filmov

tv

R2R:EXAMPLES OF INTERCOMPANY ACCOUNTING TRANSACTIONS

Показать описание

R2R:EXAMPLES OF INTERCOMPANY ACCOUNTING TRANSACTIONS#AccountsGurukul#

R2R:EXAMPLES OF INTERCOMPANY ACCOUNTING TRANSACTIONS

Intercompany Journal Entries Interview Questions and Answer | Intercompany Accounting Corporate Wala

Accenture R2R Intercompany Journal Entries | Record to Report Intercompany Journal | Intercompany JE

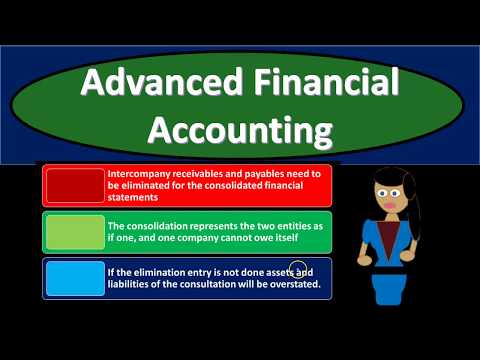

Intercompany Transactions 420 Advanced Financial Accounting

Inter company accounting

R2R-INTERCOMPANY RECONCILIATION WITH PRACTICAL EXAMPLE IN EXCEL

What's the meaning of intercompany processing

R2R-CONFUSION BETWEEN TRANSACTION, INTERCOMPANY TRANSACTION AND INTRACOMPANY TRANSACTION

Consolidation Accounting ➡️ Eliminate Intercompany Activity

Inter-Company Transactions - Elimination (Consolidation Accounting)

Fixed Asset Intercompany Transfer: Process and Accounting Entries

Consolidation Accounting ➡️ Eliminating Intercompany Activity

R2R RECORD TO REPORT INTERCOMPANY:AUDIENCE QUERY RELARED TO MARKUP, CONSOLIDATION & TRANSFER PRI...

R2R: THE SOLUTIONS TO IMPROVE INTERCOMPANY RECONCILIATION

How to Process Intercompany Transactions

Intercompany reconciliation

Inter company accounting |Part - 3|

NetSuite Advanced Intercompany Journal Entries Demo

What is Contra Entry? | Corporate Wala |Journal Entry Interview Questions and Answers #corporatewala

Intercompany Transactions

INTERCOMPANY ELIMINATIONS: MEANING, TYPES & EXAMPLES OF INTERCOMPANY ELIMINATIONS😇

QuickBooks Online: Easy Intercompany Transactions Tutorial | QuickBooks I Intuit

R2R-INTERCOMPANY CHARGE BACK:MEANING,TWO DIFFERENT APPROACHES & HOW TO DECIDE WHICH APPROACH IS ...

Intercompany: Accounting, Eliminations & Journal Entries in Holding & Subsidiary😇

Комментарии

0:15:57

0:15:57

0:06:38

0:06:38

0:04:17

0:04:17

0:08:00

0:08:00

0:20:18

0:20:18

0:43:56

0:43:56

0:00:25

0:00:25

0:11:30

0:11:30

0:00:41

0:00:41

0:17:22

0:17:22

0:12:44

0:12:44

0:00:58

0:00:58

0:15:17

0:15:17

0:16:23

0:16:23

0:04:43

0:04:43

0:12:43

0:12:43

0:14:36

0:14:36

0:09:37

0:09:37

0:00:11

0:00:11

0:05:07

0:05:07

0:15:51

0:15:51

0:07:16

0:07:16

0:15:27

0:15:27

0:27:26

0:27:26