filmov

tv

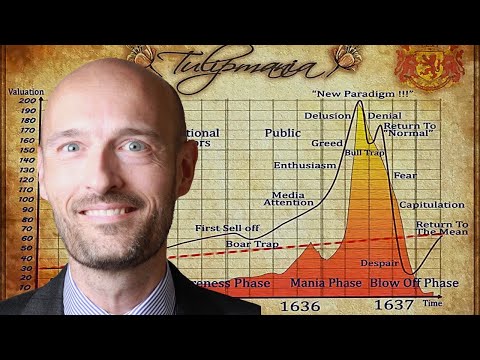

From Tulip Mania to Meme Stocks: Applying Shiller's Insights to Modern Markets

Показать описание

Welcome to the podcast where we delve into the fascinating world of behavioral finance and market psychology. Today, we're unpacking a seminal work that has revolutionized how we understand market booms and busts: Robert Shiller's "Irrational Exuberance." This book isn't just for finance gurus; it's a crucial read for anyone who wants to understand the forces that shape our economic landscape.

Shiller, a Nobel laureate and a pioneer in behavioral finance, challenges the traditional view of efficient markets, arguing that human psychology, media narratives, and social influences can lead to significant deviations from intrinsic value, creating bubbles that inevitably burst. He posits that markets are not always rational, efficient machines but rather are heavily influenced by human emotions, biases, and the contagious spread of narratives.

Throughout "Irrational Exuberance," Shiller explores the psychological factors that contribute to market bubbles. He discusses how overconfidence leads investors to overestimate their knowledge and underestimate risks. He shows how herd behavior can create self-reinforcing cycles where rising prices attract more buyers, regardless of fundamentals. The book examines how social contagion spreads investment ideas and narratives. Shiller also introduces concepts such as anchoring bias, which distorts perceptions of value, and the narrative fallacy, which causes us to create stories to explain market trends even if they are inaccurate. The concept of moral hazard, where bailouts encourage excessive risk, and new era thinking, where people think old rules no longer apply, are also important.

Shiller's analysis goes beyond psychology, examining how the media acts as an amplifier of market trends. He explores how the framing of market events shapes perceptions and how the 24/7 news cycle encourages short-term thinking. The rise of the internet and social media has created echo chambers and filter bubbles, further complicating the investment landscape. The power of social media to influence market prices, exemplified by the rise of "meme stocks," also comes under scrutiny.

"Irrational Exuberance" also features a detailed examination of historical market bubbles, including the Roaring Twenties stock market boom, the dot-com bubble, and the housing bubble that led to the 2008 financial crisis. Shiller also discusses valuation metrics, particularly the Cyclically Adjusted Price-to-Earnings ratio (CAPE), challenging the Efficient Market Hypothesis. He emphasizes the role of speculation and investor sentiment in driving market fluctuations.

Join us as we unpack Shiller's insights, explore the real-world implications of his work, and provide you with a practical understanding of how to navigate the complexities of financial markets. This podcast is your guide to understanding not just the numbers but the human story behind market booms and busts.

------

Welcome to Vivubook!

Dive into the world of literature with our engaging and insightful book reviews. At Vivubook, we explore the most popular and influential books across various genres, offering you in-depth analyses and thoughtful discussions. Whether you’re a passionate reader or just looking for your next great read, our podcast has something for everyone. Join us on this literary journey and discover the stories that shape our world.

I hope you like it! If you need any adjustments or additional details, feel free to let me know.

Irrational Exuberance, Robert Shiller, Behavioral Finance, Market Bubbles, Market Crashes, Investor Psychology, Efficient Market Hypothesis, CAPE Ratio, Speculative Manias, Herd Behavior, Overconfidence, Social Contagion, Financial Markets, Stock Market, Housing Bubble, Dot-Com Bubble, Meme Stocks, Financial Literacy, Market Regulation, Investor Sentiment

#BookReview #Podcast #Vivubook #IrrationalExuberance #RobertShiller #BehavioralFinance #MarketBubbles #MarketCrashes #Investing #StockMarket #FinancialLiteracy #InvestorPsychology #Economics #FinancePodcast #InvestingTips #Money #WallStreet #MemeStocks #FinancialMarkets

Shiller, a Nobel laureate and a pioneer in behavioral finance, challenges the traditional view of efficient markets, arguing that human psychology, media narratives, and social influences can lead to significant deviations from intrinsic value, creating bubbles that inevitably burst. He posits that markets are not always rational, efficient machines but rather are heavily influenced by human emotions, biases, and the contagious spread of narratives.

Throughout "Irrational Exuberance," Shiller explores the psychological factors that contribute to market bubbles. He discusses how overconfidence leads investors to overestimate their knowledge and underestimate risks. He shows how herd behavior can create self-reinforcing cycles where rising prices attract more buyers, regardless of fundamentals. The book examines how social contagion spreads investment ideas and narratives. Shiller also introduces concepts such as anchoring bias, which distorts perceptions of value, and the narrative fallacy, which causes us to create stories to explain market trends even if they are inaccurate. The concept of moral hazard, where bailouts encourage excessive risk, and new era thinking, where people think old rules no longer apply, are also important.

Shiller's analysis goes beyond psychology, examining how the media acts as an amplifier of market trends. He explores how the framing of market events shapes perceptions and how the 24/7 news cycle encourages short-term thinking. The rise of the internet and social media has created echo chambers and filter bubbles, further complicating the investment landscape. The power of social media to influence market prices, exemplified by the rise of "meme stocks," also comes under scrutiny.

"Irrational Exuberance" also features a detailed examination of historical market bubbles, including the Roaring Twenties stock market boom, the dot-com bubble, and the housing bubble that led to the 2008 financial crisis. Shiller also discusses valuation metrics, particularly the Cyclically Adjusted Price-to-Earnings ratio (CAPE), challenging the Efficient Market Hypothesis. He emphasizes the role of speculation and investor sentiment in driving market fluctuations.

Join us as we unpack Shiller's insights, explore the real-world implications of his work, and provide you with a practical understanding of how to navigate the complexities of financial markets. This podcast is your guide to understanding not just the numbers but the human story behind market booms and busts.

------

Welcome to Vivubook!

Dive into the world of literature with our engaging and insightful book reviews. At Vivubook, we explore the most popular and influential books across various genres, offering you in-depth analyses and thoughtful discussions. Whether you’re a passionate reader or just looking for your next great read, our podcast has something for everyone. Join us on this literary journey and discover the stories that shape our world.

I hope you like it! If you need any adjustments or additional details, feel free to let me know.

Irrational Exuberance, Robert Shiller, Behavioral Finance, Market Bubbles, Market Crashes, Investor Psychology, Efficient Market Hypothesis, CAPE Ratio, Speculative Manias, Herd Behavior, Overconfidence, Social Contagion, Financial Markets, Stock Market, Housing Bubble, Dot-Com Bubble, Meme Stocks, Financial Literacy, Market Regulation, Investor Sentiment

#BookReview #Podcast #Vivubook #IrrationalExuberance #RobertShiller #BehavioralFinance #MarketBubbles #MarketCrashes #Investing #StockMarket #FinancialLiteracy #InvestorPsychology #Economics #FinancePodcast #InvestingTips #Money #WallStreet #MemeStocks #FinancialMarkets

Комментарии

0:38:03

0:38:03

0:00:46

0:00:46

0:26:38

0:26:38

0:00:08

0:00:08

0:03:36

0:03:36

0:00:45

0:00:45

0:00:36

0:00:36

0:00:38

0:00:38

0:08:36

0:08:36

0:00:14

0:00:14

0:00:50

0:00:50

0:13:47

0:13:47

0:00:28

0:00:28

0:00:39

0:00:39

0:00:11

0:00:11

0:00:31

0:00:31

0:01:01

0:01:01

0:00:28

0:00:28

0:00:49

0:00:49

0:00:09

0:00:09

0:00:09

0:00:09

0:00:41

0:00:41

0:00:57

0:00:57

0:01:02

0:01:02