filmov

tv

AI Certainty Clashes with Economic Uncertainty | ITK with Cathie Wood

Показать описание

On episode 45 of "In the Know," (July 7, 2023) ARK CEO/CIO, Cathie Wood, weighs in on artificial intelligence (AI), Bitcoin, Fed Policy, electric vehicles, the discrepancy between GDP and GDI, bankruptcies, and the German and Chinese economies.

As always, she discusses fiscal policy, monetary policy, market signals, economic indicators, and innovation. We hope you find this monthly series useful, especially during periods of heightened volatility. Stay Healthy. Stay Innovative.

00:00:00 - Intro

00:01:33 - Fiscal Policy

00:08:38 - Monetary Policy

00:14:07 - Economic Indicators

00:22:55 - Market Signals

00:28:21 - Innovation

For more updates, follow us on:

As always, she discusses fiscal policy, monetary policy, market signals, economic indicators, and innovation. We hope you find this monthly series useful, especially during periods of heightened volatility. Stay Healthy. Stay Innovative.

00:00:00 - Intro

00:01:33 - Fiscal Policy

00:08:38 - Monetary Policy

00:14:07 - Economic Indicators

00:22:55 - Market Signals

00:28:21 - Innovation

For more updates, follow us on:

AI Certainty Clashes with Economic Uncertainty | ITK with Cathie Wood

AI Certainty vs. Economic Uncertainty - Cathie Wood

Certainty vs. Intelligence

Dario Amodei: Anthropic CEO on Claude, AGI & the Future of AI & Humanity | Lex Fridman Podca...

GOTOWI na WSZYSTKO: RÓWNOWAGA w finansach, zdrowiu i relacjach – Phil Konieczny [Archiwum AS] 416

Xi Criticizes Biden Administration, Signals Openness to Trump’s Leadership | Times Now World

The AI Revolution | ITK with Cathie Wood feat. Frank Downing & Will Summerlin

Eliezer Yudkowsky: Dangers of AI and the End of Human Civilization | Lex Fridman Podcast #368

3 MINS AGO China Unleashes HELL After U S BANNED TSMC’s AI Chips What's Happening? 'DAIL...

AI in Healthcare: Will the Reality Match the Hype?

Edward Lee: 'Certainty or Intelligence: Pick One!'

Will AI Fix Banking? | ITK with Cathie Wood

ÍGÉRETES VAGY FÉLELMETES? Tilesch György, M.I.-szakértő /// F.P. 71. adás

China's $10 Billion Flying Car Factory Shocks The ENTIRE World.

You Won't Believe what This 150-Year Chart PREDICTS for Stock Markets

3 game theory tactics, explained

Aculist's Statistically Speaking: Real Estate Certainty - What the Economy is Telling Us.

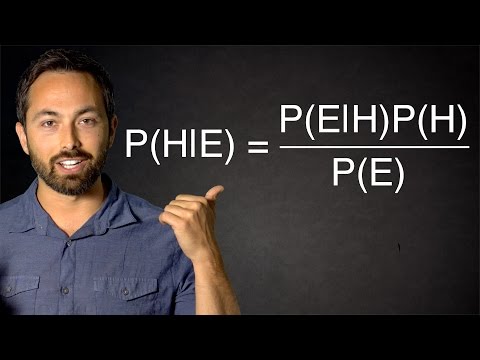

The Bayesian Trap

Artificial Intelligence: Humans and/with/vs Machines? Powerful Keynote Talk Futurist Gerd Leonhard

Eliezer Yudkowsky – AI Alignment: Why It's Hard, and Where to Start

How to Predict Divorce With 95% Accuracy | Jordan Peterson

The Challenge with Gen Z | Simon Sinek

The 12 Principles of Prosperity- #8 Certainty

Crypto's Future in Donald Trump's Second Term

Комментарии

0:33:13

0:33:13

0:08:45

0:08:45

0:49:03

0:49:03

5:15:01

5:15:01

0:39:41

0:39:41

0:08:04

0:08:04

0:53:37

0:53:37

3:17:51

3:17:51

0:33:52

0:33:52

1:16:53

1:16:53

1:00:01

1:00:01

0:51:10

0:51:10

1:51:30

1:51:30

0:35:12

0:35:12

0:13:45

0:13:45

0:07:11

0:07:11

0:59:34

0:59:34

0:10:37

0:10:37

0:59:30

0:59:30

1:29:56

1:29:56

0:04:37

0:04:37

0:03:35

0:03:35

0:00:45

0:00:45

0:14:26

0:14:26