filmov

tv

Biotech investing basics part 1: value in biotech

Показать описание

This is the first in a series of videos about how to invest in biotech. This video covers the concept of value in biotech and investing more generally. We look at Netflix and Seres Therapeutics as real-world examples.

If there are topics related to biotech investing you'd like for us to cover, or companies you'd like us to look at, let us know in the comments below!

If there are topics related to biotech investing you'd like for us to cover, or companies you'd like us to look at, let us know in the comments below!

Biotech investing basics part 1: value in biotech

Intro to clinical data: biotech investing basics

Biotech Investing Made Easy - Introduction

Biotech investing basics part 3: intro to valuation

Biotech investing basics part 2: measuring value in biotech

Biotech Investing | How to Invest in Biotech Stocks (Finance Explained)

Biotech Investors: How to Find Value in a Bear Market - Season 2 Episode 1

Startup Funding Explained: Everything You Need to Know

Biotech Takeover: Successfully Identifying and Profiting from Biotech Buyout Targets

Penny Stocks Explained

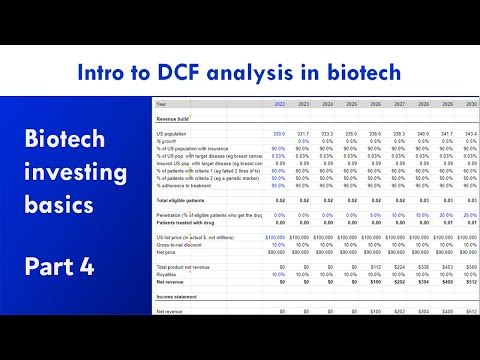

Biotech investing basics part 4: DCF analysis

Investing in Biotech

How do investors evaluate early stage biotech startups? 👀

How BioTech investing is broken #biotechnology #tech #vc #healthcare #ipoh #investing #ceo #startup

Biotech Startup 101: How to Create Financial Projections for a Biotech Startup

Investing in Biotech Important Concepts to Succeed | Daniel Montano

Shorting a stock - $100 in 9mins

What are YOU Buying? #AI or #Biotech? #shorts

Top 3 Biotech and Healthcare Investing Secrets You Need to Know in 2025 🔥📈

Why You Should Invest In Biotech Stocks

Legal 101 for Biotech part 1

1st yr. Vs Final yr. MBBS student 🔥🤯#shorts #neet

The #1 Biotech Stock Today

Biotech Panel: State of Biotech Venture Market 2023

Комментарии

0:21:39

0:21:39

0:25:25

0:25:25

0:02:29

0:02:29

0:23:50

0:23:50

0:35:48

0:35:48

0:01:56

0:01:56

0:28:57

0:28:57

0:09:26

0:09:26

0:48:19

0:48:19

0:00:31

0:00:31

0:46:02

0:46:02

1:15:18

1:15:18

0:00:43

0:00:43

0:00:43

0:00:43

0:11:57

0:11:57

0:46:14

0:46:14

0:00:33

0:00:33

0:00:44

0:00:44

0:09:15

0:09:15

0:04:38

0:04:38

1:16:43

1:16:43

0:00:20

0:00:20

0:00:15

0:00:15

0:55:56

0:55:56