filmov

tv

How To Set Up Taxes On Shopify 2024 (Step-By-Step)

Показать описание

How To Set Up Taxes On Shopify 2024 (Step-By-Step)

In this video we show you How To Set Up Taxes On Shopify. It is Super Easy to Use and Learn to Use it like a Pro by Watching this Helpful Tutorial.

If this tutorial helped you out please like & commenting down below if this works!

Subscribe for more daily videos! See you in the next video!

LET’S GET SOCIAL:

📷 Instagram: @itsryanvandonkelaar

📷 Instagram: @manizha_lopez

🤗 SUBSCRIBE FOR NEW VIDEOS EVERY WEEK

WHO ARE WE: We’re Manizha & Ryan, two content creation experts. We create easy-to-follow tutorials around dropshipping, e-commerce, digital marketing and much more!

#tutorials by #Manizha_Lopez #ItsRyanVanDonkelaar

In this video we show you How To Set Up Taxes On Shopify. It is Super Easy to Use and Learn to Use it like a Pro by Watching this Helpful Tutorial.

If this tutorial helped you out please like & commenting down below if this works!

Subscribe for more daily videos! See you in the next video!

LET’S GET SOCIAL:

📷 Instagram: @itsryanvandonkelaar

📷 Instagram: @manizha_lopez

🤗 SUBSCRIBE FOR NEW VIDEOS EVERY WEEK

WHO ARE WE: We’re Manizha & Ryan, two content creation experts. We create easy-to-follow tutorials around dropshipping, e-commerce, digital marketing and much more!

#tutorials by #Manizha_Lopez #ItsRyanVanDonkelaar

How to setup your Shopify taxes correctly 👌

How To Set Up Taxes On Shopify 2024 (Step-By-Step)

Setup your Shopify Taxes Correctly (only 5 min!)

How Do Taxes Work?

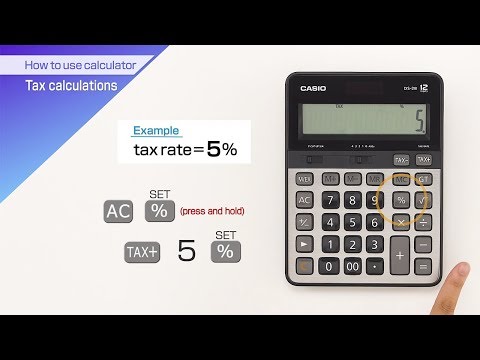

CASIO【How to use calculator Tax calculations】

How To Set Up Taxes On Shopify - Step By Step For Beginners

Shopify Tax Setup - How To Setup Sales Tax In Your Shopify Store

Settings. How to set up City Taxes

Visa & Tax Strategies for Brits Moving to the U.S.

How Big Earners Reduce their Taxes to Zero

How to set up taxes on shopify 2024

Tax Basics For Beginners (Taxes 101)

How to set up Taxes in WooCommerce

How to set up EU taxes in your Shopify store in 2024

Shopify Sales Tax Setup Complete Tutorial (2023) | Easy Set Up Taxes On Shopify (Step-By-Step)

How To PROPERLY Set Up Taxes On Shopify (FULL GUIDE)

How to Set Up Taxes on Shopify 2024 (Step By Step Tutorial)

Don't Setup an LLC Until You Watch This Video (Time Sensitive)

How to Set Up Taxes on Shopify (2024)

HOW TO SET UP TAXES IN SHOPIFY (2024)

How to set up EU taxes in your Shopify store in 2020

How to set up Dutch taxes in your Shopify store in 2024

Avoid These MISTAKES BEFORE Starting an LLC!

How To Add Taxes To Shopify (How To Set Up Taxes On Shopify)

Комментарии

0:00:46

0:00:46

0:08:23

0:08:23

0:04:12

0:04:12

0:00:36

0:00:36

0:00:48

0:00:48

0:06:29

0:06:29

0:10:37

0:10:37

0:01:27

0:01:27

0:28:13

0:28:13

0:13:37

0:13:37

0:01:17

0:01:17

0:18:05

0:18:05

0:12:10

0:12:10

0:12:04

0:12:04

0:05:31

0:05:31

0:00:47

0:00:47

0:08:18

0:08:18

0:16:08

0:16:08

0:02:37

0:02:37

0:00:37

0:00:37

0:08:14

0:08:14

0:09:56

0:09:56

0:16:40

0:16:40

0:01:18

0:01:18