filmov

tv

The Dangers of Fiscal Policy

Показать описание

Argentina, Mexico, Thailand, Indonesia, Greece...what do all these countries have in common? Sadly, they’ve all faced crippling sovereign debt defaults.

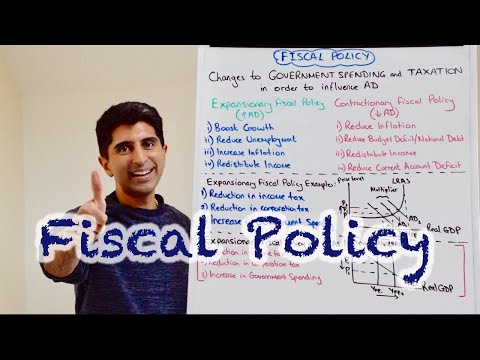

Fiscal policy can be a super useful tool – under the right circumstances. In this video we’ll discuss fiscal policy gone bad, and the warning signs to look out for.

------------------------------------------------------------------------------------------------------------

Fiscal policy can be a super useful tool – under the right circumstances. In this video we’ll discuss fiscal policy gone bad, and the warning signs to look out for.

------------------------------------------------------------------------------------------------------------

The Dangers of Fiscal Policy

Macro: Unit 3.2 -- The Effects of Fiscal Policy

GCSE Economics: Evaluating the effects of fiscal policy

Monetary and Fiscal Policy: Crash Course Government and Politics #48

Macro: Unit 3.5 -- Problems with Fiscal Policy

How Governments control the economy (Fiscal Policy Explained)

The Difference Between Fiscal and Monetary Policy

Fiscal & Monetary Policy - Macro Topic 5.1

We're On The Brink Of Economic Collapse | Peter Schiff | Impact Theory w/ Tom Bilyeu

Fiscal Policy's effects on Long-run Economic Growth

Y1 31) Fiscal Policy - Problems and Evaluation

Monetary and fiscal policy | Aggregate demand and aggregate supply | Macroeconomics | Khan Academy

Y1 30) Fiscal Policy - Government Spending and Taxation

Recession And Fiscal Policy

The Limits of Fiscal Policy

30. Problems of Fiscal Policy

Effects of fiscal policy in case intermediate, classical and keynesian (closed economy class-14)

Fiscal Policy (Part 1): Effects on Economic Activity

Fiscal Policy and Stimulus: Crash Course Economics #8

Effects of Fiscal Policy in the AS-AD-Model

Effects of Change in Fiscal Policy

6.2 - Fiscal Policy (Keynes and Fiscal Policy)

Fiscal Policy part 6| Dangers of High Debt| Debt Default| Debt Explosion| Macroeconomics| Blanchard

Olivier Blanchard: 'Ongoing thoughts about fiscal policy'

Комментарии

0:06:03

0:06:03

0:07:09

0:07:09

0:02:58

0:02:58

0:09:19

0:09:19

0:09:16

0:09:16

0:01:56

0:01:56

0:07:47

0:07:47

0:03:59

0:03:59

0:10:16

0:10:16

0:10:45

0:10:45

0:11:36

0:11:36

0:08:54

0:08:54

0:08:15

0:08:15

0:01:11

0:01:11

0:07:06

0:07:06

0:08:39

0:08:39

0:23:29

0:23:29

0:05:03

0:05:03

0:11:54

0:11:54

0:06:15

0:06:15

0:07:48

0:07:48

0:07:58

0:07:58

0:09:07

0:09:07

0:56:55

0:56:55