filmov

tv

FA18 - Closing Journal Entries EXPLAINED

Показать описание

Module 3 examines five types of adjustments: 1.) Depreciation/Amortization, 2.) Prepaid expenses, 3.) Accrued expenses, 4.) Accrued Revenues, and 5.) Unearned Revenues.

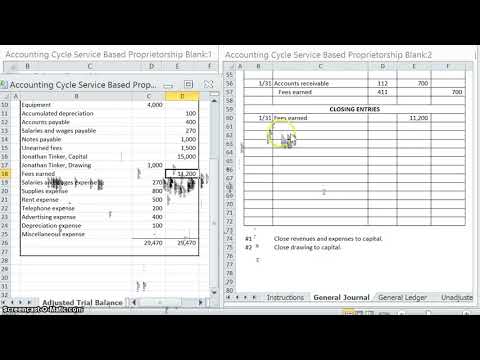

We learn how to prepare an adjusted trial balance, closing entries and a post-closing trial balance.

FA18 - Closing Journal Entries EXPLAINED

CLOSING ENTRIES: Everything You Need To Know

Closing entries in accounting

Accounting Cycle Example #2: Journalizing Closing Entries (The Two-Entry Method)

Closing Journal Entries

How to Prepare Closing Entries

Financial Accounting - Lesson 4.14 - The Closing Entries

Preparing Closing Entries

How to Close Journal Entries in 4 Steps and Preparation of Post-Closing Trial Balance

Closing Entries & Post Closing Trial Balance- Examples | Accounting How To | How to Pass Account...

3 Easy Steps - How to Record Closing Entries [SUPER FAST]!

How To Do the Month End Close — A Step-by-Step Explainer | FloQast

How to Journalize Closing Entries

Closing Journal Entries Trial Balance | What are Closing Entries

How to do Closing Entries with a Net Loss in Accounting

Closing Entries

JOURNAL ENTRIES FOR WINDING UP OR CLOSING A BUSINESS: Part 1

CLOSING ENTRIES | Revenue Account | Expense Account | Income summary Account | Drawing Account |

Accounting Bootcamp - Closing Entries

Closing Entries Review

FA13 - Adjusting Journal Entries Explained

Closings in Accounting - Post Closing Trial Balance - Example

WEEK 7 -CLOSING ENTRIES . POST-CLOSING TRIAL BALANCE

Preparing a Post-Closing Trial Balance

Комментарии

0:09:34

0:09:34

0:13:59

0:13:59

0:07:15

0:07:15

0:05:54

0:05:54

0:05:54

0:05:54

0:04:20

0:04:20

0:08:47

0:08:47

0:06:02

0:06:02

0:07:22

0:07:22

0:10:42

0:10:42

0:13:26

0:13:26

0:06:16

0:06:16

0:05:12

0:05:12

0:06:06

0:06:06

0:08:42

0:08:42

0:11:08

0:11:08

0:09:10

0:09:10

0:01:33

0:01:33

0:04:53

0:04:53

0:16:41

0:16:41

0:04:34

0:04:34

0:06:41

0:06:41

0:08:40

0:08:40

0:02:28

0:02:28