filmov

tv

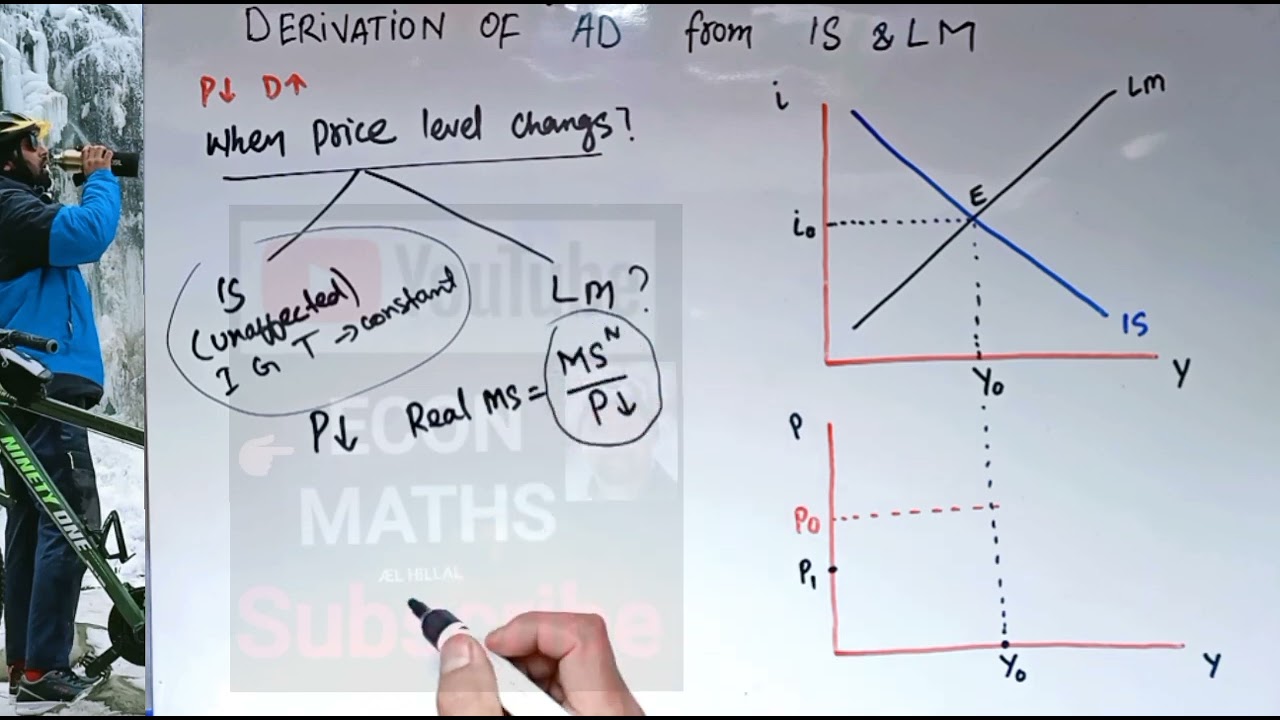

Deriving Aggregate demand (AD) Curve From IS and LM Curve

Показать описание

The IS-LM model is a macroeconomic model that describes the relationship between interest rates and real output in the goods and services market (IS curve) and the money market (LM curve). The aggregate demand curve can be derived from the IS-LM model by showing how changes in the interest rate affect both the goods and services market and the money market, and how these changes in turn affect the overall level of economic activity (i.e. aggregate demand).

The IS curve represents the relationship between the interest rate and real output in the goods and services market. It shows that as the interest rate increases, investment spending decreases, and as a result, real output decreases. The LM curve represents the relationship between the interest rate and the level of income in the money market. It shows that as the interest rate increases, the demand for money decreases, and as a result, the level of income decreases.

When both the IS and LM curves are combined, they form the aggregate demand curve, which shows the relationship between the interest rate and the overall level of economic activity. As the interest rate increases, aggregate demand decreases, and as the interest rate decreases, aggregate demand increases.

In this video, we will go through the steps of deriving the aggregate demand curve from the IS and LM curves. We will also explain how changes in government spending, taxes, and the money supply affect the IS and LM curves, and how these changes in turn affect the aggregate demand curve.

Overall, this video is useful for students and professionals who want to understand how macroeconomic factors such as interest rates, government spending, taxes, and money supply affect the economy, and how these factors are interconnected in the IS-LM model.

The IS curve represents the relationship between the interest rate and real output in the goods and services market. It shows that as the interest rate increases, investment spending decreases, and as a result, real output decreases. The LM curve represents the relationship between the interest rate and the level of income in the money market. It shows that as the interest rate increases, the demand for money decreases, and as a result, the level of income decreases.

When both the IS and LM curves are combined, they form the aggregate demand curve, which shows the relationship between the interest rate and the overall level of economic activity. As the interest rate increases, aggregate demand decreases, and as the interest rate decreases, aggregate demand increases.

In this video, we will go through the steps of deriving the aggregate demand curve from the IS and LM curves. We will also explain how changes in government spending, taxes, and the money supply affect the IS and LM curves, and how these changes in turn affect the aggregate demand curve.

Overall, this video is useful for students and professionals who want to understand how macroeconomic factors such as interest rates, government spending, taxes, and money supply affect the economy, and how these factors are interconnected in the IS-LM model.

Комментарии

0:03:26

0:03:26

0:07:35

0:07:35

0:10:19

0:10:19

0:13:53

0:13:53

0:07:26

0:07:26

0:05:32

0:05:32

0:04:48

0:04:48

0:05:54

0:05:54

0:07:06

0:07:06

0:08:21

0:08:21

0:05:48

0:05:48

0:05:00

0:05:00

0:10:44

0:10:44

0:07:35

0:07:35

0:02:43

0:02:43

0:11:47

0:11:47

0:39:28

0:39:28

0:10:43

0:10:43

0:11:25

0:11:25

0:25:33

0:25:33

0:07:15

0:07:15

0:06:43

0:06:43

0:12:05

0:12:05

0:19:42

0:19:42