filmov

tv

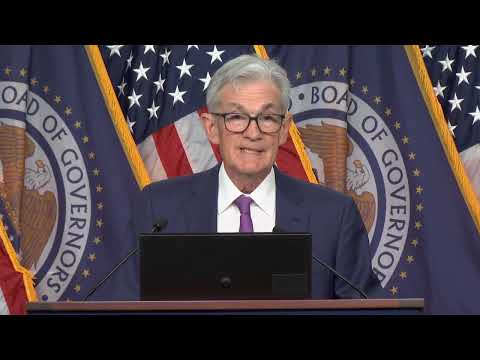

Fed FOMC Meeting January 2024 - My Take

Показать описание

The Federal Reserve's monetary policy drives every single asset price globally. Markets are focused on whether the Federal Open Markets Committee (FOMC) will start discussing rate cuts marking the end of this rate cycle now that core inflation has fallen to a 2-1/2-year low of 3.9%. Markets expect a rate cut as early as March, but does the Fed think inflation is now under control? Hear our concise summary of what the Fed says and our take on what it means for your investments.

What Else PensionCraft Offers:

I Use The Following Data Sources To Help Me Create My Videos

(These links provide new users with a special offer and may also provide me with a small commission)

Where Else You Can Find Me

Take A Look At Some Of My Other Videos & Playlists

DISCLAIMER

All information is given for educational purposes and is not financial advice. Ramin does not provide recommendations and is not responsible for investment actions taken by viewers. Figures that are quoted refer to the past and past performance is not a reliable indicator of future results.

What Else PensionCraft Offers:

I Use The Following Data Sources To Help Me Create My Videos

(These links provide new users with a special offer and may also provide me with a small commission)

Where Else You Can Find Me

Take A Look At Some Of My Other Videos & Playlists

DISCLAIMER

All information is given for educational purposes and is not financial advice. Ramin does not provide recommendations and is not responsible for investment actions taken by viewers. Figures that are quoted refer to the past and past performance is not a reliable indicator of future results.

Комментарии

1:11:01

1:11:01

0:04:29

0:04:29

0:49:29

0:49:29

0:06:48

0:06:48

0:51:55

0:51:55

0:44:59

0:44:59

3:01:31

3:01:31

1:38:50

1:38:50

0:16:46

0:16:46

0:01:54

0:01:54

0:00:27

0:00:27

1:05:45

1:05:45

0:00:57

0:00:57

0:00:24

0:00:24

0:00:49

0:00:49

0:49:05

0:49:05

0:55:46

0:55:46

1:06:35

1:06:35

0:48:11

0:48:11

2:59:52

2:59:52

0:10:44

0:10:44

0:03:12

0:03:12

0:51:16

0:51:16

0:17:20

0:17:20