filmov

tv

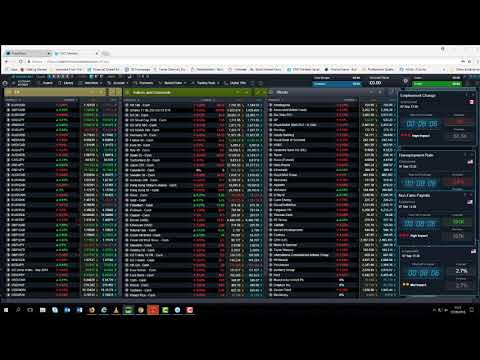

LIVE NFP: 169th Non-Farm Payrolls Coverage

Показать описание

Do you expect a rebound in job creation? How is the labor market performing in the Trump presidency? What is the best strategy to trade the non-farm payrolls number?

FX Bootcamp provides live play by play commentary and analysis during the release of the Employment Report:

- Learn how to conservatively trade during news events.

- See technical analysis applied to live market charts.

- Apply Pivot Point & Fibonacci Theories in real-time.

- Entry and exits point clearly defined in advance.

- Ask questions while the market is moving.

- Get the NFP NEWS Live!

Read Wayne's Model of Non-Farm Payrolls: How To Prepare For and Trade the Employment Situation Report

LIVE NFP: 169th Non-Farm Payrolls Coverage

LIVE NFP: 170th Non-Farm Payrolls Coverage

LIVE NFP: 168th Non-Farm Payrolls Coverage

LIVE NFP: 172nd Non-Farm Payrolls Coverage

Live Trading Non Farm Payroll with Market Coach: Nick Quinn

NAGA | Today, US releases their latest Non-Farm Payroll data.

Non-Farm Payroll live webinar, 1 August 2014, CMC Markets

Non-Farm Payrolls - Live Webinar - December 2018

Non Farm Payroll August 1 2014

1st Sept 2023 Non-farm Payroll Event Coverage with Andrew Lockwood

US Non Farm Payrolls replayed - 7th September 2018

Ждем выхода данных по Nonfarm payrolls

Non Farm Payroll 6 Oct 2017

LIVE ON AIR with Wayne McDonell on NFP Coverage!

U.S. Live NFP trading room with Tshepo and Ashley Reeve - 1 September 2023.

[ENGLISH] Live News Trading 01.09 - Nonfarm Payroll | OctaFX

Non-Farm Payrolls live coverage 2 October 2015 - CMC Markets

NFP Realizado 5 febrero 2021 - Live NFP Trading Session ¿Veremos Volatilidad? Acciones Forex Índices...

The US dollar declines, while investors wait for NFP numbers - 28th of November 2022

Прямое включение на NonFarm Payrolls. 07.06.2013

Non Farm Payroll Live Forex Friday Forex Trading October 6 2017

🔴 TRADING NFP NEWS LIVE - FUNDAMETAL NEWS TRADING

🔴 LIVE: Cập nhật thị trường bản tin Nonfarm Payrolls | Phạm Thành Biên

Non-Farm Payrolls September 2024 LIVE Stream Special - Sponsored by TheTrustedProp

Комментарии

2:13:53

2:13:53

2:59:02

2:59:02

3:02:03

3:02:03

2:50:03

2:50:03

0:36:51

0:36:51

0:00:56

0:00:56

0:34:15

0:34:15

0:44:05

0:44:05

0:07:14

0:07:14

0:40:23

0:40:23

0:33:11

0:33:11

0:00:14

0:00:14

0:04:08

0:04:08

0:01:02

0:01:02

0:34:36

0:34:36

![[ENGLISH] Live News](https://i.ytimg.com/vi/AtE4MeSOYlU/hqdefault.jpg) 1:01:30

1:01:30

0:41:05

0:41:05

0:23:01

0:23:01

0:20:55

0:20:55

0:25:31

0:25:31

0:50:46

0:50:46

1:12:23

1:12:23

0:11:57

0:11:57

0:26:21

0:26:21