filmov

tv

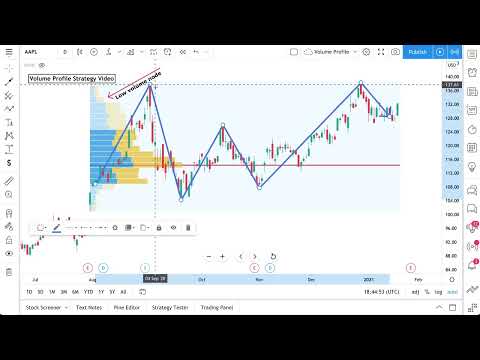

#1 Volume Profile Long and Short Trading Rule (2024 Version)

Показать описание

--------------

- Trading with Price Action and Volume Profile

- Day Trading with Volume Profile and Orderflow

- Trading with Market & Volume Profile

- Trading with Fibonacci and Market Structure

* Complete 4 course bundle = save 25% *

--------------

--------------

📉 Free Beginner Classical Chart Pattern Course:

--------------

Disclaimer: I am not a financial adviser nor a CPA. These videos are for educational and entertainment purposes only. Investing of any kind involves risk. While it is possible to minimize risk, your investments are solely your responsibility. You must conduct your own research. I am sharing my opinion with no guarantee of investment gains or losses. You should never trade with money you can’t afford to lose. Prove profitability in a simulator before trading with real money.

Affiliate Disclosure: I only recommend products and services I genuinely believe in and use myself. Some of the links on this webpage are affiliate links, meaning, at no additional cost to you, I may earn a commission if you click through and make a purchase and/or subscribe. Commissions earned will be used towards growing this channel.

- Trading with Price Action and Volume Profile

- Day Trading with Volume Profile and Orderflow

- Trading with Market & Volume Profile

- Trading with Fibonacci and Market Structure

* Complete 4 course bundle = save 25% *

--------------

--------------

📉 Free Beginner Classical Chart Pattern Course:

--------------

Disclaimer: I am not a financial adviser nor a CPA. These videos are for educational and entertainment purposes only. Investing of any kind involves risk. While it is possible to minimize risk, your investments are solely your responsibility. You must conduct your own research. I am sharing my opinion with no guarantee of investment gains or losses. You should never trade with money you can’t afford to lose. Prove profitability in a simulator before trading with real money.

Affiliate Disclosure: I only recommend products and services I genuinely believe in and use myself. Some of the links on this webpage are affiliate links, meaning, at no additional cost to you, I may earn a commission if you click through and make a purchase and/or subscribe. Commissions earned will be used towards growing this channel.

Комментарии

0:26:09

0:26:09

1:03:09

1:03:09

0:09:40

0:09:40

0:08:13

0:08:13

0:00:56

0:00:56

0:00:38

0:00:38

0:11:33

0:11:33

0:00:38

0:00:38

0:22:22

0:22:22

0:20:47

0:20:47

0:05:30

0:05:30

0:00:56

0:00:56

0:15:36

0:15:36

1:09:23

1:09:23

0:00:27

0:00:27

0:19:44

0:19:44

0:49:26

0:49:26

0:00:47

0:00:47

0:34:10

0:34:10

0:07:38

0:07:38

0:00:48

0:00:48

0:00:36

0:00:36

0:00:25

0:00:25

0:08:03

0:08:03