filmov

tv

The Volatility Smile and Skew

Показать описание

★★ Save 10% on All Quant Next Courses with the Coupon Code: QuantNextYoutube10 ★★

★★ For students and graduates, we offer a 50% discount on all courses, please contact us if you are interested ★★

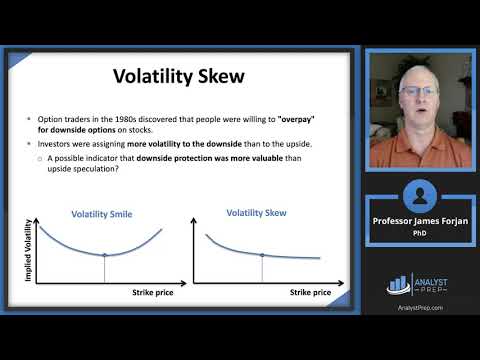

In this video we will look at the volatility smile and discuss the implied volatility shape coming from options on the same underlying asset, that have the same maturity date, but have different strike prices.

We will see that before October 1987 market crash the volatility curve was actually flat. Market participants started to price after the crash that the geometric Brownian motion assumption for the dynamic of stock prices was not true, stocks can jump and their distributions are fat-tailed.

0:00 Introduction

0:19 The Volatility is assumed Constant in Black-Scholes Model...

0:42 ... This is Not True in Practice

1:33 S&P Implied Volatility Before and After 1987 Market Crash

1:45 S&P Daily Returns Are Fat-Tailed

2:30 The Volatility Smile...

3:36 ...and Skew

#optionpricing, #quantitativefinance, #financeeducation, #derivatives, #quant, #quantnext

★★ For students and graduates, we offer a 50% discount on all courses, please contact us if you are interested ★★

In this video we will look at the volatility smile and discuss the implied volatility shape coming from options on the same underlying asset, that have the same maturity date, but have different strike prices.

We will see that before October 1987 market crash the volatility curve was actually flat. Market participants started to price after the crash that the geometric Brownian motion assumption for the dynamic of stock prices was not true, stocks can jump and their distributions are fat-tailed.

0:00 Introduction

0:19 The Volatility is assumed Constant in Black-Scholes Model...

0:42 ... This is Not True in Practice

1:33 S&P Implied Volatility Before and After 1987 Market Crash

1:45 S&P Daily Returns Are Fat-Tailed

2:30 The Volatility Smile...

3:36 ...and Skew

#optionpricing, #quantitativefinance, #financeeducation, #derivatives, #quant, #quantnext

The Volatility Smile and Skew

Options Strategies – Part III: Volatility Skew and Smile, and Strategies (2025 Level III CFA® – R7)...

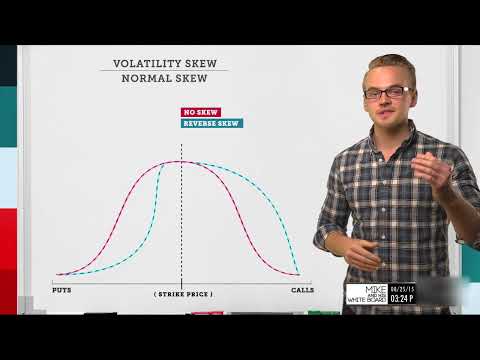

Volatility Skew Explained | Options Trading Concepts

Volatility Smile and Skew | FRM Part 2 | Market Risk

The Volatility Smile - Options Trading Lessons

Volatility Surface & Volatility Smile Explained

Level III: VOLATILITY SKEW AND SMILE

Implied Volatility Skew & Three Things it Can Tell You

How to beat Market Makers || Volatility Smile and Put-Call Parity Explained

[CFA3] Module 8.11 Option Strategies: Volatility Skew and Smile

Bitcoin's Volatility Smile and Skew: Unlocking the Secrets of Options Trading

Volatility Skew Secrets | 2x Your Accuracy | Equityincome

Why there is volatility smile and volatility skew

The Ultimate Guide To Option Skew & Volatility Smile - Show #137 - Option Alpha Podcast

Understanding Volatility Skew/Smile

Implied Volatility, Volatility Skew, and the Term Structure of Volatility

Volatility Skew Vs Smile!!! & various Option Volatility Trading Strategies

Volatility Smile

Volatility Skew Simplified #optionstrading #nse

Explaining the Volatility Smirk

GVol: Explaining Option Skew

Volatility Smiles (FRM Part 2 2025 – Book 1 – Chapter 15)

Implied volatility | Finance & Capital Markets | Khan Academy

The Term Structure of Volatility and the Volatility Surface

Комментарии

0:04:31

0:04:31

0:23:35

0:23:35

0:10:43

0:10:43

0:15:29

0:15:29

0:14:14

0:14:14

0:12:44

0:12:44

0:21:25

0:21:25

0:16:40

0:16:40

0:07:48

0:07:48

![[CFA3] Module 8.11](https://i.ytimg.com/vi/K4xrMB0B-QY/hqdefault.jpg) 0:11:33

0:11:33

0:05:39

0:05:39

0:05:13

0:05:13

0:03:40

0:03:40

0:35:38

0:35:38

0:04:32

0:04:32

0:35:08

0:35:08

0:13:19

0:13:19

0:07:47

0:07:47

0:09:18

0:09:18

0:09:22

0:09:22

0:04:36

0:04:36

0:37:09

0:37:09

0:05:00

0:05:00

0:05:46

0:05:46