filmov

tv

Pandas Dataframe | Python for Machine Learning in Finance | Free Quantra Course

Показать описание

Part of the *FREE* course on Python for Machine Learning in Finance:

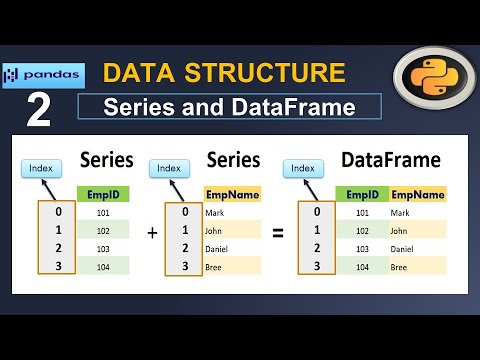

Welcome to this video on pandas dataframe. Pandas is an open source library which is used in data preparation, manipulation, modeling and analysis. It is a very powerful and important library which we will be using throughout the course.

Typically in trading you are working with a huge set of data such as close price of a stock. Pandas dataframe helps you to store such data. You can think of dataframe as excel spreadsheets. The data is stored in a tabular format consisting of rows and columns.

In our example, the columns are the date and the close price. The row represents the close price for each day. You can see that row 4 contains the closing price for 6th March, 2020. Further, you can set any column as index. For example, you can set date as the index.

This enables you to easily find the close price on any particular date. Notice how the row numbers are not present. Now we can find the data by specifying the date itself. You can add more columns to a dataframe as well.

Python lets you manipulate your data completely. If you don’t want the prices on 5th March, 2020, you could simply delete that row as well. You can compute analytics such as the simple moving average, ADX, and store them in a new column.

Further, if you want to visualise this data, you can plot it in a graph as well. You can see the graph which contains the “SMA”, “EMA”, and the closing price on screen. If you want to see the data of a particular date, you can do that as well. You can access the data for 27th January, 2021 which is shown on screen.

To summarize, a dataframe can be used to:

Store 2 dimensional data such as OHLCV data, Add or remove rows and columns, Compute analytics, technical indicators, Access the values on particular date or date range, Visualise data.

Quantra is an online education portal that specializes in Algorithmic and Quantitative trading. Quantra offers various bite-sized, self-paced and interactive courses that are perfect for busy professionals, seeking implementable knowledge in this domain.

Welcome to this video on pandas dataframe. Pandas is an open source library which is used in data preparation, manipulation, modeling and analysis. It is a very powerful and important library which we will be using throughout the course.

Typically in trading you are working with a huge set of data such as close price of a stock. Pandas dataframe helps you to store such data. You can think of dataframe as excel spreadsheets. The data is stored in a tabular format consisting of rows and columns.

In our example, the columns are the date and the close price. The row represents the close price for each day. You can see that row 4 contains the closing price for 6th March, 2020. Further, you can set any column as index. For example, you can set date as the index.

This enables you to easily find the close price on any particular date. Notice how the row numbers are not present. Now we can find the data by specifying the date itself. You can add more columns to a dataframe as well.

Python lets you manipulate your data completely. If you don’t want the prices on 5th March, 2020, you could simply delete that row as well. You can compute analytics such as the simple moving average, ADX, and store them in a new column.

Further, if you want to visualise this data, you can plot it in a graph as well. You can see the graph which contains the “SMA”, “EMA”, and the closing price on screen. If you want to see the data of a particular date, you can do that as well. You can access the data for 27th January, 2021 which is shown on screen.

To summarize, a dataframe can be used to:

Store 2 dimensional data such as OHLCV data, Add or remove rows and columns, Compute analytics, technical indicators, Access the values on particular date or date range, Visualise data.

Quantra is an online education portal that specializes in Algorithmic and Quantitative trading. Quantra offers various bite-sized, self-paced and interactive courses that are perfect for busy professionals, seeking implementable knowledge in this domain.

0:26:46

0:26:46

0:20:58

0:20:58

0:15:52

0:15:52

0:13:31

0:13:31

0:22:50

0:22:50

0:20:52

0:20:52

0:09:17

0:09:17

1:34:11

1:34:11

0:05:49

0:05:49

0:33:35

0:33:35

0:18:18

0:18:18

0:05:55

0:05:55

0:09:49

0:09:49

0:22:09

0:22:09

0:01:47

0:01:47

0:04:23

0:04:23

0:12:54

0:12:54

0:11:05

0:11:05

1:00:27

1:00:27

0:25:14

0:25:14

0:11:15

0:11:15

0:48:10

0:48:10

0:47:04

0:47:04

0:00:53

0:00:53