filmov

tv

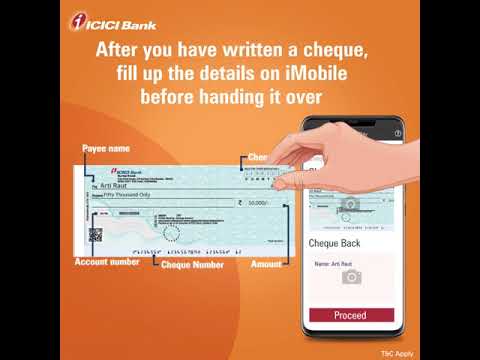

Positive Pay System For Cheques - Avoid Cheque Fraud

Показать описание

How to avoid Cheque frauds using Positive Pay System? The Positive Pay System introduced by RBI & NPCI explained in Hindi. We’ll also discuss the benefits of Positive Pay system and its compulsion in Indian banks.

Join All-In-One Video Finance App here:

Unlimited Access to Stock Recommendations, IPO Analysis, Finance Courses, Sectoral Analysis & In-depth case studies of public companies

-------------------------------------------------------------------------------------------

* Invest & Trade in Stocks & Mutual Funds *

Open your Discount Demat Account here:

-------------------------------------------------------------------------------------------

***Start investing in Fixed Income Securities***

Start Covered Bonds Here:

Start Invoice Discounting Here:

Start Bonds Investing Here:

-------------------------------------------------------------------------------------------

Related Videos & Playlists:

-------------------------------------------------------------------------------------------

Time Stamps

00:00 – Intro

00:51– How to avoid Cheque frauds with a Positive Pay system?

01:37- RBI released this Positive Pay system Circular

02:27- High value check

About the Video

To prevent cheque frauds, financial institutions use a positive-pay system that automates cash management. A company's cheques and the ones it submits to the bank for payment must match in order for positive pay to take place. Any questionable cheque is returned to the issuer for review. The method serves as a sort of insurance for a business against losses, fraud, and other obligations to the bank. While most banks still charge for the service, others now provide it for a discounted price or for free.

The RBI has proposed an electronic authentication method called Positive Pay that will allow you to communicate the check's data with your bank before the bank processes it, and it will go into effect on January 1st 2021. This extra security measure is intended to combat the growing number of check fraud incidents that have garnered media attention over the past year. Positive Pay is undoubtedly a boost for banks as counterfeit check perpetrators' techniques advance with each passing day.

In this video, we’ll cover the following concepts and questions:

1. How to avoid Cheque Frauds?

2. What is positive pay system?

3. SBI positive pay system.

4. Positive pay system for cheques SBI.

5. Positive pay system in Indian bank.

6. What is positive pay system in BOB?

7. RBI directives positive pay CPPS system.

8. Benefits of positive pay system.

-------------------------------------------------------------------------------------------

Connect with Us

-------------------------------------------------------------------------------------------

Website

#chequefrauds #cheques #positivepaysystem

-------------------------------------------------------------------------------------------

Disclaimer:

Investment in securities market is subject to market risks. Read all the related documents carefully before investing.

Registration granted by SEBI, enlistment as an RA with exchange and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

Join All-In-One Video Finance App here:

Unlimited Access to Stock Recommendations, IPO Analysis, Finance Courses, Sectoral Analysis & In-depth case studies of public companies

-------------------------------------------------------------------------------------------

* Invest & Trade in Stocks & Mutual Funds *

Open your Discount Demat Account here:

-------------------------------------------------------------------------------------------

***Start investing in Fixed Income Securities***

Start Covered Bonds Here:

Start Invoice Discounting Here:

Start Bonds Investing Here:

-------------------------------------------------------------------------------------------

Related Videos & Playlists:

-------------------------------------------------------------------------------------------

Time Stamps

00:00 – Intro

00:51– How to avoid Cheque frauds with a Positive Pay system?

01:37- RBI released this Positive Pay system Circular

02:27- High value check

About the Video

To prevent cheque frauds, financial institutions use a positive-pay system that automates cash management. A company's cheques and the ones it submits to the bank for payment must match in order for positive pay to take place. Any questionable cheque is returned to the issuer for review. The method serves as a sort of insurance for a business against losses, fraud, and other obligations to the bank. While most banks still charge for the service, others now provide it for a discounted price or for free.

The RBI has proposed an electronic authentication method called Positive Pay that will allow you to communicate the check's data with your bank before the bank processes it, and it will go into effect on January 1st 2021. This extra security measure is intended to combat the growing number of check fraud incidents that have garnered media attention over the past year. Positive Pay is undoubtedly a boost for banks as counterfeit check perpetrators' techniques advance with each passing day.

In this video, we’ll cover the following concepts and questions:

1. How to avoid Cheque Frauds?

2. What is positive pay system?

3. SBI positive pay system.

4. Positive pay system for cheques SBI.

5. Positive pay system in Indian bank.

6. What is positive pay system in BOB?

7. RBI directives positive pay CPPS system.

8. Benefits of positive pay system.

-------------------------------------------------------------------------------------------

Connect with Us

-------------------------------------------------------------------------------------------

Website

#chequefrauds #cheques #positivepaysystem

-------------------------------------------------------------------------------------------

Disclaimer:

Investment in securities market is subject to market risks. Read all the related documents carefully before investing.

Registration granted by SEBI, enlistment as an RA with exchange and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

Комментарии

0:03:27

0:03:27

0:03:06

0:03:06

0:01:15

0:01:15

0:03:24

0:03:24

0:01:00

0:01:00

0:07:16

0:07:16

0:01:10

0:01:10

0:10:30

0:10:30

0:08:26

0:08:26

0:02:50

0:02:50

0:03:18

0:03:18

0:00:59

0:00:59

0:00:31

0:00:31

0:08:01

0:08:01

0:02:33

0:02:33

0:05:39

0:05:39

0:00:12

0:00:12

0:04:16

0:04:16

0:00:22

0:00:22

0:02:41

0:02:41

0:02:40

0:02:40

0:04:14

0:04:14

0:01:40

0:01:40

0:01:41

0:01:41