filmov

tv

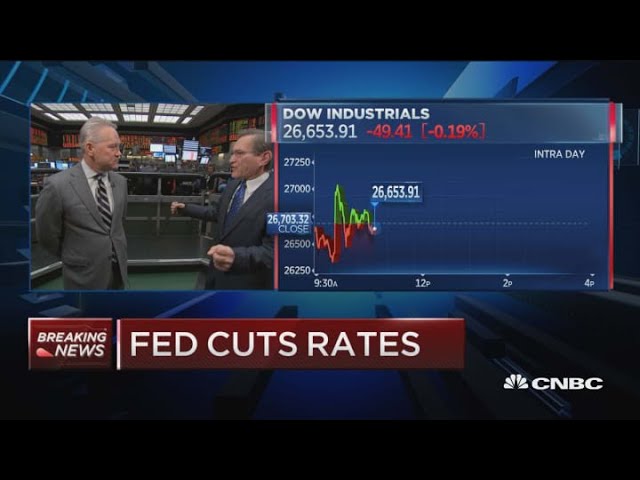

Santelli Exchange: The Fed cuts rates

Показать описание

Neuberger Berman's Chief Investment Officer, Fixed Income Brad Tank and CNBC's Rick Santelli discuss the Fed's first unscheduled policy meeting rate cut since 2008.

Stocks fell sharply in volatile trading on Tuesday as an emergency rate cut by the Federal Reserve failed to assuage concerns of slower economic growth due to the coronavirus outbreak.

The decision to cut rates by half a percentage point came two weeks before the Fed’s scheduled meeting as the central bank felt it was necessary to act quickly to combat the effect of the virus spreading worldwide. It’s the first such emergency action coming in between scheduled meetings since the financial crisis.

The Dow Jones Industrial Average closed 785.91 points lower, or nearly 3%, to 25,917.41; it rose more than 300 points earlier in the day. The 30-stock average gyrated between sharp gains and solid losses after the decision was announced. The S&P 500 fell 2.8% to 3,003.37 while the Nasdaq Composite pulled back 3% to 8,684.09.

Investors, in turn, loaded up on U.S. Treasurys, pushing the benchmark 10-year yield below 1% for the first time ever. Gold, meanwhile, jumped 2.9% to settle at $1,644.40 per ounce.

“It’s great that the Federal Reserve recognizes that there’s going to be weakness, but it makes me feel, wow, the weakness must be much more than I thought,” CNBC’s Jim Cramer said on “Squawk on the Street” right after the sudden cut. “I’m now nervous. I’m more nervous than I was before.”

Traders had already priced in a rate cut of 50 basis points by this month’s policy meeting. Fed Chairman Jerome Powell noted the central bank was not prepared to use any additional tools to stimulate the economy aside from rate cuts. This may have disappointed some on Wall Street who were expecting something more from the central bank.

Bank shares fell broadly as the benchmark 10-year Treasury yield hit a record low. Bank of America dropped more than 5.5% while JPMorgan Chase and Citigroup slid 3.8% each. The 10-year rate hit a low of 0.906%.

“The market is still trying to find its footing,” said Adam Crisafulli, founder of Vital Knowledge, in a note. “The panicked collapse of the last week isn’t something that will be quickly forgotten, and it will take a couple of weeks (at least) before stocks are on firmer ground.”

Turn to CNBC TV for the latest stock market news and analysis. From market futures to live price updates CNBC is the leader in business news worldwide.

Connect with CNBC News Online

#CNBC

#CNBC TV

Stocks fell sharply in volatile trading on Tuesday as an emergency rate cut by the Federal Reserve failed to assuage concerns of slower economic growth due to the coronavirus outbreak.

The decision to cut rates by half a percentage point came two weeks before the Fed’s scheduled meeting as the central bank felt it was necessary to act quickly to combat the effect of the virus spreading worldwide. It’s the first such emergency action coming in between scheduled meetings since the financial crisis.

The Dow Jones Industrial Average closed 785.91 points lower, or nearly 3%, to 25,917.41; it rose more than 300 points earlier in the day. The 30-stock average gyrated between sharp gains and solid losses after the decision was announced. The S&P 500 fell 2.8% to 3,003.37 while the Nasdaq Composite pulled back 3% to 8,684.09.

Investors, in turn, loaded up on U.S. Treasurys, pushing the benchmark 10-year yield below 1% for the first time ever. Gold, meanwhile, jumped 2.9% to settle at $1,644.40 per ounce.

“It’s great that the Federal Reserve recognizes that there’s going to be weakness, but it makes me feel, wow, the weakness must be much more than I thought,” CNBC’s Jim Cramer said on “Squawk on the Street” right after the sudden cut. “I’m now nervous. I’m more nervous than I was before.”

Traders had already priced in a rate cut of 50 basis points by this month’s policy meeting. Fed Chairman Jerome Powell noted the central bank was not prepared to use any additional tools to stimulate the economy aside from rate cuts. This may have disappointed some on Wall Street who were expecting something more from the central bank.

Bank shares fell broadly as the benchmark 10-year Treasury yield hit a record low. Bank of America dropped more than 5.5% while JPMorgan Chase and Citigroup slid 3.8% each. The 10-year rate hit a low of 0.906%.

“The market is still trying to find its footing,” said Adam Crisafulli, founder of Vital Knowledge, in a note. “The panicked collapse of the last week isn’t something that will be quickly forgotten, and it will take a couple of weeks (at least) before stocks are on firmer ground.”

Turn to CNBC TV for the latest stock market news and analysis. From market futures to live price updates CNBC is the leader in business news worldwide.

Connect with CNBC News Online

#CNBC

#CNBC TV

Комментарии

0:03:25

0:03:25

0:02:05

0:02:05

0:03:35

0:03:35

0:03:00

0:03:00

0:03:10

0:03:10

0:03:29

0:03:29

0:03:59

0:03:59

0:04:31

0:04:31

0:02:59

0:02:59

0:05:59

0:05:59

0:03:26

0:03:26

0:03:14

0:03:14

0:03:25

0:03:25

0:03:12

0:03:12

0:03:02

0:03:02

0:02:58

0:02:58

0:03:22

0:03:22

0:03:19

0:03:19

0:03:33

0:03:33

0:03:16

0:03:16

0:03:18

0:03:18

0:04:04

0:04:04

0:02:56

0:02:56

0:03:06

0:03:06