filmov

tv

What Is (Fat) Tail Risk?

Показать описание

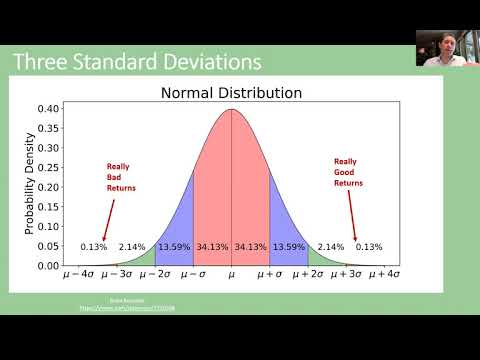

The Bank of America Merrill Lynch #investors survey indicates that #inflation is currently the biggest tail #risk concern for professional investors. But what do we actually mean by tail risk? As investors we worry about extreme negative events/returns, but embrace extreme positive events/returns. With tail risk, we are technically talking about negative three standard deviation or worse events. In a normal distribution these events happen about 0.13% of the time. In terms of daily returns, these are the extreme negative events that happen about once every three years. Unfortunately, #asset #returns are not normally distributed. They are negatively skewed and exhibit positive excess kurtosis. Negative events occur more often than positive events and both the tails are fat. Fat tail risk still measures extreme negative #events. They just happen to occur more often than a normal distribution would suggest. #financialmarkets #cfainstitute #caia #frm

Related Videos:

Related Videos:

What Is (Fat) Tail Risk?

Tail Risk in Finance: What You Need to Know in Just 45 Seconds

Heavy-Tailed Distributions: What Lurks Beyond Our Intuitions? - Anders Sandberg

What Is Tail-Risk Hedging?

What is a Tail Risk?

MINI-LESSON 2: Fat Tails, a Very, Very Introductory Presentation.

Tail Risk Will Wipe You Out?

What is Tail Risk?

What about the 'Fat Tail' Risk?

You Don't Understand Fat Tails (And You'll Suffer). Nassim Taleb.

Tail Risk: A Guide for Investors

Tail Risk Hedging von Black Swans - Unwahrscheinliche Ereignisse mit dramatischen Auswirkungen

Risks and fat tails

‘Tail Risk’: A Chat with Climate Scientist Radley Horton

Protect Yourself From the Next Crash With Tail Risk Hedges

Pareto, Power Laws, and Fat Tails

Tail Risk Hedges - Behavioral Value Investor

The Rising Fat Tail: A New Wave in the Realm of Investing

Maximize Your Investing Returns: My Bull/Bear Tail Risk Strategy

Tail Risk Management

What's the Biggest Tail-Risk for Markets?

What is Tail Risk? | Market Updates 25/08/2022 #Shorts #Stockmarket #technicals

Tail risk parity Top #7 Facts

Level III CFA: Liquidity Risk and Tail Risk in Credit Portfolios Demystified

Комментарии

0:02:57

0:02:57

0:00:46

0:00:46

0:04:12

0:04:12

0:02:18

0:02:18

0:04:28

0:04:28

0:05:32

0:05:32

0:01:50

0:01:50

0:07:11

0:07:11

0:00:57

0:00:57

0:08:04

0:08:04

0:05:23

0:05:23

0:12:55

0:12:55

0:28:49

0:28:49

0:03:31

0:03:31

0:01:00

0:01:00

0:26:34

0:26:34

0:07:49

0:07:49

0:08:00

0:08:00

0:09:01

0:09:01

0:00:16

0:00:16

0:01:31

0:01:31

0:00:53

0:00:53

0:01:19

0:01:19

0:10:26

0:10:26