filmov

tv

Building a Trading Strategy: Entry, Exit or Money Management?

Показать описание

Zak Mir, an experienced technical analyst speaks about trading timeframes and money management

What are the market conditions that you consider ideal, and which ones are the most challenging, for the performance of your strategy?

When developing a trading strategy, do you give a higher priority to building entry signals, exit signals or money management rules?

Do you favor any particular timeframe in your strategies? What is your average trade duration and trading frequency?

What should an inexperienced trader watch when choosing a time frame?

In terms of day to day strategy, it shouldn't really make a difference unless the market is very volatile. If you've got your methodology correct and you're trading with stop losses you shouldn't really be bothered.

What are the market conditions that you consider ideal, and which ones are the most challenging, for the performance of your strategy?

When developing a trading strategy, do you give a higher priority to building entry signals, exit signals or money management rules?

Do you favor any particular timeframe in your strategies? What is your average trade duration and trading frequency?

What should an inexperienced trader watch when choosing a time frame?

In terms of day to day strategy, it shouldn't really make a difference unless the market is very volatile. If you've got your methodology correct and you're trading with stop losses you shouldn't really be bothered.

Building a Trading Strategy: Entry, Exit or Money Management?

Creating your First Winning Trading System: Entries & Exits! 📈📉

amazing DAY TRADING strategy - entry, exit and all rules

How to Build a Profitable Trading Strategy in 2024 | Step by Step

Very PROFITABLE Trading Strategy with Only 1 Indicator! #shorts

I Tested This Trading Strategy & It Made 310%

Ultimate SMC Trading Strategy: How I Made My FIRST $100,000+ (Forex Trading)

How To Grow A Small Stock Account

Forex Retracement Trading Strategy 2025 | Best Forex Trading Strategies 2025 | Best Forex Strategies

Trading SECRETS: How to Enter & Exit like a Pro

The Simplest Day Trading Strategy for Beginners (with ZERO experience)

BEST Scalping Trading Strategy For Beginners (How To Scalp Forex, Stocks, and Crypto)

I Found A Trading Strategy With a 225% Profit Rate #shorts

The ONLY 5-Step SMC Strategy You Need In 2023 | (EASY Winning Trades)

How to build a TRADING STRATEGY (OF YOUR OWN)

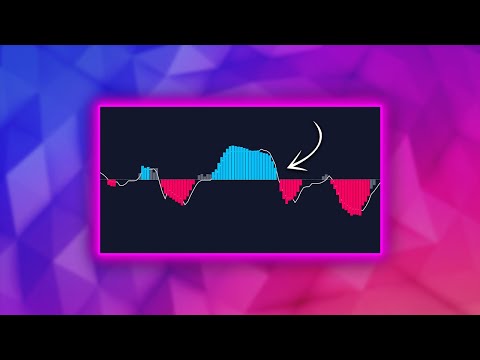

Best Trading Indicator To Build A Strategy Upon (100 Year Back Test!)

The ULTIMATE Supply & Demand Guide (My Secrets)

The Only Day Trading Strategy I Would Use If I Could Start Over...

The Billion Dollar Trading Strategy

THE BEST FOREX TRADING STRATEGY | KEEP IT SIMPLE

Parameter To Build Your Own Trading System - I Will Be A Trader

'Mastering Entries in SMC: Final Step to Profitable Trading'🚀📊🔥

Making Profit in 10 Second With easy Method | Quotex Trading Strategy

How To Build A Profitable Trading System

Комментарии

0:06:35

0:06:35

0:19:24

0:19:24

0:12:58

0:12:58

0:42:25

0:42:25

0:00:39

0:00:39

0:01:00

0:01:00

0:28:40

0:28:40

0:08:45

0:08:45

0:07:23

0:07:23

0:11:52

0:11:52

0:18:26

0:18:26

0:07:22

0:07:22

0:01:00

0:01:00

0:10:14

0:10:14

0:28:57

0:28:57

0:10:26

0:10:26

0:09:44

0:09:44

0:20:02

0:20:02

0:07:48

0:07:48

0:16:42

0:16:42

0:10:43

0:10:43

0:42:51

0:42:51

0:05:59

0:05:59

0:47:30

0:47:30