filmov

tv

Corporate Banking Simply Explained in 8 Minutes

Показать описание

clubhouse: @bryanjun

*DISCLAIMER: The Amazon links above are my unique affiliate code and I get a percentage of sales if you use the link to purchase items on Amazon's website*

*DISCLAIMER: The Amazon links above are my unique affiliate code and I get a percentage of sales if you use the link to purchase items on Amazon's website*

Corporate Banking Simply Explained in 8 Minutes

Banking Explained – Money and Credit

Banking, Simply Explained

Investment Banking Explained | How does Investment Banks Work | Intellipaat

INVESTMENT BANKING EXPLAINED | Introduction, History, Lifestyle

Investment Banking Areas Explained: Capital Markets

Why choose Corporate Banking? Explained by JBIMS Alumnus - Sushmit Pal, Senior Relationship Manager

Investment Banking Explained in 2 Minutes in Basic English

BANKER EXPLAINS: Millionaires Bank HERE for 4 Reasons

Investment Banking Explained (M&A, ECM, DCM, Leveraged Finance and Restructuring)

Investment Banking Areas Explained: Advisory Services

Banking explained

Investment Banking Explained in less than 60 seconds | Shatakshi Sharma

Fractional Reserve Banking Explained in One Minute

How do banks actually create money? We explain

Anton Kreil Explains What A Trader at an Investment Bank Does

Banking Money Creation Explained Simply

The International Monetary Fund (IMF) and the World Bank Explained in One Minute

INVESTMENT BANKING easily explained /ECM/DCM/M&A/IPO's/IBD

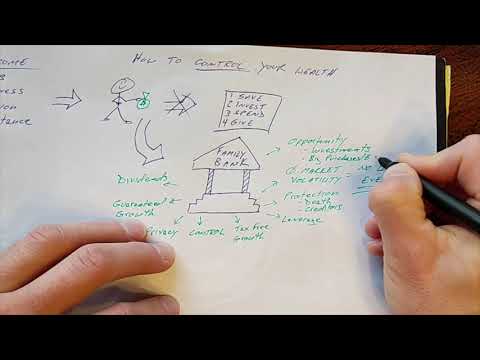

The Infinite Banking Concept explained

The difference between islamic banking and conventional banking explained in Urdu.

Shadow Banking (Hedge Funds, Money Market Funds, etc.) Explained in One Minute

Paul Horvath explains how over-leveraged banks helped caused Global Financial Crisis.

Open Banking Explained

Комментарии

0:07:44

0:07:44

0:06:10

0:06:10

0:08:26

0:08:26

0:03:50

0:03:50

0:06:38

0:06:38

0:06:18

0:06:18

0:53:10

0:53:10

0:03:15

0:03:15

0:07:20

0:07:20

0:05:44

0:05:44

0:07:00

0:07:00

0:03:59

0:03:59

0:00:51

0:00:51

0:01:08

0:01:08

0:01:00

0:01:00

0:17:51

0:17:51

0:00:37

0:00:37

0:01:24

0:01:24

0:08:05

0:08:05

0:04:27

0:04:27

0:02:16

0:02:16

0:01:17

0:01:17

0:00:56

0:00:56

0:05:15

0:05:15