:31

0:13:34

0:13:34

0:07:22

0:07:22

0:11:24

0:11:24

0:12:59

0:12:59

0:12:50

0:12:50

0:22:39

0:22:39

0:00:31

0:00:31

0:00:52

0:00:52

0:01:31

0:01:31

0:07:20

0:07:20

0:15:28

0:15:28

0:00:24

0:00:24

0:13:48

0:13:48

0:10:02

0:10:02

0:08:05

0:08:05

0:00:28

0:00:28

0:00:14

0:00:14

0:00:53

0:00:53

0:14:10

0:14:10