filmov

tv

What is the Advantage of Lump Sum Investing vs Dollar-Cost Averaging?

Показать описание

What is the Advantage of Lump Sum Investing vs Dollar-Cost Averaging?

Did you miss the latest Ramsey Show episode? Don’t worry—we’ve got you covered! Get all the highlights you missed plus some of the best moments from the show. Watch debt-free screams, Dave Rants, guest interviews, and more!

Check out the show at 4pm EST Monday-Friday or anytime on demand. Dave Ramsey and his co-hosts talking about money, careers, relationships, and how they impact your life. Tune in to The Ramsey Show and experience one of the most popular talk radio shows in the country!

Ramsey Network (Subscribe Now!)

• The Ramsey Show (Highlights):

Did you miss the latest Ramsey Show episode? Don’t worry—we’ve got you covered! Get all the highlights you missed plus some of the best moments from the show. Watch debt-free screams, Dave Rants, guest interviews, and more!

Check out the show at 4pm EST Monday-Friday or anytime on demand. Dave Ramsey and his co-hosts talking about money, careers, relationships, and how they impact your life. Tune in to The Ramsey Show and experience one of the most popular talk radio shows in the country!

Ramsey Network (Subscribe Now!)

• The Ramsey Show (Highlights):

Advantage | Meaning of advantage

What Is The Advantage Of Using Hemlock Lumber?

What is the Advantage of Lump Sum Investing vs Dollar-Cost Averaging?

Advantage Meaning

TILOS - What is the advantage of using a time distance diagram for managing your project?

Is ADHD An Advantage?

Why Being Lonely Is An Advantage

What is the advantage of using const in Kotlin?

What is the advantage of using a ladder line in amateur radio?

What is the Advantage of Car Builders Plushlay over Factory Cotton Jute Underlay?

The Advantage - Dunsin Oyekan

What is Competitive Advantage? (With Real-World Examples) | From A Business Professor

The e-Learning Advantage

What is the advantage of a superconducting quantum computer?

What is Oxygen Advantage® and who is it for?

The Advantage of Online Learning

Handbooker Helper: Advantage & Disadvantage

What is the Advantage of Costco Travel? Booking Through Costco Travel

What is the Happiness Advantage? by Shawn Achor

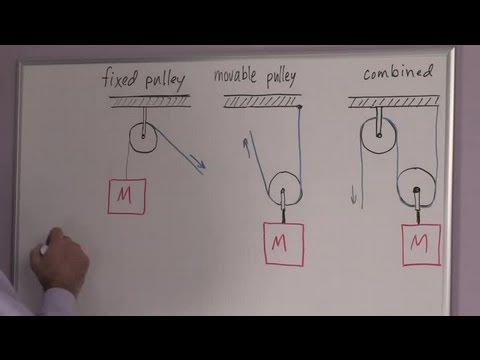

What Is an Advantage & Disadvantage of Movable Pulleys? : Chemistry & Physics

What is the advantage of Laparoscopy Surgery? - Dr. Nupur Sood

What is the 'Southpaw Advantage' used by Holly Holm?

What is the advantage of having a Q cycle in electron transport in spite of its complexity?

The advantage of SSD over hard drive

Комментарии

0:01:46

0:01:46

0:08:15

0:08:15

0:04:23

0:04:23

0:00:54

0:00:54

0:19:55

0:19:55

0:03:29

0:03:29

0:22:02

0:22:02

0:02:49

0:02:49

0:03:34

0:03:34

0:00:43

0:00:43

0:09:32

0:09:32

0:07:14

0:07:14

0:01:23

0:01:23

0:02:31

0:02:31

0:03:08

0:03:08

0:02:02

0:02:02

0:04:12

0:04:12

0:02:15

0:02:15

0:02:39

0:02:39

0:02:50

0:02:50

0:01:37

0:01:37

0:02:42

0:02:42

0:00:33

0:00:33

0:01:43

0:01:43