filmov

tv

Case Study on Conditions of Input Tax Credit (ITC) and Rule 36(4) in GST by CA Sushil K Goyal

Показать описание

This video (GST Webinar/Webcast) contains detailed discussion on the current topic in GST (Goods and Services Tax) covering a practical case study on conditions for taking eligible Input Tax Credit (ITC) and Rule 36(4) of CGST Rules 2017 regarding condition of 20% or Now 10% credit of entries coming in Form GSTR-2A by CA Sushil K Goyal, Fellow Member of the Institute of Chartered Accountants of India (ICAI).

Recent Videos:

#GST #CASushilKGoyal #Rule36(4)

Music: Royalty Free Music from Bensound

Recent Videos:

#GST #CASushilKGoyal #Rule36(4)

Music: Royalty Free Music from Bensound

Nursing Case Study Practice for NCLEX, HESI, and ATI: Part I

HOW TO PASS ICAEW CASE STUDY ACA EXAM

How to stand out in your case study interview

Main Tips On How To Write Case Study Analysis

How To Write A Case Study? | Amazon Case Study Example

Case study clinical example CBT: First session with a client with symptoms of depression (CBT model)

Why America and Israel are Afraid of Iran? Geopolitical Case Study

Interviewing with McKinsey: Case study interview

A Case Study in Structural Racism and Urbanism: The Neglect of Valley Fever

Accident Case Study: VFR into IMC

Next Generation NCLEX (NGN) Sample Questions Case Study Practice | Heart Failure NCLEX Review

Accident Case Study: High Aspirations

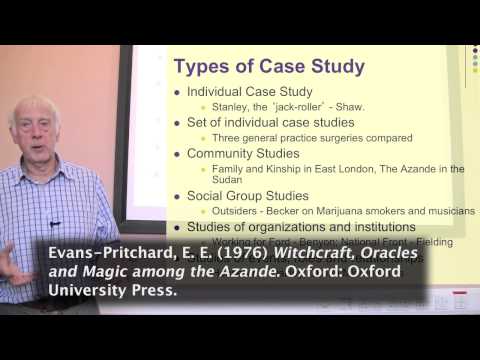

Types of Case Study. Part 1 of 3 on Case Studies

🚨Case Study🚨 (07/01/22)

Case Study: Mr. Y

Ethics Case Study: It was Just a Careless Mistake

Case study on Liver cancer|ncp|nursingcriteria

Why UK 🇬🇧 is going Bankrupt? : Detailed Economic Case Study

Consulting Case Interview: A Profitability Case Study with ex-BCG Consultants

Medical Coding Case Study - Evaluation and Management Walkthrough and Explanations for Beginners

Case Study 4/08/22

Accident Case Study: Airframe Icing

Nursing Case Study Practice for NCLEX, HESI, and ATI: Part II

Case Study (October 28th, 2022)

Комментарии

0:32:59

0:32:59

0:14:13

0:14:13

0:01:26

0:01:26

0:06:53

0:06:53

0:04:53

0:04:53

0:13:55

0:13:55

0:20:18

0:20:18

0:07:32

0:07:32

0:59:28

0:59:28

0:16:02

0:16:02

0:29:42

0:29:42

0:14:15

0:14:15

0:18:59

0:18:59

0:00:38

0:00:38

0:04:19

0:04:19

0:03:02

0:03:02

0:01:45

0:01:45

0:20:37

0:20:37

0:28:44

0:28:44

0:22:14

0:22:14

0:00:45

0:00:45

0:13:23

0:13:23

0:33:21

0:33:21

0:00:25

0:00:25